Some hoteliers want to ignore the data of the past two years. After all, the pandemic brought closures, capacity restrictions, and so many uncertainties that it seems natural to think the past 24 months are unreliable when forecasting 2022 profits.

Some hoteliers want to ignore the data of the past two years. After all, the pandemic brought closures, capacity restrictions, and so many uncertainties that it seems natural to think the past 24 months are unreliable when forecasting 2022 profits.

Yet, revenue management methodology says otherwise.

There is (perhaps) surprising data that shows despite the pandemic, accurate revenue forecasting still depends on the recent past. Revenue management proved it’s a well-tested discipline. Those hotels who practiced these methods pre-pandemic and throughout the pandemic ended 2021 with a revenue increase.

The data tells a (success) story

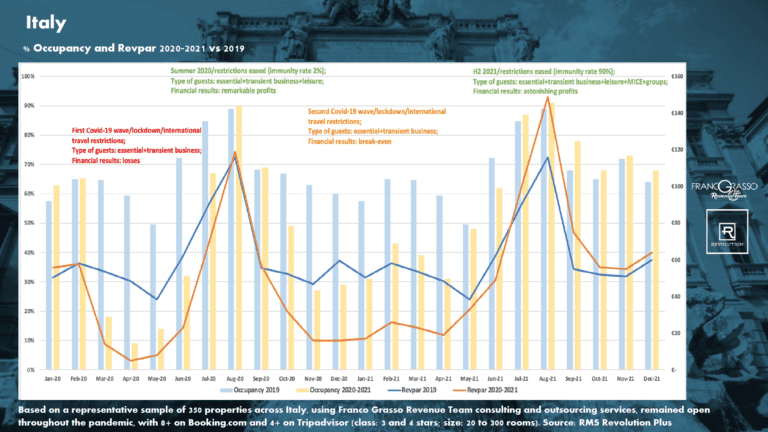

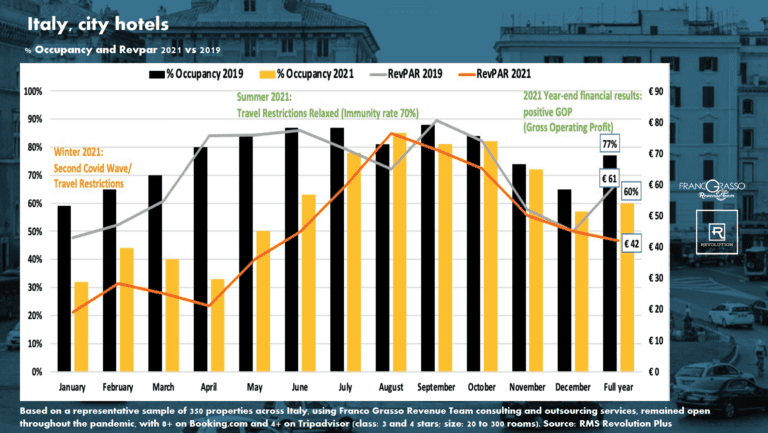

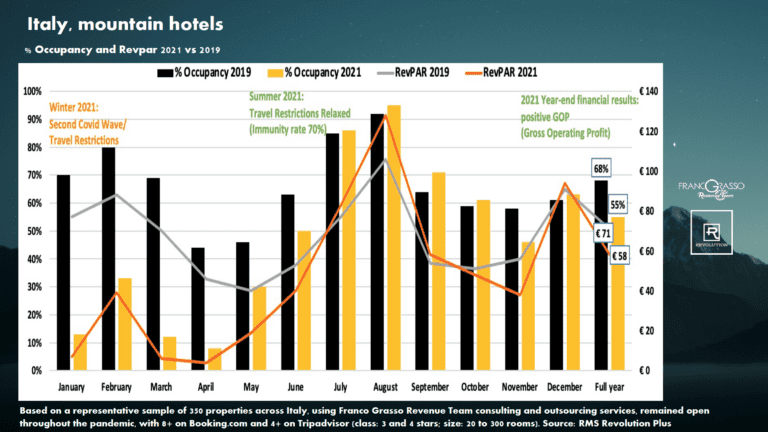

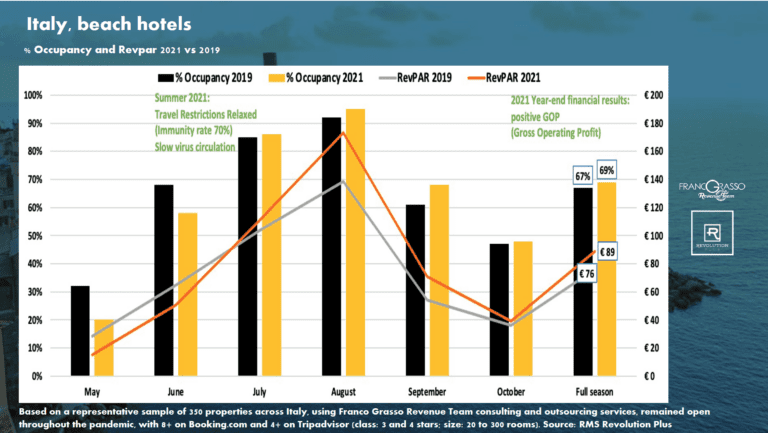

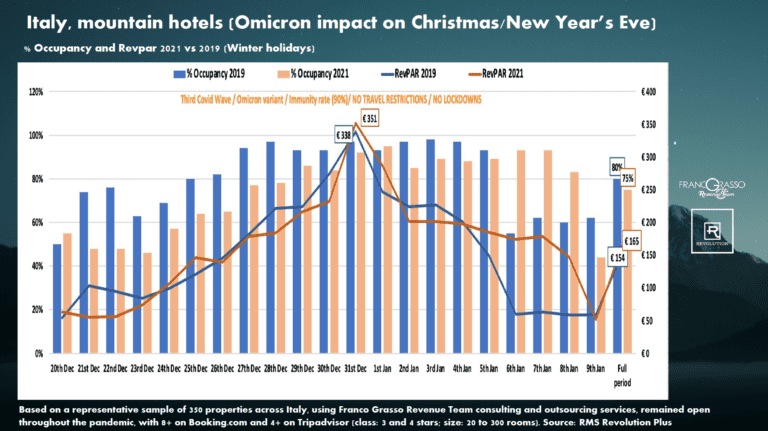

Revenue Team by Franco Grasso studied 350 Italian hotels to compare 2019 data with the 2020 and 2021. These revenue-managed hotels are 3 and 4-star hotels representing the city, mountain, lakeside, seaside, and countryside. Each hotel uses the FGRT consulting services and RMS (revenue management system.) Besides shared consulting and software services, they each have an 8+ rating on Booking.com and a 4+ on Tripadvisor. Revenue management principles help them manage cash flow.

It’s a striking contrast with similar hotels that don’t use revenue management. This external data is available in the public realm via area hotel associations, press releases, STR and OTAs.

We found applicable observations worldwide, regardless of covid spikes and local restrictions. For example, this graph compares the data of 2020 and 2021 with 2019 results. Such data supplies revenue managers with the insights they need to predict 2022.

Spring 2020

