There are many ways for hoteliers to boost revenue. Two avenues include visibility on booking channels and using dynamic pricing. Direct credit card pre-authorization helps maintain necessary visibility on OTAs during peak demand without ceding control of your revenue projections or putting your customer’s credit card information at risk.

There are many ways for hoteliers to boost revenue. Two avenues include visibility on booking channels and using dynamic pricing. Direct credit card pre-authorization helps maintain necessary visibility on OTAs during peak demand without ceding control of your revenue projections or putting your customer’s credit card information at risk.

What Hoteliers Need to Know About Pre-Authorization

Some misunderstand credit card pre-authorization. Sometimes, guests think it’s a charge when it’s not. When a hotel pre-authorizes a guest’s credit card, they put a temporary hold on a specific amount on the card when the guest books. Some hotels pre-authorize a night’s stay, while others extend it to the entire stay.

The purpose of the pre-authorization is multi-pronged. One, it reduces credit card fraud because the cardholder receives an alert. If it is a stolen credit card, they can cancel their card with the bank, and your hotel can sell the room to someone else. Additionally, if the guest books and then cancels last minute during peak season, your hotel has the guarantee of the pre-authorized amount. That way, you don’t lose money. You can offer a cancellation window for flexibility.

A direct pre-authorization protects both the guest and the hotel.

Five Reasons Why Some Hotels Don’t Pre-Authorize

Some hoteliers don’t fully understand the importance of pre-authorizations in their overall revenue management strategy. As a result, they cite one or more of the following:

1-Lack of time

2-Lack of will

3-Lack of authorizations (by the ownership)

4-Lack of permissions (by the banks)

5-Lack of means (POS)

Those are all expensive reasons. The OTAs know this and offer to do it for the hotel, and that is not in the hotel’s best interest because the OTAs sometimes reduce their rates to encourage bookings, and the hotel can lose out.

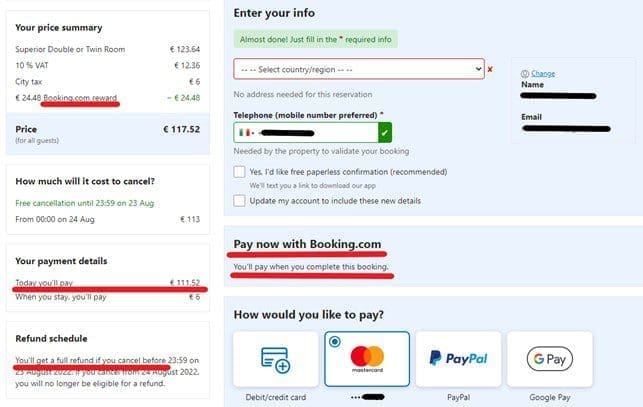

Below, you’ll see a few screenshots that demonstrate the potential lost revenue when leaving pre-authorizations up to OTAs.

Yet, when you consider handling pre-authorizations in-house, you’ll have questions about the details. You may ask:

- When should pre-authorization occur?

- How long before and for what amount?

- When and how should it be canceled/released?

Revenue Management Relies on Pre-Authorization

Revenue management is a series of tactics designed to increase a hotel’s profitability. One of those tactics is dynamic pricing or adjusting rates based on market demand.

When demand is low, it may make sense to waive any pre-authorization requirement. That’s because if people search the OTAs, they might use the filter of “book without a credit card.” Such a filter can improve your visibility in low season if you don’t require a pre-authorization.

But come high season, you want to drive higher profit percentages, and pre-authorizations can help. They help because they prevent income loss due to no-shows and late cancellations as long as you control the pre-authorization.

- How early should you pre-authorize?

Many hoteliers opt for 10-15 days before the guest’s arrival, and that’s enough time to freeze an amount for no-shows, late cancellations, early departures, or property damage.

This is also enough time to discover if a card is invalid in time to cancel the reservation and resell the room at the correct rate. Otherwise, you may lose money to discounted last-minute (or second) rates.

