In the past year, a lot has been said and happened in regards to Millennials and the hospitality industry.

For example, there was exciting news from Marriott and Commune Hotels with the announcement of new brands geared towards Millennials, Moxy and Tommie, respectively. But due to the intense interest in the next generation of travel, a lot of noise has been added to the conversation as well, with the same repetitive points being made.

Millennials are technologically savvy. Obviously. They are social and want a lobby design to reflect that where they can interact with others, but also practice isolated togetherness. Got it. Be on social media and connect with them instead of just pushing promotions. Yes, is this 2009? These are all things that should have been realized and acted upon by now. I summarized all these and the other top ten travel trends for Millennials a year ago.

The one thing that has not changed is the huge spending potential from this age group and the need for the industry to capture their business and fit their lifestyle.

These sweeping generalizations about millennials are not enough anymore. To truly gain their loyalty and thus, the money in their pockets, hoteliers and others in the travel industry must segment the millennial generation even further: millennial business travelers versus millennial leisure travelers. This article will go through the top two trends and opportunities in each of these segments and give one millennial's (read: my) viewpoint on each of these trends.

MILLENNIAL BUSINESS TRAVELERS

1. Millennials spend more per business trip than non-millennials.

OPPORTUNITY: Companies should be offering more amenities to generate additional revenue that millennials are willing to spend money on.

Due to their younger age group and point of their career they are in, it would be expected that millennials account for a lower number of business trips annually. However, there seems to be a geographical divide.

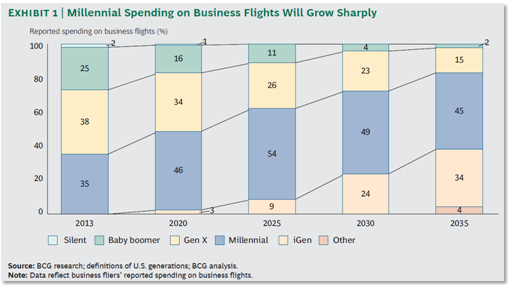

BCG reports that millennials currently account for approximately one-third of US business travelers, but is expected to increase to 50 percent by 2020, while Baby Boomers will drop to 11 percent. This strong demand from millennials is forecasted for the next fifteen years. Only 28 percent of American millennials report taking four or more business trip annually compared to 45 percent of non-millennials. It was also reported that Millennials take more trips related to training, recruiting, and conferences than client site visits or client relations; again, due to the stage of their career millennials are currently in.

On the other hand, according to a global study conducted by Expedia and Egencia, millennials worldwide (considered 30 and under) travel 4.7 times annually for business versus 3.6 times for 31-45 year-olds, and 4.2 times for 46-65 year-olds. No matter the debate over the number of trips millennial business travelers are taking, it is clear the huge potential of business this generation currently and will continue to represent in the future.

Another large potential of millennial business travelers is that they spend more per trip compared to non-millennials due to more last-minute booking, refundable tickets, and itinerary changes. Millennials are 60 percent more likely to upgrade their seat to another with more leg room and spend more on in-flight entertainment, which results in Millennials paying 13 percent more for airfare than non-Millennials.

Not only do they use more amenities on board, but they also use more amenities at the airport. This is in line with the finding that millennials are freer with company money than their own. 42 percent of millennials will spend company money on high-end meals compared to 26 percent of non-millennials. Millennials are also more likely to order room service , four times more likely to pay for wifi onboard, and two times more likely to download and watch in flight entertainment.

This all means more spending and more opportunities for the travel industry to earn revenue by offering amenities millennials are willing to pay for. This significant amount of spending highlights the largest potential in millennials: gaining their loyalty as business travelers. Not only does this capture the business demand that will only grow, but also will also carry their loyalty over to when they travel for leisure.

Millennial Viewpoint:

The finding from Expedia that millennials are freer with company money is not surprising. I have eaten steak on business trips simply because I cannot afford it in New York City. I live in one of the most expensive cities in the world and pay an exorbitant amount of rent on a typical post grad salary. One steak dinner on my own dime would blow my monthly food budget out of the water. On my first training assignment, my training manager explained it to me this way, "We are inconvenienced by travel, and thus we can expense overpriced food at the airport if we are hungry." That has been my viewpoint ever since.

Don't get me wrong, my company has limits and I never order anything unreasonable, but I do believe it is in my right to budget my daily allowance as it pleases me. If I hardly eat breakfast and get fast food for lunch because I am rushing between meetings and site visits, I feel that I am entitled to a pricier steak dinner if it is within my daily allowance. Or as a female traveler, I sometimes go to a grocery store and stock my hotel mini fridge with yogurt and fruit for breakfast because I want to be healthy and this is honestly the most economical situation as well. I think that is absolutely fair. We millennials don't mind playing an antiquated game, but we will play them using our rules.

