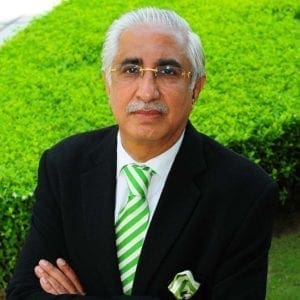

eHotelier recently had the opportunity to sit down with Andreas Flaig, Executive Vice President, Development, Asia Pacific for Carlson Rezidor Hotel Group. We chatted with him about the company’s plans and priorities, and how operating in this region differs from other parts of the world.

What is your focus?

My role is Head of Development Asia Pacific which entails a large and diverse area, stretching from India to China, Japan, to the Pacific islands, Australasia and all of South East Asia. Not only is it a large patch, but its also very diverse. Each of the economies, as well as the hotel sector in particular, are at different stages in development. Vietnam is at a very different stage than China, and China is obviously very different to Australia – not just in the make-up, but also in the evolution of where the market is at, so that obviously creates different kinds of opportunities.

India

We have 109 hotels in operation in Asia Pacific. Most of those – over 75 – are in India. So from an operational perspective, we are the largest international operator in India. We have started to grow into Asia Pacific from this very large Indian base. I think that’s important to note because it’s different from how many other brands have grown in the region.

Since we are the No. 1 player in India, we do obviously want to retain that position. Why? Because it is a very large market and it is a growing market where operating performance has turned around into the positive. And quite frankly, where more and more so, the outbound market is coming about. Maybe it’s not yet to the scale of the Chinese outbound market – which everyone is talking about – but I think in five, six, or seven years from today, we’re going to be talking a lot more about the Indian outbound market. It’s early, but is a reason why we certainly want to make sure we continue with that strategy of staying No. 1 in India, as this outbound market becomes ever more important.

China

Next, a very key focus for our strategy for Asia Pacific is China. In China, we currently have a modest portfolio of 14 hotels in operation, with 50 more in the strong pipeline. Now in China, we’ll have to see how we are going to amend that strategy given the new ownership by the HNA Group that was announced three months ago. I can’t speculate on that transaction, but it’s fair to say that with our new HNA owners, our access to the Chinese market, either directly or indirectly, will increase dramatically because of their 90 hotels, plus all the other business interests and subsidiaries that they own and influence there.

Indonesia and Australasia

Our third largest market is Indonesia and it’s going to be a very important country where we’ll want to grow our presence. Australasia is part of our strategy as well. The in-bound travel numbers in Australasia are now starting to pick up in a big way. Whether it’s for investment, business travel, leisure travel or for study, people from around Asia want to experience Australia. We’ve seen a dramatic increase in airlift from China into Australia which will continue going forward. Looking at the Indian and the Chinese markets, we therefore need to make sure we increase our presence in Australia. We’ve taken one direct step in hiring a key member of my development team in Australia early this year to have resources on the ground to better and more directly interact with development partners.

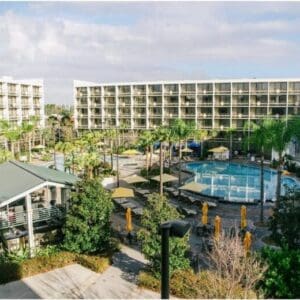

We have four hotels in the region, a Radisson Hotel in Melbourne, Radisson Blu Plaza Hotel and a Radisson Suites Hotlel in Sydney, and then we have a Radisson Blu Resort in Fiji, on Denarau island. Now we’re currently under construction for our first Park Inn Hotel in Australasia which is in Suva, the capital of Fiji. Luckily we have the same owner of both properties in Fiji. It’s very positive to be growing with our existing ownership base.

Brands

In three out of those four key Asia Pacific markets, we do need to make a high priority of increasing our presence by putting flags in the ground. In India we have already achieved that. In these three other important markets, there is more urgency in making sure we’re going into them with one of our seven brands. Obviously which brand goes where is dependent on the owner and location, but we’re seeing definitely a trend towards our lifestyle brand, Radisson Red, which is resonating strongly. We have signed five Radisson Red deals in the Asia Pacific since the brand was launched in 2015.

