Over the course of the pandemic, I was in constant contact with revenue and cluster revenue managers helping them find solutions to decreased demand.

Over the course of the pandemic, I was in constant contact with revenue and cluster revenue managers helping them find solutions to decreased demand.

Our discussions covered shifting consumer trends, activities to drive demand, and ways to reduce non-value-adding expenses. In all of these conversations, I sensed subtle yet undeniable shifts in attitude.

Revenue managers appeared to be unanimously changing the way they view their hotels’ KPIs, a seismic shift that foreshadows the onset of a drastically different approach to revenue management in 2021.

Driving RevPAR as a North Star metric came up only a handful of times while driving Total Revenue Per Available Room (TRevPar), Net Operating Income (NOI), and Gross Operating Profit Per Available Room (GOPPAR) and came up more frequently than I was used to.

Despite a clearly shifting focus, responding to this crisis is not as easy as simply replacing your North Star metric with another one. You have to identify which key metric you are trying to affect, how different KPIs are interconnected and how you can tweak each individual KPI to help you reach your end goal.

For the better part of 2020, revenue managers have struggled with constantly changing regulations that impact travel trends, making it impossible to forecast revenues. For instance, the traditional guest composition of some hotels might lean heavily on business travel. This segment has now been more or less wiped out and is not predicted to return any time soon since many organisations are transitioning to digital-only work environments.

Hotels can aim to maximise revenue streams while reducing expenses wherever possible with the goal of maximising profits. They can achieve this by exploring ways to drive TRevPAR, and reducing labour or operational costs and other overheads This will positively influence NOI and GOPPAR. Easier said than done, but well worth the effort and planning.

Before delving into KPIs, let’s consider the concept of increasing all revenue metrics and optimising all cost metrics with the goal of driving NOI. In any scenario, either at peak travel or during low travel cycles, we know it is crucial to monitor both cost metrics and revenue metrics.

Ideally, cost metrics should not outweigh revenue metrics by a huge margin, and this is especially true for the situation we are in now. For the foreseeable future, we can expect revenue to be unpredictable and Average Daily Rates (ADR) to continue to fluctuate or be set to lower than normal to boost occupancy rates.

A smart revenue manager will not only work with other departments to drive revenue metrics up but also work twice as hard to drive cost metrics down. Doing this should create a comfortable profit cushion for hotel owners, and let’s be honest– during this time, cash/profit is king, so an unconscious shift of focus to TRevPAR and GOPPAR over RevPAR makes sense.

3 key hotel KPIs

ADR

The ADR or Average Daily Rate is calculated by dividing the number of rooms sold by the revenue earned from said rooms. This KPI is usually used to compare hotels’ historic performance and benchmark themselves against similar or competing hotels in the same market. ADR is also a lever normally used to impact occupancy rates as explained above. The goal here for a Revenue Manager should be to increase the ADR incrementally, by leveraging/improving their hotel’s reputation/branding, infrastructure and packages. The higher the ADR a hotel is able to command, the higher the quality of guest they attract. An important determinant of this is your sentiment score on TripAdvisor and other similar review sites, which we’ll delve into shortly. Are guests raving about the amazing service/experience and ancillary services offered to them (TRevPAR)?

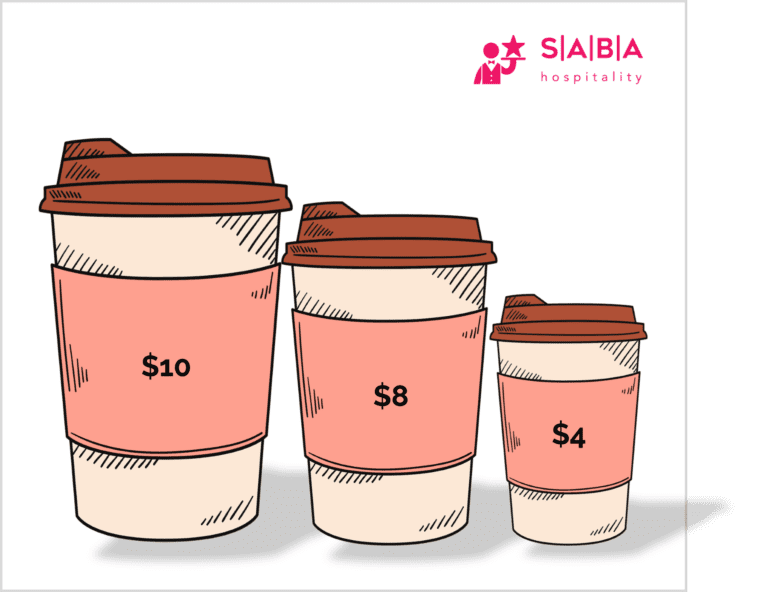

Guests who are comfortable with a higher ADR can also have a higher spending capacity during pre-arrival or in-stay which could also have a positive effect on your TRevPAR. On the flipside, you could potentially reduce your ADR marginally, but only in the knowledge that you have a solid pre-arrival/during-stay upselling strategy to drive your TRevPAR.

Occupancy rate

A hotel’s occupancy rate refers to the percentage of available rooms sold for a certain period of time. Having your end profit goals in mind will help revenue managers to calculate their minimum occupancy rates in order to either break even or turn a small profit. Occupancy rates, like all other KPIs, have to be viewed within the context of other KPIs. For instance, will high occupancy rates have an impact on TRevPAR and other cost metrics? You could be pleased at achieving a 100% occupancy after dropping your ADRs to generate revenue in the short-term, but in doing so have only attracted guests with low TRevPAR potential. At the same time, there will be spend required to service these guests, which may drive up cost metrics and possibly lower your NOI. When thinking about occupancy rates, don’t forget to check in on whether you’re focusing on the quality or quantity of guests. Do you want to attract budget-conscious travelers or travellers who can spend on ancillary services?

Sentiment score on review sites

The importance of this small, yet powerful KPI cannot be emphasised enough. A sentiment score aggregating online reviews is comparable to an NPS score (net promoter score) i.e. how likely are you to recommend this hotel to your friends. It is standard practice now to read reviews before making any purchase decisions. Your review pages are like free marketing/sales pages for your hotel that can bring or take away business from hotels.

So focus on how you can shine and showcase your product here. Think about all the amazing ancillary services/experiences you can offer your guests that will lead them to leave a glowing review that will bring in even more guests to the hotel. It is, in essence, like a never-ending sales loop.

To stay on top of guest sentiment towards your hotel, you can either use a social media monitoring tool or simply closely monitor your average ratings and guest comments on Tripadvisor and other sites that you deem important to your hotel’s performance.

For more KPIs, including an in-depth rundown of Total Revenue Per Available Room (TRevPar), Net Operating Income (NOI) and Gross Operating Profit Per Available Room (GOPPAR) and how you can leverage these for increased profitability, click below.