Revenue management is the science of annual profitability increases. It’s a complex process that considers demand, fixed and variable costs, and the hotel’s online reputation before establishing room rates. Revenue management isn’t siloed. It looks at data across departments and understands the context for those numbers.

Revenue management is the science of annual profitability increases. It’s a complex process that considers demand, fixed and variable costs, and the hotel’s online reputation before establishing room rates. Revenue management isn’t siloed. It looks at data across departments and understands the context for those numbers.

In this article, you’ll better understand the analysis of revenue management so you can apply them to your hotel’s profitability.

Room Rate Considerations

Pricing is a big component of revenue management but it’s not as simple as plopping a price tag on a room. We consider many factors including

- Fixed and variable costs

- Surrounding competition

- Hotel Quality

- Seasonal market demand and trends

- Area Events

- Historical performance

- Forecasting

- Dynamic pricing

First, a quick primer on our definition of revenue management, so we’re working from the same definition.

What Is Revenue Management?

Revenue management is the science of maximizing hotel revenue through correct pricing at the right time to the right guest through the best distribution channels.

It requires understanding historical data and the current environment – including the hotel’s online reputation. Every hotel has a fixed inventory (number of rooms), and you can’t expand or contract them based on demand. You also have fixed costs. If you think of your rooms as perishable inventory, you know that every night the room sits empty, you have lost revenue.

Revenue management analyzes many factors to discover the right balance of pricing vs. quality.

Revenue Management Common Misconceptions

Some hoteliers argue: “My costs are huge. I can’t sell below cost.” Or “I don’t want to lose perceived value with a low rate. I’d rather stay empty.”

But revenue management doesn’t mean you have to sell rooms at low rates. It also doesn’t mean selling the rooms at high rates with the idea you’ll attract high-quality guests. Instead, revenue management has one goal: to sell your rooms at the best price that day.

Every day is different. But that doesn’t mean wild pricing swings from day to day. However, if you follow revenue management guidelines, you can see BIG increases during peak season.

Your revenue management plan starts with the basics.

What Are Your Fixed Costs?

Your fixed costs don’t change whether you’re fully booked or not.

For example:

- Rent/mortgage.

- Insurance and taxes.

- Fixed monthly costs, such as internet and TV.

- Staff salaries

- Marketing/advertising costs.

You can add these up if you don’t already have your fixed cost number. Then you’ll divide that number by the number of rooms and working days. For example, $ 1.000.000 / 100 rooms / 365 days = $27.

This two-digit number represents your daily fixed cost per room regardless of whether you sell it that day. Then you have variable costs and, finally, profits.

One big mental shift in revenue management is the shift from “unsold rooms” to “permanent loss of money.” That shift in reference can change your entire outlook.

What Are Your Variable Costs?

Unlike your fixed costs, these change depending on whether you have guests.

These include

- Toiletries

- Robes, pens, notepads,

- Linens

- Utilities: water, gas, and electricity,

- Breakfast (if included in the room rate)

- Housekeeping costs if you use an outsourced service

- Sales channels commissions

You can tally these for the year and divide by your number of rooms. Then, divide that number by the number of working days. For example, $500.000 / 100 rooms / 365 days = $14. This total represents the variable cost per room per day.

In this example, our fixed costs plus the variable equate to $41. Is everything above profit? Not just yet. Revenue management still looks at other factors, such as the bottom rate, CostPAR, and RevPAR.

CostPAR vs. RevPAR,

Two important concepts in revenue management, are RevPAR (Revenue Per Available Room) and its counterpart CostPAR (Cost Per Available Room.)

These help you have a picture of the hotel’s economic health.

RevPAR is the revenue generated by each room in a single timeframe. For example, you can calculate RevPAR by day, week, or month. Calculate the room revenue, and divide by the total number of available rooms and open days.

CostPAR gives you the room costs for a specific time. For instance, you may want to calculate your CostPAR per day. To do so, you’ll divide the fixed and variable cots by the total number of available rooms and days.

In our example, this calculation will give you the CostPAR of $41 (e.g., $1.500.000 / 100 rooms / 365 days = $41.) Many revenue managers calculate the CostPAR annually on a historical basis. Then they can use that data to forecast next year’s budget.