- What amount should you pre-authorize?

It depends on your hotel and location. Some revenue managers pre-authorize a cancellation fee of one night, while others extend it for the entire stay. You can use your property’s cancellation policy as a guide. In some countries, hoteliers pre-authorize higher amounts to protect against damage or theft.

- When should you release the hold?

Banks and credit card providers often automatically release pre-authorizations after 15 or 20 days. Hotel staff can remove it manually if guests prefer to pay by another method. If the guest chooses to use the credit card on file, then you can do that too and convert the pre-authorization into payment.

Yet, all of this hinges on your control of the pre-authorization process. Otherwise, you risk the OTAs undercutting your revenue.

How OTAs behave

OTAs clearly define the parameters of pre-authorization towards customers at all booking stages, putting hoteliers in a position to feel more protected against customers in bad faith and, at the same time, have a clear conscience even in the face of upset customers. Hoteliers themselves can reduce possible complaints by clearly communicating this practice in their post-booking and pre-stay messages.

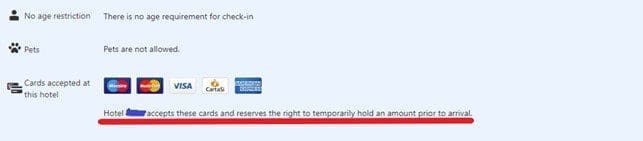

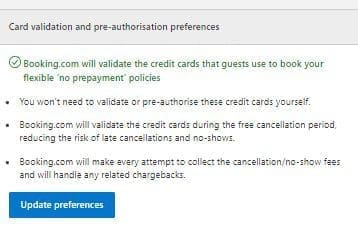

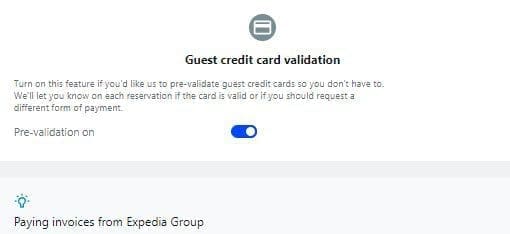

On some OTAs, such as Booking.com, hoteliers can set the pre-authorization parameters directly on the extranet (Property->Policies for Booking.com and Payments->Manage Payment Settings for Expedia). This appears on the public page front end.

Analog vs. Digital Pre-authorizations and Regulations

There are two ways of making pre-authorizations:

- The manual (analog) version occurs at the POS (point of sale.) The guest doesn’t need to be in front of you, but they may call or email their request along with their credit card information—the front desk staff keys the credit card information in by hand, along with the pre-authorized amount.

Depending on your area, this is not a secure method and may be against the law.

- Then, there’s digital where an online payment gateway connects to the relevant bank and automates the pre-authorization with a click.

It’s not surprising that digital pre-authorizations are the most practical, convenient, and secure. It’s even required in Europe, where the regulation psd2 (Payment Service Directive 2) handles credit card security. It also requires Strong Customer Authentication (SCA) in the context of online payments. If the customer is not physically present, SCA verifies guests’ identities via one of the following three authentication methods.

- Password or PIN

- Mobile device (such as a phone)

- Biometric data (fingerprint)

The other thing to know about pre-authorization is it isn’t a payment. However, if the guest doesn’t show up or damages your property, you can use the pre-authorization and convert it into payment.

Hotels Lose Profitability When They Let the OTAs Manage Payments

It seems convenient to let the OTAs handle them as it saves time. Yet, OTAs don’t manage your revenue and have their own goals. Too many hotels have experienced their channel partners undercutting their rates.

You can see this below.