The reason why I think Radisson Red is resonating well with owners is that from a build cost perspective, it’s very efficiently built. That’s important not only in places such as Australia or New Zealand, where build costs are quite high, but even in developing markets where you might think building costs would be lower. It’s not true – costs are escalating in China and elsewhere. We want to make sure our brands resonate well with owners and developers because they can be built at a very competitive cost and can be operated at a highly efficient way – while meeting the demands of the traveller from an emotional and from a product point of view.

When you bring all these things together, operational margins, that emotion, how the customer will interact with the product and the cost of the build, you have a winning formula. And I think Radisson Red is a winning formula. The other trend we’re seeing is generally more hotels targeted towards the mid-market and more hotels of smaller size. Why? In some markets we do have an over-supply situation, so owners are becoming more cautious and therefore developments get scaled back. They’re getting scaled back especially in places like China at the moment.

They’re still going ahead, they’re just not building as many keys, and on top of that, they might move from a five star hotel to maybe a four star hotel. Owners think it resonates better with the traveller and in some places there are clampdown on government spending, so it’s actually more en vogue – if I may say so – to stay at a four star hotel, and not necessarily be seen either owning and/or staying in a five star hotel. Owners are saying, “We thought about a five hundred room, five star hotel, but you know what? Let’s do four hundred rooms, 4 Star” in the same location, on the same site. It’s all about risk. It’s all about perception. It’s all about, hopefully in the case of like, China, building the right product for the market. I think in the past, mistakes were made there. Having lived in China myself, I think some have built probably too far ahead of where the market is. So those two trends, lifestyle and build efficiency, resonate well with customers now. We are seeing slightly smaller scale projects, and certainly a more mid-market focus in terms of appeal. It’s great because we have a Radisson Brand, we have a Park Inn by Radisson brand, and Country Inns & Suites By Carlson brand.

Are most of the properties new build? Are you rebranding much?

If you look at Asia Pacific as a whole, I would say most are new builds. However in the last two years, we’ve seen an increase in conversions. These could be conversions for a variety of ways; these could be conversions from another operator to us. But actually to be honest, more often we’re seeing conversions from hotels that have been operated by the owner or operator, but who have realised that for whatever reason, generational change, financial performance, or age of the property, that might not be the path that they want to continue on. They now want to affiliate themselves with a brand either through management or through franchising, they want to change the direction they’re taking with the hotel asset. This has given us a lot of opportunities, last year as well as this year, to be able to convert and then to manage, or to manage and then convert, under a franchise agreement where we think that is either required or desirable.

What’s your split between franchise and management?

If you looked at our business model this year, I would say that we’re probably looking at roughly 75% management 25% franchising. This varies according to country and region, because it really is a function of the market.

If I cannot find the partner who’s either really willing or able to operate a hotel, then I cannot franchise, I cannot believe that I can entrust my brand and my brand equity to someone else. If that exists however, I think we’re probably a company, more so than our competitors, who is very flexible in being able to asses that situation and then offer one or the other. We’re certainly no stranger to franchising, as our US business is predominantly franchising. In Asia Pacific, we take a view of select franchising, and select really on the basis of who is the partner, do they want it, and can they do it? We do find those partners and that’s why we have it as a share of our business. It also helps us to gain scale faster, especially for unique market brands or lower tier brands. And if you can do so through conversion, again you’re accelerating that development curve even further compared to building a hotel which might take you five years in India, it might take you three and a half years in China, maybe three years in Australia. It is all in the mix when it comes to development and how we approach the opportunities in the market.

Other than the long lead development times, what are the other challenges you see from this region?

Money is always a challenge. It’s not unique to the Asia Pacific, so why do I say that? I say that because financing can be an issue. We have different levels of interest rates throughout Asia Pacific. The region is diverse. If you were just to map the domestic interest rates of all countries in the Asia Pacific, I think it would be a very interesting study to see how wide that spectrum is. So you translate that into financing, you translate that into real estate – it’s clear that financing plays an important part of if something can happen or not. Interest rates in Indonesia having increased, they have also increased in India, so there are some challenges around that.