2. Millennials are not loyal to travel brands…yet.

OPPORTUNITY: Companies have a large potential at capturing and maintaining this loyalty as millennials enter their prime spending years and become the majority of business travelers.

As millennial business travelers are just becoming road warriors, their loyalty is up for grabs. Millennials are less loyal towards travel brands than non-millennials and more willing to switch to another airline or hotel brand if they believe that loyalty program has a better product or global alliance network or is willing to match their elite status. (Millennials are generally three times more brand loyal in other industries and are willing to take action on social media on behalf of brands.)

It is important to note that millennials want different benefits out of loyalty programs than non-millennials, which should indicate to airlines and the hospitality industry they need to use different tactics and strategies to gain their loyalty. For example, millennials report more dissatisfaction with airline mile programs, particularly with how fast miles expire since they do fewer trips. Additionally, millennials are more likely to use miles and points for free or discounted travel rather than upgrades as cashing in a large number of reward points at once is more prevalent among millennials. And due to their stage in life and spending, millennials are currently less likely to use a specific brand's credit card, which is another big opportunity to capture their loyalty.

As millennials are testing out the different brands, they are slowly figuring out what they prefer and what brands fit their travel lifestyles. Companies should be communicating and marketing to millennials already using targeted campaigns and social media. Not only should brands offer a product millennials want, but their loyalty program and distribution systems should match their lifestyles and way of booking as well. The next several years are crucial as companies with more foresight and planning in their marketing departments capture the loyalty of millennials. Once they start accruing status and a large number of points on one program, they are less likely to switch to another unless their status is matched.

Millennial Viewpoint:

I have to confess that I am a miles and points junkie. I travel a lot for work, but due to the obscure locations I often fly to, I cannot choose just one airline to be loyal to as many do not fly to the smaller regional airports I am trying to reach. And as I get reimbursed for all expenses, I earn all the points and miles on my credit cards. Thus, I have become quite fluent in the world of credit card sign-on offers and capturing the large bonuses they use to entice you to apply for their cards. But I have to admit, I am currently not brand loyal. I do have an airline alliance that I prefer to earn miles on, but this was only after I finally earned status with them and I wanted to maintain and get to the next level.

Similarly to many other millennials, I report that I prefer Southwest and JetBlue for their superior product. And by superior product, I simply mean free snacks and in-flight entertainment. It truly is that simple. (Sometimes I like to fly Delta for the complimentary Biscoff biscuits and although many airlines serve Coca-Cola products, only Delta serves Fresca.) However, as was reported by BCG, millennials respond that they prefer Southwest and JetBlue much more often than they actually fly these two airlines. I believe that some of this is due to the limited routes these two airlines offer compared to the other major airlines. On the other hand, I often forget to check Southwest's own website as their flights do not show up in any OTA aggregators when I do my research. Another major pet peeve of mine regarding the Southwest website is their search function. The most common route I book with them is New York City to the San Francisco Bay Area. Southwest operates at Newark and LaGuardia for NYC and out of San Francisco, San Jose, and Oakland for the Bay Area. That means I have to perform individual searches for each possible combination as they do not have an "All New York City Airports" or "All San Francisco Bay Area Airports" option. This is extremely frustrating when my dates are flexible as well.

MILLENNIAL LEISURE TRAVELERS

1. Millennial leisure travelers with lower incomes take fewer, but longer vacations and are opportunistic about travel packages and deals.

OPPORTUNITY: Create bundles and vacation packages that appeal to the millennial lifestyle to entice them to book longer vacations.

Millennial leisure travelers are largely based on income level and the stage of life they are in. The major indicators are: relationship status, financial spending, children, and the number of vacation days they have. Not surprisingly, leisure travel increases with income level. Currently, approximately half of millennials report taking four or more overnight trips a year compared to 75 percent of non-millennials.

However, high-income millennials travel as much as non-millennials. It is also interesting to point out that to save money, millennials will book fewer, but longer trips as airfare is often the largest cost of their trip. They will book further in advance to save money and seek out more vacation packages. Millennials will often view booking as a game and respond to low prices and interesting packages. This creates opportunities for travel deals, combination packages, and rewards.

Millennial Viewpoint:

While I won't blink twice at booking a last minute $700 ticket to Texas for a business trip, I constantly search and use tools like Airfare Watchdog to check if prices go up or down for my own leisure trips. I book far in advance, particularly if they are international flights. This is just an example of how important good revenue management is for airlines and hotels.

