The hotel industry outlook for the top 25 North American Markets is showing an increase of 7.4% in committed occupancy for October 2013 – September 2014, based on group commitments and individual reservations on the books as of September 29, 2013 compared to the same time last year. The group segment is up 7.6% in room nights committed (contracted). New group business added over the last month (pace) is up, 49.5% over the comparable period last year. Transient room nights booked are up 6.8% compared to the same time last year. Average daily rate (ADR) is up 3.0% based on reservations currently on the books for 2013.

For the fourth quarter of 2013, overall committed occupancy is up 5.5% in the top 25 markets. Committed occupancy for the group segments is up 4.8% and the transient segment is up 6.3% compared to a year ago. Average daily rate for the fourth quarter is up 2.4% over the same time last year. Business segment ADR, which includes weekday transient negotiated and retail segments, is up 5.8%. Leisure segment ADR, which includes transient discount, qualified and wholesale segments, is up 6.1%.

Update on Group Demand

RevPAR growth in 2013 year to date has been largely driven by the transient segment, with transient occupancy growing by 3.3% and transient ADR by 3.8%. While group ADR has seen some growth, up 2.6%, group occupancy has been flat year over year.

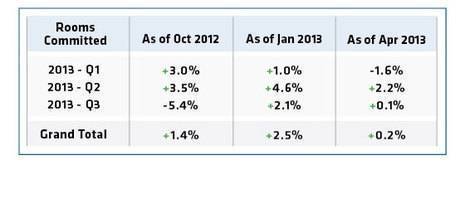

That group performance could be weaker this year came as no surprise, since we had been tracking the pace of group bookings for this period well beforehand. For example, in October of 2012, we saw that group bookings for Q1-Q3, 2013 were only up 1.4% versus the same time a year prior. As we entered 2013, that position had improved slightly, up 2.5%. However, poor booking performance during the first quarter of this year all but eliminated expectations for significant group growth this year, at least through the first three quarters.

The TravelClick Perspective – October 2013

So naturally we have been keeping a close eye on the pace of group bookings for the last quarter of the year and into 2014. The developments over the past couple of months have been quite positive. For example, at the beginning of August, group room nights committed for the fourth quarter were only up 1.5% versus the same time last year. By October 1, group room nights on the books for the fourth quarter were up 4.8%. In August, the first two quarters of 2014 were up 3.4% over the prior year. Those two quarters are now ahead by 8.8%.

The TravelClick Perspective – October 2013

This improved group outlook is largely due to a recent surge in new group sales activity. Each month we track the past 30 day new sales pace versus the comparable period the prior year. This represents the leading edge of demand, providing an indication of whether the outlook is improving or deteriorating. For the first six months of 2014, the past two months demand pace has exceeded last year by 9.7% and 53.5%, respectively. While we speculate that the very high most recent month's pace could be affected by group contract administration nuances (catch-up loading of group sales booked in prior months as part of budget season activities), it is nevertheless clear that group sales activity has picked up.

This good news from the group segment is welcome news indeed. The industry's demand position heading into 2014 has improved significantly. This strong base of group business will provide opportunity to drive improved outcomes in both group and transient ADR. Based on this most recent group booking activity and continued transient demand strength, the RevPAR outlook for at least the first half of 2014 grows more positive.

Performance Summary

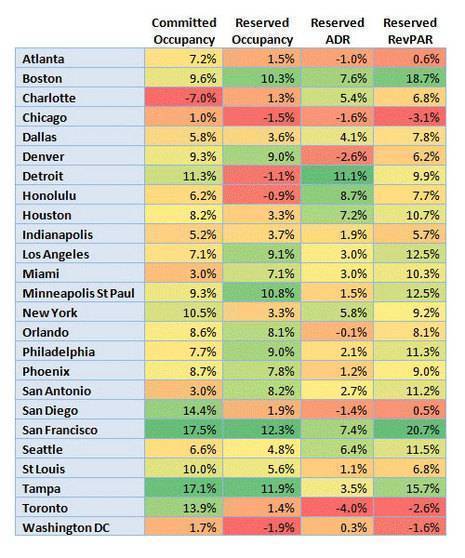

The chart below shows the year-over-year position by market of committed occupancy, reserved occupancy, ADR, and revenue per available room (RevPAR), based on business on the books for the future 12 months. Committed occupancy is group blocks plus transient reservations. Reserved occupancy, ADR, and RevPAR are based only on reservations (group pickup and transient reservations). Shades of green indicate highest performance of the markets, while shades of orange indicate average performance, and shades of red indicate lowest performance.

The TravelClick Perspective – October 2013

ABOUT TRAVELCLICK, INC.

TravelClick (TravelClick.com) provides innovative cloud-based solutions for hotels around the globe to grow their revenue reduce costs and improve performance. TravelClick offers hotels world-class reservation solutions, business intelligence products and comprehensive media and marketing solutions to help hotels grow their business. With local experts around the globe, we help more than 36,000 hotel clients in over 160 countries drive profitable room reservations through better revenue management decisions, proven reservation technology and innovative marketing. Since 1999, TravelClick has helped hotels leverage the web to effectively navigate the complex global distribution landscape. TravelClick has offices in New York, Atlanta, Philadelphia, Chicago, Barcelona, Dubai, Hong Kong, Houston, Melbourne, Orlando, Shanghai, Singapore and Tokyo. Follow us on twitter.com/TravelClick and facebook.com/TravelClick.