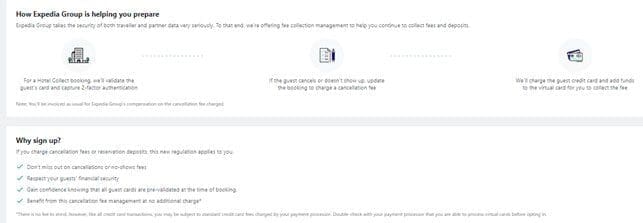

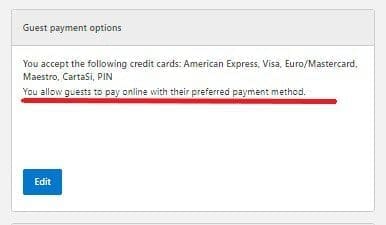

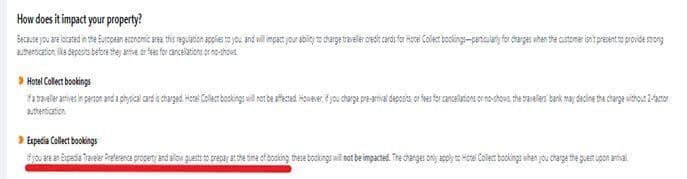

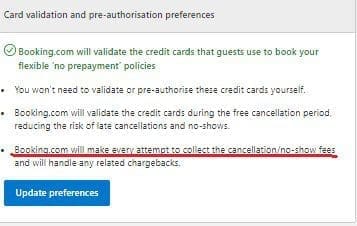

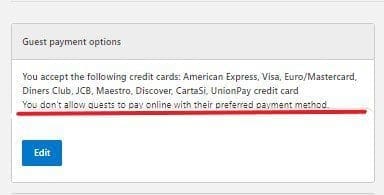

First, you can see how Booking.com and Expedia set up pre-authorizations: Booking.com (Property->Policies in the extranet) and Expedia (Property details->Fees, policies and settings->Payment methods in the extranet.)

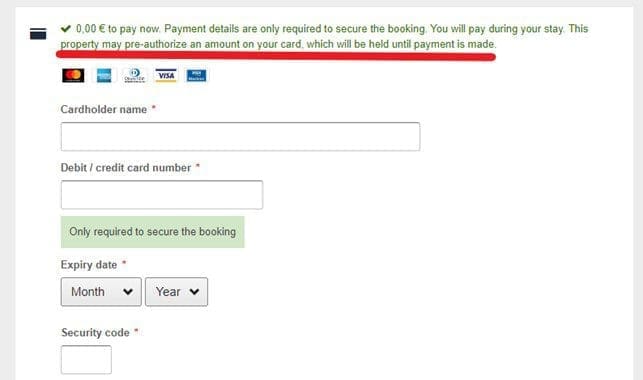

When the OTA handles online payments and pre-authorizations, it can create a revenue problem because it can change your rates. In fact, you must allow guests to pre-pay online as a prerequisite, as per the screenshot below.

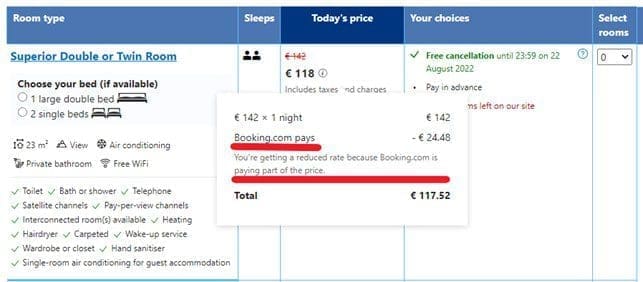

For example, if you allow them to take your reservation payments and the guest sees a lower rate, how do you handle it?

OTAs have different business goals than yours. Sometimes, they’ll cut their commissions to make the sale. They’ll accept payment from a guest and apply a lower price. They’ll then send the hotel a virtual credit card with the full amount, and the hotel may not even notice.

Below are some screenshots that represent the problem.

Such undercutting can derail your entire revenue management plan. You can retain control if you take charge of online payments and pre-authorizations.

OTA Pre-authorization Challenges

You can prevent guests from booking on an OTA at a lower rate. You can also use software to match the OTA rates if they lower the rates. It all depends on your revenue management strategy.

