Google is taking the hotel industry by storm to gain market share and grow their advertising revenues. We will take a look at how Google is penetrating the hotel distribution vertical with Google Hotel Ads, and what opportunities this gives in terms of hotel revenue management and marketing.

Google is taking the hotel industry by storm to gain market share and grow their advertising revenues. We will take a look at how Google is penetrating the hotel distribution vertical with Google Hotel Ads, and what opportunities this gives in terms of hotel revenue management and marketing.

From Hotel Finder to GHA

Exactly ten years ago, Google launched what Andrew McCarthy, at the time Software Engineer for the Mountain View’s company, described as an “experimental search tool designed to help users locate and book hotels.” We’re talking, obviously, about Hotel Finder.

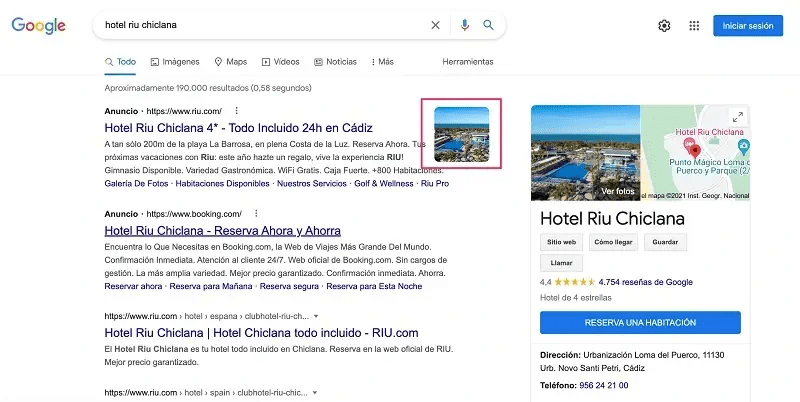

In that distant summer of 2011, however, Google’s metasearch engine looked way different from what it is today. You may remember how, for example, the ads were shown inside a traditional Google’s yellow paid search box, just below the search ads results and above the organic ones. When clicking on the ads, users were taken to a dedicated URL, google.en/hotelfinder, a page providing information, reviews, and photos principally taken from Google My Business property listings. Originally, moreover, published rates were solely coming from third-party advertisers (such as OTAs), while the official websites were only visible thanks to a backlink to brand.com, not unlike TripAdvisor.com ‘s Business Advantage.

Looking back, the system looked almost clumsy, at least in terms of pure user experience. However, flash-forward to just a decade later, and Google has taken the metasearch world by storm, with a staggering percentage of market share estimated between 64% and 80%. But how did we get here?

Google in Travel: Some History

Going through the history of Google, it is not particularly hard to identify some of the most significant milestones that created this “perfect storm.” Apart from the abovementioned introduction of Hotel Finder in 2011, there are some other crucial dates that helped the growth of Google in our industry over the last 15 years. Amongst them, it’s worth mentioning the acquisition of Where 2 Technologies and the consequent launch of Google Maps in 2004-5; the introduction (dubbed by Search Engine Land as the “most radical change” to SERP) of Universal Search in 2007; the launch of Google Places (later renamed Google My Business) in 2009; the acquisition of ITA Software and the rebranding to Google Flights in 2011, and the release of the, later discontinued, intelligent travel assistant app, Trips, in 2016. All these features opened the way, in 2019, for what may be described, without exaggerating, as “Google’s OTA on steroids:” Google Travel (google.com/travel).

The Evolution of Google Hotel Ads

Similarly, Google kept improving its advertising system for hotels, with a huge acceleration over the last couple of years. Here are just a few additions Big G made to its hotel ads platform that are worth remembering:

April 2020: The Pay-per-Stay program (formerly known as Google Hotel Ads Commission Program) became available to all Google Hotel Ads partners globally. Instead of paying for each click or per transaction, advertisers finally had the opportunity to pay Google a commission only after the guest’ stay occurred. This means that, in case of cancellation, no commission is due to Google. “What became clear as the COVID crisis unfolded,” Michael Trauttmansdorff, Google’s Group Product Manager for Travel Ads, stated, “was that cancellations especially were a major factor. Helping our partners manage cancellation risk motivated us to prioritize and scale up the “Pay-per Stay” program and accelerate it.” Revenue management-wise, adopting a PPS approach is a no-risk opportunity to deal with the last-minute conversions and high cancellation ratios we’re experiencing since the start of the pandemic. Moreover, it does not prevent advertisers from switching back to a CPC model if and when the market will recover and stabilize. On top of that, most metasearch advertising management platforms, such as Meta I/O, also give advertisers the opportunity to work in PPS on some markets and in CPC for others, maximizing ROAs and increasing NRevPAR.