Other than that, generally everything looks quite good in most parts of the Asia-Pacific. You have a three to five year outlook, because if you are building three to four years and you’re going to have to ramp up in three to four years, you’re really thinking well, my hotel won’t stabilise until about six years from today. So what’s the situation going to be like in Year Six to Year Ten? Or even Year Fifteen from now? This is taking us out very far, and it’s sort of like looking at a crystal ball. At the moment, times are very good, operationally speaking. The question is, how about in six, seven or eight years from today? And you take rising interest rates (in several markets) on top of that, and people start to – in some parts of Asia – be a little bit more cautious. Therefore, decision making is taking longer than we anticipate as people try to evaluate deals, try to put deals together. They may or may not come to fruition and that is another challenge. But quite frankly, it is a challenge you always have, it just swings depending on where you are in the cycle.

Are you concerned about oversupply in the markets?

Not in the long run. We’re in the long term business of hospitality and accommodation. When it comes to Asia, I look at the outbound China numbers, and I go back to my comment about India. Look at the wealth that has been created in many parts of South East Asia. The Japanese market is again coming back to Australia, as an example. I’m assuming it’s also coming back to lots of other parts and the Koreans are starting to travel more too. I think you have an amazing backdrop of demand, which is, compared to Europe, the Middle East or compared to the US, a completely different scenario. That gives me the absolute conviction that there’s going to be long term fundamental sustainable growth in the Asia Pacific, irrespective of the supply and balances that you make or have in one year or the other.

People say Sydney at the moment is going gangbusters, but in 2018 it might be really tough because in 2017, 2000-odd rooms are going to open. Sure, maybe in ’18 it’s like that. But are we believing that Sydney is not going to do that well in ’20 or ’25 or 2030? When you lay it out, how the stars will align? I wouldn’t be worried. I’d love to have a third hotel in Sydney, or even fourth. I think that’s the Asia story. I think the global growth of hotel supply will be here, but even more so, the global demand for hotel accommodation will increasing come from this part of the world. Airlines in Asia Pacific are growing, buying aircraft and putting on seats. I think we are in for a long term, very positive growth story in the Asia Pacific. That’s why I’m less concerned about supply. I’m more excited about demand.

Outlook

There is opportunity in the diversity that Asia Pacific represents, because it is unlike other markets. When Europe is down, all of Europe is down. If the US is down, all of the US is possibly down. Asia Pacific is less homogenised.

At the moment, if you look at the Macau and Hong Kong, numbers certainly are down, but the numbers from China are up in Australia. So is China good or bad? Well it’s good for Australia and bad for Macau/Hong Kong – that’s one part of it. The other part of Asia Pacific is that it has lots of different places that are all at different stages of development. And I think, therefore, you’re going to see continued intra-regional travel and growth, regardless of whether one country or another has a domestic challenge or not. Because it is not as homogenous as the North American market, or as homogenous as we might believe the European market is, that’s a positive for travel. One market could be down but another market could be up.

On the supply side, where are most hotels being built in the world? In Asia Pacific. A company like ours wants to grow. You can only grow by opening hotels, in partnership with owners, so we go where the supply is. There is true opportunity here. The opportunity is to have supply coming out of the ground in the Asia Pacific for the right reasons. There is an opportunity for us to help owners with our brands to be successful. Where’s the money? Where’s the capital? Again the answer is in the Asia Pacific. I think there is a lot of capital being deployed in this part of the world, and that creates economic growth, and that economic growth, as we know, directly links to travel. Especially intra-regional travel, which is growing even more so than international travel into Asia Pacific, We’ve seen that for awhile, and I think it is a real opportunity, intra-regional travel and the growth of that versus the long-haul market. So I think for a company like Carlson Rezidor, irrespective of the opportunities that might come about from the new ownership, who have said they are willing to invest money into the company and help us accelerate our growth, the opportunities just lie ahead of us, or anyone doing this business in the Asia Pacific.