As a small or mid-sized hotel, you have fixed inventory. Reaching your profit goals requires strategically pricing your rooms and connecting them with the right guests. The OTA, however, has thousands of rooms on its platform. If the algorithm discounts your rates, that can impact your profits.

At times, OTAs discount hotel rates by as much as 40% to earn a customer’s trust. As a hotelier expecting to pay a 15-20% commission, this can wreck your financial projections. Paradoxically, it makes sense for a hotelier to allow the guest to book on the OTA in such a scenario. If the guest calls and asks for the 40% discounted room, you’ll invite them to book on the OTA. That way, the net margins are higher due to the amounts loaded on a virtual card.

Here’s what that can look like; imagine you offered a room rate of $100 on all available channels. Your hotel accepts online payments from Booking.com, and Booking.com shows your guest a price of $90. The OTA doesn’t mind losing part of the commission if it brings in a new customer.

If the guest calls the hotel requesting the $90 rate, the hotel may honor that rate. However, if the OTA goes as low as 40%, the hotel can’t afford to match that rate because they’ll achieve a net margin of 60 (100-40%.) Instead, they can invite the guest to book on the OTA, knowing the OTA will send the hotel a virtual credit card with the complete $100.

The hotel will initially pay the commission out of that $100 as planned, leaving a net margin of 82 (100-18%.)

The other thing to consider is the OTAs don’t always guarantee to collect penalties. As a hotelier, you don’t know how much or when (or if) they’ll pre-authorize, and you’re responsible for the virtual credit card transactions which can be as high as 3%.

As a hotelier, if you maintain control of guest credit cards and their pre-authorizations and penalties, then you won’t lose profit by relying on OTAs to manage the payment process. Most hoteliers see little difference in booking volumes but appreciate the rate transparency and more direct bookings.

A cloud-based property management system (PMS) makes it easy to safely and securely handle your guest’s credit cards. A PMS automates the pre-authorization and payment process of OTA customers and those who book directly via the site or phone/email, the so-called MOTO reservations (Mail Order / Telephone Order.).

How hotels can avoid chargebacks and fraud risk

Credit card security is a growing concern in the hacker age. In the past, phone reservations often meant staff jotting down a credit card number on a piece of paper. Or, guests might email their credit card details to reserve a room, and neither is secure.

A modern cloud-based property management system (PMS) offers security. One option uses a link to request payment authorization which you can send to the customer by phone (Whatsapp, for example) or email.

Then, the guest can open the link and pre-authorize the credit card. Two-factor authentication ensures security and consent. If the guest doesn’t follow through, the hotel can choose to cancel the reservation.

The new PSD2/SCA regulation requires a double verification process for security. Guests enter a private code that proves they own the card. This method serves as fraud protection and protects the hotel from lost revenue if you have a no-show penalty. It also lowers the risk of hacks and potentially lost data.

A modern PMS offers further fraud protection by allowing you to “tokenize” credit card data. By converting the credit card data into a specific identification number, that number is only suitable for the reservation and any potential penalties.

Once the card (or the token) is in the system, you can pre-authorize it, release it, or turn it into payment with a click of a button.

Digitizing pre-authorizations reduces the risk of fraud and chargebacks. Plus, you stay in control of your revenue.

Summary

Credit card fraud protection is a growing concern worldwide. Currently, PSD2 is specific to European hotels, but paying attention to your guest’s credit card security at any time is worthwhile everywhere, and it’s good business.

A PMS and booking engine that works with payment gateways maintains credit card security and revenue management.

The Revenue Team by Franco Grasso has worked with over 2000 hotels worldwide. Those that established internal control of pre-authorization enjoy improved cash flow and 5-10% higher total revenue per available room (Trevpar) than hotels that don’t.

As you can see, pre-authorizations are indispensable for hotels to project and preserve cash flow. They protect hotels from losses like late cancellations, chargebacks, no-shows, and property damage. Additionally, today’s automation tools make it efficient and secure to handle guest payments. There’s no need to give a third party control of your revenue and cash flow.