This brings us to pricing. How do CostPAR and RevPAR impact room rates? With this data in hand, we know our bottom rate. This is the rate below where you refuse to sell a room. For example, in our example, the bottom rate is $41 and you won’t go below that rate.

Now, you can know your starting rate for next year and you can apply it to your different room types.

By now you might be wondering about the profits. After all, a business needs to profit and your hotel’s pricing needs to exceed costs.

Let’s consider the CostPAR vs. Bottom Rate

CostPAR vs. Bottom Rate

Some hoteliers think the bottom rate must always be higher than the CostPAR. This makes sense on the surface, but when you embrace revenue management, you go deeper.

The problem with thinking the bottom rate must always be higher than CostPAR is it’s based on 100% occupancy all the time. How often is your property fully booked?

Hoteliers know demand varies throughout the year. There are nights when demand is so low you won’t sell rooms unless you go below CostPAR. Yet, this can still work in your favor because there are other times of the year when guests are willing to pay far more. Revenue managers want to find the right balance throughout the year so that your hotel is profitable at year’s end.

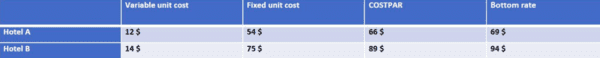

Let’s compare the CostPAR and bottom rate of two similar hotels in the below table.

While these hotels are of similar size and quality, you can see Hotel B has higher costs. This could be due to fewer rooms or poor cost rationalization.

With a bottom rate of $94, Hotel B has $5 over the CostPAR. That puts them at a pricing disadvantage compared to Hotel A in the low season.

What can Hotel B do to remain competitive?

Variable Costs vs. Bottom Rate

There’s another perspective to consider which is the per-room variable costs.

The Revenue Team by Franco Grasso has worked with thousands of hotels and discovered commonalities. Statistics show that 3 or 4-star hotels have an ideal variable cost per room between $10 and $20. Higher variable costs can lead to cost rationalization problems.

Yet, it’s a careful balance. You don’t want to compress costs too much since that can disrupt service and create unhappy guests. When your guests leave negative reviews online, your hotel’s reputation suffers which translates into lost revenues.

The solution to improved revenue is to sell rooms above the variable costs. When you understand the market and have useful data, you can list rooms at the right price point.

The seasonal trends of your hotel play a big role yet, you can remain profitable even in low-demand times. Imagine selling a room at only $1 above the variable costs during low season.

Yes, it helps cover some of the fixed costs but it does something even more important. It prompts positive reviews online which boosts your hotel’s reputation and online visibility.

This positive reputation and visibility mean you can maximize profits a few weeks from now.

Consider a hotel’s shoulder season in April and May. This hotel has historic data that shows a 50% occupancy rate during that time at an ADR (average daily rate) of $80 and a RevPAR of $40 (RevPAR = ADR Occupancy rate.)

If the hotel determines its Bottom Rate at $59, this rate is above the variable costs of $12. Yet, it’s below the forecasted CostPAR of $75. With such a margin, you can apply this manufactured bottom rate when demand is low.

This does more than boost immediate profitability. It also helps the hotel improve its historical performance because it achieves an 80% occupancy rate and a RevPAR of $47 (RevPAR=ADR*Occupancy rate.) While this approach still keeps them below the CostPAR (75-47=$28.), it also benefits the hotel’s online visibility and reputation as you’ll see below.

CostPAR, ADR, RevPAR, and The Property’s Online Reputation

Revenue management focuses on annual profitability. Part of that is a positive hotel reputation which translates into online visibility.

Consider the hotel’s shoulder season. When more guests are staying in your hotel, you sell more ancillary services. Your guests pay for spa treatments, restaurant meals, parking, etc. This additional spending makes up for lower rates. Even better, these guests leave you positive reviews online.

Imagine your guests are thrilled with the service at a lower rate. Your hotel has a higher perceived value in their eyes and their gushing reviews boost your online scores on Booking.com and Tripadvisor. Even going from 8.9 to a 9.1 rating on Booking.com can mean more bookings at higher rates. A 4.7 to a 5 on Tripadvisor will definitely attract more guests.