As COVID spread worldwide, hoteliers faced a catastrophe with no playbook. They had to make essential decisions based on limited information:

- Could they remain open?

- If so, how could they operate?

- Could they keep their guests and staff safe?

- How did local restrictions affect them?

Through all the panic and unknowns, maintaining cash flow dictated a lot of the decision-making.

The above graph shows the impact of local restrictions on our sample size from March 2020 to May 2020.

Those hotels that remained open and continued their revenue management practices maintained cash flow. Those closed hotels didn’t practice revenue management, and closing seemed the best option at the time.

The hotels that remained open still suffered losses, but they could hang on for a bigger payday down the road. It turns out staying open for even a limited number of guests – mainly essential and transient business travelers – kept a hotel at the top of SERPs and OTAs, which meant the hotel attracted more guests when restrictions dropped.

It takes courage to stick to revenue management methods when it seems like your business faces possible ruin. After all, during lockdowns, these hotels realized a 10%-15% occupancy. For some hoteliers, that would be frightening. But sticking to the original revenue management plan meant they had a portion of the essential travelers who left positive reviews, contributing to the hotel’s visibility.

When travel resumed in the summer of 2020, these hotels reaped the benefits. Because their hotel had never fallen off the online radar, they reached 60%-90% occupancy rates. Plus, they retained most or all of their staff. As they recovered from those Spring losses, things were looking up.

When comparing these revenue-managed hotels with those that closed for the Spring, it’s obvious which ones were in the lead. Those that closed with the intent to re-open when travel picked up had lost their online visibility, and they’d also had to lay off staff. Such hotels were at 20%-40% occupancy that summer compared to the 60%-90% of revenue managed hotels.