2. Millennials travel more socially and in groups for personal interests and activities.

OPPORTUNITY: Create tools and booking systems that fit the millennial itinerary and booking preferences.

Although millennials still travel for leisure less than non-millennials, the opportunity is presented in how and why millennials travel now and will continue to do so. Millennials are more likely to travel socially with friends or family. This is in line with the trend that millennials are a social generation. There is an opportunity for group travel and building itineraries.

Millennials currently think booking travel is very tiresome, so there is another opportunity to use technology or booking tools that they find less cumbersome and fit with their lifestyle. For example, there could be apps to book group travel that reserves plane tickets and other travel plans for 48 hours and having the ability for individuals to log on to a group itinerary and pay for their portion of the trip. This would be helpful in building a group itinerary and payment as many younger millennials would not have the financial ability to cover a flight or hotel reservation for four people, but are able to pay for their own portion.

Why millennials travel is also important to consider. The most popular answer is that they travel to visit friends and family, which is not unique to their generation. However, millennials more than any other generation, travel for personal interests such as food and wine, entertainment, outdoor activities, or shopping. All of these interests are social activities, which again brings back the point that millennials travel more socially than other generation and points to similar opportunities surrounding group travel.

Millennial Viewpoint:

On the most extreme side of this example, I recently took a trip with a fellow millennial who also works in consulting. Between the two of us Excel geeks, our expenses were entered on a shared Google Doc and split with fancy formulas and other nerdy functions where at the end, there were two boxes showing exactly how much each person owed the other. Because we were both fluent in Excel, this was almost a twisted sort of fun for us, but there is demand for better travel tools and technology for group travel.

What are the next steps?

The constant theme in millennial loyalty is the lack thereof. Loyalty programs currently are not designed for millennials and they need to start targeting them to capture that loyalty early on. First, companies should start communicating and marketing to millennials now. Many of these campaigns can be quick and low-cost and should be acted upon immediately.

Secondly, companies need to ensure their loyalty programs are what millennials are looking for. Millennials are a generation that grew up with video and computer games. There is no reasoning to Angry Birds or Candy Crush. We are used to games where we simply want to get to the next level, so companies should make their loyalty programs more game-like and fun to encourage millennials to reach the next status level or earn more points.

There are also many more variations in loyalty programs now. Gone are the days where Marriott Rewards and Hilton Honors are the only players in the hotel loyalty game. Starwood's SPG program has improved vastly in the past several years and their points are much more valuable now. There are also reward programs for independent hotels such as Stash Hotel Rewards. And most recently, even Expedia has their own reward program that incentivizes people to double-dip rewards and book using Expedia. Cross-promotion within the industry is also possible as this was seen when airlines and hotel chains created partnerships to double-dip rewards and status matches such as Delta and Starwood Hotels.

Thirdly, travel distribution and booking strategies must match millennial lifestyles. It is no secret that millennials use mobile and tablets to reserve travel plans. Companies should make it as easy to book through as many different channels as possible. Millennials are more comfortable with their private information being saved to ease repeat bookings than older generations. Other examples of companies using technology to change the travel process include how mobile check-in went global at Marriott hotels this year or how Lowes Hotels even started allowing guests to start booking room reservations via Twitter recently. Companies must be able to keep up with millennials' technology demands and lifestyle.

Fourth, millennials should definitely be segmented between business and leisure travelers, but this can be segmented even further with target marketing, micromarketing, and social media. There is so much data available that general campaigns are not acceptable anymore.

Lastly, no matter how good the marketing and loyalty programs are, the product is still the most important and must be what millennials desire and prefer. Free wifi and social lobbies are just a start. These may be longer term and more capital intensive, but research and focus groups should be used to continually improve and change products that do not fit the millennial lifestyle because above all, millennials are flexible and fluid.

Conclusion

To tie together millennial travelers, it is important to remember that one person, such as myself, can be both a millennial business and leisure traveler. Our preferences and practices change as we switch roles between the two. But eventually, all millennials will age, progress in their careers, and move to higher income levels and have more disposable income. Loyalty built with current millennial business travelers will carry over to leisure travelers eventually.

This leaves many opportunities for cross-promotion rewards. But even as we age, the generational trends such as our tech-savvy, group and social travel preferences, and desire for in flight and airport amenities will stay the same. To put it simply, we will always want free wifi and we will always expect it to be free. I promise you, that will never change.

Teresa Y. Lee is a Consulting and Valuation Associate with HVS’s New York office. Teresa graduated from Cornell University with a B.S. in Hotel Administration and Minor in Real Estate Finance. Teresa has worked at various hotels and resorts both in the country as well as internationally. Since joining HVS in 2012, Teresa has appraised hotels in various states throughout the United States.