Hotels with a positive reputation boost can enjoy more guests throughout the year because more people find your hotel online. Your guests rely on reviews to choose their hotels and search engines reward hotels with high review scores by pushing them to the top.

As you know, many potential guests use search filters by score. For example, if they use Booking.com, they’ll set their filters to only see hotels with a 9+ rating. They may also filter by 4-star hotels with free parking or other services.

Online scores impact your conversion rates, reservations, and the ADR (average daily rate), especially in high-demand periods. With a strong reputation and online visibility, you can charge a higher rate and get it. Data shows when people compare comparable properties, 80%+ of them will pay a little more for a hotel with a higher score.

Here’s an example.

If your hotel historically has a 100% occupancy rate in July and August with an ADR of $140 and RevPAR of $140 (with 100% occupancy ADR and RevPAR coincide), by implementing effective revenue management and brand reputation policies you can sell rooms at $200.

Here’s how it works.

Thanks to your hotel’s online visibility and positive reputation earned during the shoulder season, more people see your hotel online. They want to book with your property because other guests said great things about you. As a result, you can command full occupancy with room rates of $200 ADR.

Do you see the connection?

That’s the essence of revenue management. Cover some of your fixed expenses and boost the hotel’s reputation and online presence. When the high season comes, you’re able to command higher rates and boost profitability.

To recap: A hotel sells rooms at a bottom rate of $59 in the shoulder season. These lower rates contributed to positive reviews which boosted the online visibility and led to the ability to sell rooms for $200 during high demand. That’s a $125 surplus after the $75 CostPAR which makes up for the bottom rate in low season.

Revenue management makes it possible.

Successful Revenue Management Takes Longer-Term Thinking

Revenue management thinks in terms of annual profits rather than profits today. There’s a system for managing daily room rates throughout the year that results in greater revenue.

Part of that system is the hotel’s online presence. The algorithms reward hotels with recent, positive reviews. Reviews in recent days matter more than those from six months ago.

This strategic approach attracts more guests and higher prices and ADR.

Bottom Rate vs. Rack Rate

There’s one more consideration for you and that’s in the bottom and rack rates. As you know, rack rates are the highest room rate a room can command when demand is high.

For example, New Year’s Eve is often a night when people are willing to spend more than they might at other times.

The bottom rate is the lowest rate you’ll sell a room during low demand times. Thanks to revenue management, your rack rate can be quite high.

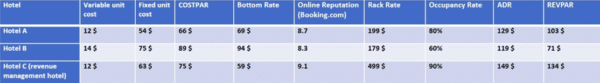

To illustrate this idea, we’ve added a hotel to the earlier table along with rack rate, hotel reputation, ADR, and other factors. To keep it simple, we’ll assume these hotels only have rooms as a revenue and cost center.

Consider Hotel A. It’s clear they don’t have proper revenue management. They have lower annual ADR and RevPAR vs. Hotel C. This means that while they have the lowest CostPAR, they still lost money when compared to area hotels.

Hotel B has a negative GopPAR (Gross operating profit per available room) despite having a higher bottom rate than Hotel A. Their RevPAR ($71) was lower than their CostPAR($89), which means that even though they had a better bottom rate, they still lost money due to low occupancy. They also suffer from a lower online reputation than Hotel A. Their guests didn’t enjoy their stay at Hotel B as much as those who stayed at Hotel A.

Hotel C is the winner in this equation. It has the best online reputation, RevPAR, GopPAR, and cost-performance ratio among area hotels. Guests leave positive reviews and enjoyed their stay.

Calculate GopPAR by dividing gross operating profit by the total number of rooms available. This figure gives a solid indication of the hotel’s business performance.

Hopefully, you see that just because a bottom rate is more than the CostPAR doesn’t indicate the hotel is profitable. Nor does it demonstrate a stronger ADR and RevPAR than surrounding hotels.

The hotels that enjoy the biggest profit boost at the end of the year are those that enhance their online presence through the number of positive reviews they attract.

Hotel C recognizes the benefits of proper revenue management and tends to outperform the competition.

If you’d like to discover how to implement revenue management at your hotel, download 10 Things to Know About Revenue Management.