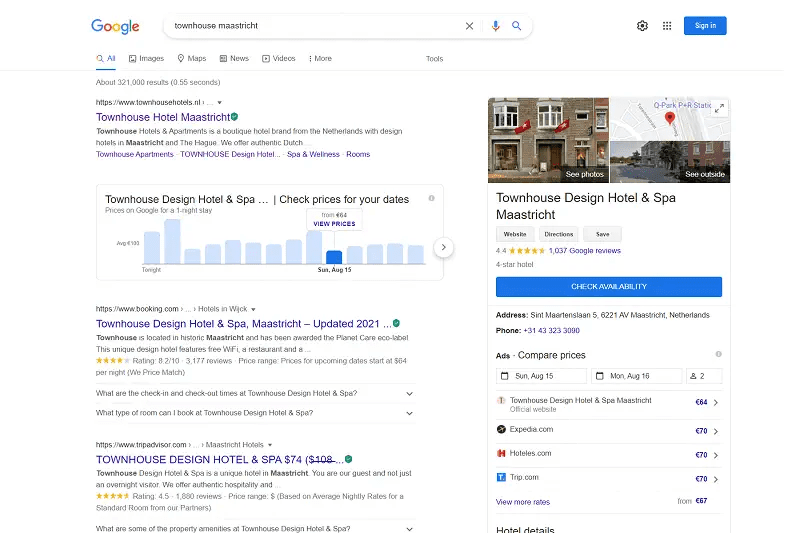

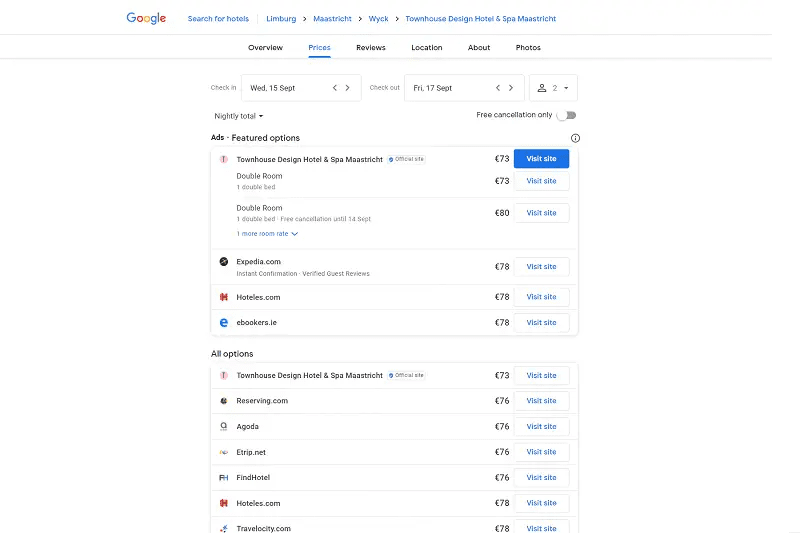

March 2021: Introduction of Free Booking Links (FBLs). Thanks to this update, accommodation providers can appear on Google Ads even without bidding on the platform. Free booking links appear just below the “featured” (paid) options in a distinctive tab called “all options” (see below screenshot), which closely mimics the traditional SERP. An extensive study by Mirai (Google free booking links impact; time for the numbers, 2021) showed that the share of these links is around “17% in clicks and 11% in sales,” and PhocusWire published similar results (10%), making it appealing even for properties not interested in advertising on the platform to be listed organically.

July 2021: Launch of the Check-In-Date multiplier. Not unlike traditional Google Ads campaigns, GHA also gives its advertisers the ability to apply bid adjustments (known as multipliers) to their campaigns. Among the most common, there are multipliers based on length-of-stay, check-in-day of the week, booking window, location, device, or even remarketing lists. This made Google Hotel Ads particularly appealing for revenue managers in recent years, excited by all the bidding opportunities. Moreover, the latest multiplier addition is particularly welcomed by RMs, as it allows hoteliers to adjust their bid for specific dates based on variables such as events in the area, pace of pick-up, occupation rate, and so forth.

On top of that, Google is constantly beta-testing new features for GHA. In July, 2021, it started supporting image extensions in the ads.

It’s early to say if the feature will be maintained and, here at XOTELS, we were not able to find a single ad with image extension, anyhow it’s interesting to see how Google is always keeping a “trial and error” approach in the way it promotes its travel products. And this happened many times before with Google Hotel Ads: in 2018, for example, Google tested Room Booking Module (RBM) extensively. Thanks to this feature, Google was able to incorporate room photos into the hotel ads results. The same happened with Book on Google. BoG, according to the official support blog, “enables users to complete their booking and payment with partners directly on Google, without being redirected to the partner’s site”. The possible benefits of BoG are, always according to Google, “simple user experience, convenience, convenience, and easier conversions.” As of today, it doesn’t seem like either of these features are out of the beta test stage yet, and it’s probably unlikely that they ever will. However, this says a lot about the will to innovate that Google is showing in travel.

