Hotels’ pricing is complex and disparities in rates are very common. With the rise of new-age channels, hotels are having problems maintaining a clean and clear vision over their pricing strategy. The inventory and rates distribution went out of control and it is crucial for hotels to regain control over their distribution channels. This article explains the different distribution channels of any hotel in a simple format, and represents part one of a two-part article.

Hotels’ pricing is complex and disparities in rates are very common. With the rise of new-age channels, hotels are having problems maintaining a clean and clear vision over their pricing strategy. The inventory and rates distribution went out of control and it is crucial for hotels to regain control over their distribution channels. This article explains the different distribution channels of any hotel in a simple format, and represents part one of a two-part article.

Many hotels are increasingly adopting a multichannel distribution strategy to sell their products and services such as:

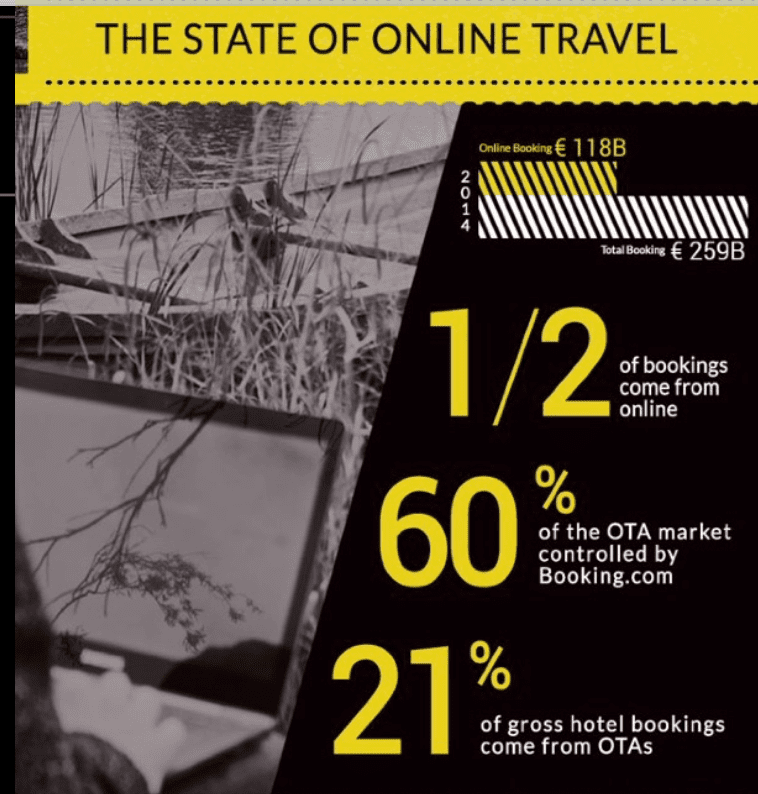

(1) the traditional offline channel (telephone, mail, traditional travel agents, sales representatives) representing 30% of total bookings in Europe and 50% in the Middle East, and

(2) the online channel (online travel agencies (OTAs), online tour wholesalers) representing 70% of total bookings in Europe and 50% in the Middle East.

Hotels imply rate parity on the online distribution channels with which they work. Rate parity involves the sale of the same room, to the same customer, at the same price across all online distribution channels.

Rate parity is a legal agreement between hotels and OTAs in which the hotel guarantees to use the same rate and terms for a specific room type, regardless of the online distribution channel. The price of the room can regularly change – which means the exact rate is flexible – but it must always remain the same across all online distribution channels. The importance of rate parity is in regaining control of the online distribution channels and driving more business through the branded website of the hotel. In other words, OTAs and hotels are not able to offer discounts on the room rates to customers but only to those characterized by being part of a loyalty program or part of a membership in the purchase process.

An agreement between several governments and OTAs requires OTAs to cease certain practices around how they merchandise and price hotel rooms to customers. However, giant OTAs like booking.com and Expedia are now making price snapshots on various sites such as TripAdvisor or Google in order to check for rate parity, and send alerts to hotels in case disparity appears. The result for hotels not maintaining rate parity across their online distribution channels is seen in hotels losing their ranking on Bookings.com and Expedia. This price transparency makes it easier for customers to compare different options and identify the best deals.

Despite hotels’ efforts to provide rate parity across online distribution channels and due to the growing popularity of online bookings, rate disparity appears as an essential issue in information consistency. Price disparity is defined as charging and/or selling different prices for the same product/service on different online distribution channels; it is a form of price discrimination. When customers identify different prices offered across various online distribution channels for the same room, they are encouraged to become rate conscious to search online to find better deals.

Customers booking an accommodation are divided into two main segments: Business-to-Customer (B2C) and Business-to-Business (B2B). Customers under the B2C segment are generally quoted a Best Available Rate (BAR). The B2C segment consists of OTAs such as booking.com, expedia.com, opodo.com, orbitz.com, priceline.com, among others, and Brand.com such as the hotel direct website and/or chain direct website. From a hotel’s perspective, controlling B2C platforms in terms of price is easy considering that these platforms are public and accessible for all unrestricted customers.

However, practically, this becomes uncontrollable and leakage exists and surprisingly, most of the time, the hotel is not aware of that issue. Indeed, B2B portals become complicated since multiple intermediaries are involved in the process and the rate is not made public. The B2B segment consists of wholesalers, corporate contracts, allotments, FIT, cruise, GDS, among others, and B2B customers are under static/flat seasonal contract or dynamic contract based on a percentage of the BAR. The contracts can be static, which means a flat rate per season or dynamic rate, which floats with the BAR based on a certain percentage, and they may come under different format: net or commissionable. Practically, B2B platforms re-sell the hotel’s inventory to another intermediary without the knowledge of hotels, hence the problem of the commissioning structure imposed by these channels. Indeed, B2B platforms do not have control over their own distribution channels.

For example, Amoma, an online travel agency, was alleged by hotels that it misused wholesale rates not intended for consumption by this travel agency. Hotels suspected that Amoma was taking inventory provided to wholesalers for the offline market and often undercut the rates for general consumption on its site. This resulted in rate disparity, as prices available on Amoma’s site were lower than prices available on OTAs’ sites. Nowadays, Amoma does not exist anymore, but the problems reside as other travel agencies are operating with the same business model as the one adopted by Amoma.

Most of the larger hotel chains and some of the smaller hotel groups have been tightening up the supply of so-called static rates that the Amomas of the world have depended on. Moreover, the giant OTAs (i.e. Booking.com and Expedia) have introduced their own wholesale rate service, which will allow them to capture some of the discounted inventory.

The above seems simple but it can get complicated when the OTAs strive to gain customers via their fidelity program, or wholesalers selling a huge amount of rooms for the hotel to other intermediaries. In both cases, the hotel is forced to work with all channels to optimize the sale of its inventory. Stay tuned for part two to enhance your knowledge about rate parity from a practical perspective, where recommendations will be provided.