You can guess where this is going. The Fall and Winter spike hit the hotel industry again just as hoteliers dared launch winter holiday campaigns. The closed hotels hadn’t recovered their earlier losses, and some of them wouldn’t make it through this next round. However, revenue-managed hotels had replenished their coffers.

A tale of two hoteliers during the first winter spike

Between 2020 and 2021, we saw the two approaches continue on their trajectories. Revenue-managed hotels had cash flow and could adjust to new restrictions. Most kept their staff.

The “traditional” hotels faced tough decisions, and many opted for the covid or quarantine hotel model as a survival strategy. Such hotels lost their online visibility, and since they could only accept guests who “had” to stay there, they weren’t attracting positive reviews. On top of that, the ADR of quarantine hotels was just half, if not one third, of pre-covid levels, and in any case much lower of what revenue-managed hotels were able to charge to normal guests through online channels.

The revenue-managed hotels at least broke even. Plus, with less competition, they enjoyed even more online visibility, which attracted more guests and, with them, their positive reviews.

Statistically, hotel break-even numbers between costs and revenues require occupancy rates of 30%-50%. The revenue-managed hotels managed that or better.

As an aside, if the hotel isn’t breaking even at those percentages, it’s usually due to one of two problems.

- Inefficient cost rationalization

- Lack of revenue management (ADR is too low)

With all of this in mind, let’s move to the following travel period: summer 2021.

Summer 2021 travel

Traditionally, summer is one of the busiest travel seasons. Summer holidays make for fun memories, and after the previous months of quarantine and restrictions, people were eager to get out again. The immunity rate (percentage of vaccinated + recovered) was up to 70% by July 2021, and restrictions dropped.

Those revenue-managed hotels were primed. Like the previous summer, these hotels could accept travelers, achieving or exceeding their 2019 results. Leisure travelers, groups, and MICE all contributed to these results.

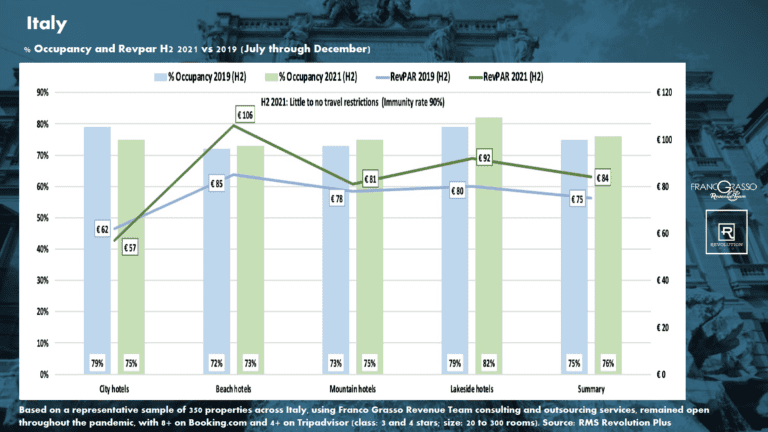

Within the city hotel segment, there was a gap of only 8% between 2019 and late 2021, mainly due to hybrid events and attendance restrictions.

The below graph shows leisure hotels with revenue management exceeded expectations by the second half of 2021. Some of these mountain, lake, and beach hotels enjoyed higher results than in 2019 through a boost in occupancy, Revpar, and Average Daily Rate (ADR.)

Grow profits with revenue management

We know pandemic restrictions differ worldwide, and even within the same country, there are differences.

Consider city and mountain hotels. At the beginning of 2021, hotels in these locations faced a significant loss of guests. However, the latter part of 2021 made up for the losses at the beginning. Many of these properties – those with revenue management practices – ended 2021 with a positive gross operating profit (GOP.)

City hotels practicing revenue management ended the 2021 year on a high note. Their annual occupancy of around 60% gave them a positive GOP. This is despite a lower Revpar versus 2019.

Hopefully, you’re excited by the possibilities of revenue management now. You can see the data shows that hotels that closed and reopened discovered they’d sacrificed their online visibility. This means it was tough to attract guests, and as a result, some of these hotels faced up to 70% loss in revenue when compared to 2019.

Even seasonal hotels, from beach to countryside ones, fared well. For example, summer hotels closed in 2021 with an occupancy of around 70%. Compared to 2019, with a final incremental turnover of 15%-20%, you can see it was much higher.

Hotels without revenue management still benefited from the summer recovery and got fully booked on some dates, but they weren’t able to charge as much as revenue-managed hotels did, and missed on potential revenue. So, their results were lower than in 2019.