Why Is GHA so Important Now?

Direct booking is living its momentum post-pandemic; it’s no mystery. “The Website Direct channel,” a recent study published by D-EDGE stated, “surpassed Booking and OTAs in Asia (41% share), and is the second-largest in Europe (32%)”. SiteMinder comes to similar conclusions, talking about a market share increase of up to 300% (Top Booking Channels Global, 2020). Most vendors agree on what the main drivers behind this historical shift in distribution are. In the abovementioned publication five major factors are identified which, here at XOTELS, we tend to agree with:

- “More relevant information on hotel websites when compared to OTAs, especially regarding anti-COVID measures,

- More flexible policies on website direct,

- Rate disparity favoring direct channels, especially on metasearch engines,

- More domestic/local travelers, with no need for air transportation,

- The lower overall volume of bookings giving preference to frequent travelers who are more informed about the advantages of booking direct.”

Point three is particularly important when it comes to advertising in GHA: with more and more users relying on metasearch engines (especially Google) to find the best available rate, it’s not surprising that properties bidding in GHA (possibly with a discounted rate) are seeing their conversions going up. Not to mention that the competitiveness of your rates, compared with other distribution channels, is a key variable to rank on FBLs. According to a recent study by Mirai (How to maintain or increase your direct sales quota after the pandemic, 2021), in fact, FBLs have given “an extra boost to hotel direct channels with an increase of 0.84% to 4.32% in direct sales” even for those properties not actively participating in the bidding game on GHA. In order not to lose grip over one’s distribution (and find ourselves in two years time exactly where we were pre-pandemic: overdependent by Booking.com and Expedia), it’s time for hotels, apartments, resorts, and vacation rentals alike to use all the arrows in our distribution quiver, starting from Google Hotel Ads.

The Gloves are Off

And don’t wait too long, because the OTA are all geared up to regain market share, or even penetrate your hotel business mix even further. To give a bit of insight on how they plan to do this, read a recent article by Mirai titled ‘What Booking.com was doing to gain market share while we were all in lockdown’. And now they have also just launched Flash Sales promotions. And they are not the only ones. Expedia has also launched options in their extranet which seem to have been activated automatically to break your rate parity.

Conclusions: Five Tips to Start Getting the Best Out of GHA

Of all the moments in the history of our industry, there is probably none better than this one to start implementing a proper Google Hotel Ads strategy. Over the last ten years, we’ve witnessed an increasing interest in hotel metasearch advertising. However, only Google was able to consolidate and become THE big guy at the table.

We’ve already discussed percentages of market share for GHA, and it’s not uncommon that when hoteliers talk about “metasearch advertising,” they’re mainly referring to Google Hotel Ads. GHA is, slowly but steadily, becoming a synonym with the metasearch concept tout-court, not something to simply add “on top of” the other distribution strategies. If you still haven’t started using this channel, here are five tips to get the best out of the platform:

- GHA offers multiple bidding options: CPC, CPA, PPS, together with half a dozen bidding multipliers. It’s virtually impossible not to find the right fit for your property. Our suggestion is to start with a low/no-risk bidding system (CPA or PPS), and expand from there;

- Even if you’re not actively bidding on GHA, as long as your booking engine is feeding Google with ARI (Availability, Rates, and Inventory), then you can benefit from the extra visibility provided by FBLs, without investing one euro;

- Being listed (organically or via paid ads) on GHA with your best available rate dramatically increases your direct revenue. It’s not uncommon to see hotels generating over 1/4 of their brand.com revenue through GHA, so why shouldn’t this work for you?

- Rate leakage is one of the principal obstacles to satisfying ROAs in GHA (and in metasearch advertising, in general). Make sure you work with a proper revenue management company to get better control over your distribution, and review your OTAs policies (especially virtual card payments, mobile rates, accelerators, etc.) periodically to avoid possible commission cuts;

- There is no right or wrong when it comes to metasearch advertising. The only way to optimize results is by testing, adjusting, and testing some more. Luckily, GHA is a pretty “forgiving” platform, unlike more expensive advertising programs, such as Expedia Travel Ads or TripAdvisor Sponsored Placements. Don’t be afraid to try new, different approaches.

We see very good ROI results at our hotels bidding 9% to 10% in the main source markets. And in secondary markets we achieve a 90%+ coverage in add exposure bidding 5% – 6%.

And be ready, this is just the beginning, many more updates will be coming our way in travel search on Google. Some of you might already see the hotel carrousel showing alternative hotel suggestions when searching for your own hotel.

This is the biggest shift in the power balance of hotel distribution we have seen in the last decade. So I would recommend every hotelier to get with the program.