Omicron spikes 3rd wave

By winter 2021, weary hoteliers made the necessary adjustments. With Covid protocols part of everyday life, travelers and hotel staff alike adapted. Fewer travel restrictions combined with pent-up demand meant more people traveled.

The results continue to demonstrate the power of revenue management. The below graph shows a 5% occupancy gap in mountain hotels for the 2021 and 2019 holiday seasons. By practicing revenue management pre-pandemic and throughout, these hotels closed the 2021 holiday season at +7% higher Revpar (revenue per available room.) They may have sold fewer rooms, but they sold at a higher rate (+15%).

These hotels sold fewer rooms in the 2021 holiday season than in 2019 due to the rise in the Omicron variant. This 3rd spike demanded millions cancel holiday travel plans. Many were asymptomatic but had covid exposure, or a positive test kept them home.

This trend also affected hotel staff. As a result, many hotels operated at a fraction of their capacity.

This was a change from the year before when hotels wanted 100% occupancy if possible. By 2021, labor shortages due to Omicron’s contagiousness meant the hotels wanted to limit their occupancy so they could provide good service to their guests.

Despite these challenges, the revenue-managed hotels still came out ahead, and they eclipsed their 2019 winter numbers by 10%. The data showed a possible 30% or 40% increase in 2021 vs. 2019 numbers without the virus.

The pandemic lessons help forecast 2022 profits

Throughout the pandemic, hoteliers have learned plenty about viruses. It turns out these science lessons impact 2022 financial projections. Smart hoteliers started using these principles of biology already in March 2020, as a guide for their short, medium, and long-term decisions.

For example, consider these three facts:

- Lockdowns and restrictions failed to eradicate the virus, they just delayed the virus’s spread. However, the limits did lead to social and psychological consequences that many governments eventually took into account (1)(2).

- Viruses spread during the winter and slow down in warm weather (3).

- The purpose of a virus is to reproduce as much as possible. Yet, it must do so without killing the host cell otherwise it would die too. As a result, mutations are often more contagious yet less aggressive (4).

How does this affect 2022 predictions? The data shows hoteliers who maintained revenue management principles through the past two years discovered 4-5 months of maximum revenue could make their year. Throughout navigating see-sawing restrictions, they ended 2021 with a gross operating profit. They have financial stability, and some received incentives, subsidies, or tax breaks from banks and governments as a consequence of their stable position.

These hotels are in a strong position now. They’ve remained open throughout the pandemic and maintained high online visibility. They kept their staff, improved service and property, and many upgraded technologies.

Every single time restrictions were lifted, these hotels benefited.

Then there’s the other side. Some hoteliers hold a false belief. That belief is that revenue management is only something to manage demand. By that logic, if there’s no demand, it’s useless. Yet, nothing could be further from the truth.

Those non-revenue-managed hotels continue struggling. They’ve lost their online search rankings, had to lay off staff, and if they’ve managed to reopen, they face stiff competition and struggle to find qualified staff.

Your 2022 revenue forecast

Past trends indicate fewer quarantine requirements in the future and those who have relied only on quarantine business or government aids will find it hard to bounce back to pre-covid levels. Some will close for good reducing the overall competition. As a result, revenue-managed hotels will continue to see increased gains as pandemic shifts to endemic. Provided there are no other major variables on the way (wars, natural disasters, financial crises etc.) these hotels may even enjoy a 40% boost in turnover in 2022 vs 2019 if mandated quarantines, even for positive and asymptomatic guests, disappear (5)(6).

Hopefully, this data demonstrates the effectiveness of revenue management and how it impacts a hotel’s revenue stream despite reduced demand.

No matter what 2022 holds, recent trends prove revenue management is a powerful business tool, and it gives hoteliers the power to manage cash flow despite a world of unknowns.

That’s the power of revenue management.

Discover how your hotel can implement revenue management by downloading these ebooks:

10 things to know about revenue management

5 revenue tips for city, beach, mountain, and countryside hotels

Sources

(2) https://www.straitstimes.com/singapore/politics/spore-must-press-on-with-strategy-of-living-with-covid-19-and-not-be-paralysed-by

(3) https://www.frontiersin.org/articles/10.3389/fpubh.2020.567184/full

(4) https://news.northeastern.edu/2021/12/13/virus-evolution/

(5) https://www.cdc.gov/media/releases/2021/s1227-isolation-quarantine-guidance.html