As hoteliers welcome guests back, many are hunched over spreadsheets reviewing the first half of the year (H1.) Are you happy with your numbers so far? Is your property predicting a 15%-40% increase over 2019 this year? Four hundred revenue-managed hotels are on track for such increases.

As hoteliers welcome guests back, many are hunched over spreadsheets reviewing the first half of the year (H1.) Are you happy with your numbers so far? Is your property predicting a 15%-40% increase over 2019 this year? Four hundred revenue-managed hotels are on track for such increases.

You may have seen a recent webinar with STR. In the webinar, the industry benchmark showed the hotel recovery is going strong, and people are traveling again. However, for many hotels, Revpar (revenue per available room, one of the main top line indicators) is lower in some European urban markets than in 2019.

Many hoteliers might chalk these lower numbers up to the pandemic or other external factors like the inflation, the war in Ukraine, the chaos in airports etc. Yet, revenue management consultancy firm Franco Grasso Revenue Team conducted research of 400 hotels and found these hotels are on track to exceed their 2019 numbers by 15%-40%.

Revenue management makes the difference

STR is an industry leader and represents a wide variety of hotels. Some of these properties tend to be underperformers, and they may have a low brand reputation online (below an 8 on Booking.com or below a 4 on Tripadvisor/Google.) Then, many closed for one or even two years due to the pandemic. As they reopen, these hotels are facing a struggle in finding staff and regaining their online visibility.

It turns out that properties that closed briefly at the beginning of the pandemic – or that remained open – are in a strong position. Such properties have maintained online visibility, and many practiced revenue management to control cash flow.

This article shares a performance overview from the first six months of the year (H1) 2022. The 400 hotels in the sample are European and South American and include revenue management. The graphs compare these past six months with the first six months of 2019, with a focus on some Italian and Argentinian cities. In context, these are not outliers, and the results are similar to other countries in Europe and South America.

These 400 properties share many similarities. They all use the consulting services and revenue management system of the Franco Grasso Revenue Team. They also:

- Never closed during the pandemic

- Use revenue management methods for profitability (even in crisis)

- Have a good reputation score of 8 or more on Booking.com and 4 or more on Tripadvisor/Google

- 3-star category (from 20 to 200 rooms)

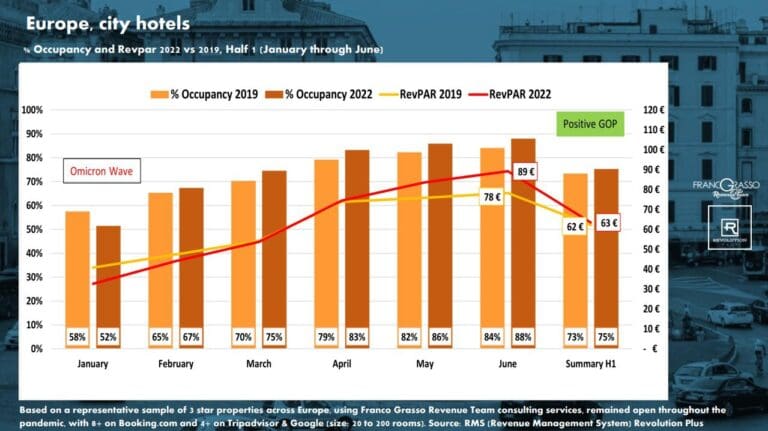

European city hotels: performance 2019 vs. 2022

The graph shows the results of European city hotels from the first six months of 2022. You’ll see Omicron affected the January and February numbers less to travel restrictions to people testing positive right before traveling. As a result, many people had to cancel or reschedule their reservations.

Things started changing in March. Occupancy and RevPAR crept past 2019 numbers and continued into spring and early summer. Thanks to smart revenue management, April, May, and June were able to maximize revenue which made up for the beginning of the year. These properties saw a total turnover higher than the same period in 2019 (+2%.)

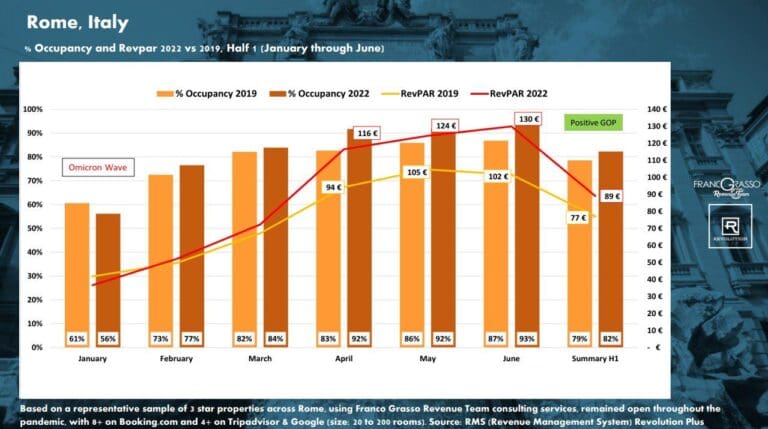

The following graph shows the success of select hotels in Rome, Italy.

There are fewer hotels in Rome 2022

As travel restrictions lifted, tourists flocked back to the Italian capital. While the hospitality industry is happy to welcome them, there are fewer hotels. The president of the local hoteliers association reported at least 350 hotels out of more than 1200 have been closed since March 2020 for almost two years. Furthermore, around 200 are still closed or will never reopen. A quick search on Booking.com to analyze the listed properties shows this change.

Along with hotel closures, small BnBs and guesthouses also closed. Many were not licensed but still attracted visitors and impacted the market.

An influx of visitors and less competition is good for the existing hotels. The graph below shows exceptional revenue increases in the second quarter compared to 2019. These increases reduced Q1 losses and allowed these hotels to close the mid-year with a +15% increase in revenue compared to 2019.

As demand returns, these remaining hotels are poised to welcome visitors. Additionally, these hotels practiced revenue management methodology

before and during the pandemic and learned how to manage cash flow during all seasons.

Consider what they accomplished in 2020 and 2021 with revenue management principles:

- Captured essential or transient business travelers during restricted leisure travel.

- Maintain an operational break-even throughout

- Recouped previous losses by maximizing revenues during relaxed restrictions

- Accumulated positive reviews

- Maintain online visibility

- Retain staff

- Acquire new clients from hotels that were closed during the pandemic

- Achieve a positive GOP (Gross Operating Profit) at the end of the year

- Analyze the market to predict demand in the short, medium, and long term

- Invest in service improvements

- Bypass competitors

Now, as the busy summer travel season is in full swing, hotels that remained open thanks to revenue management and have stable staff can operate at 100% capacity. Many hotels that have only recently reopened can’t, and staff shortages prevent many such hotels from operating at full capacity.

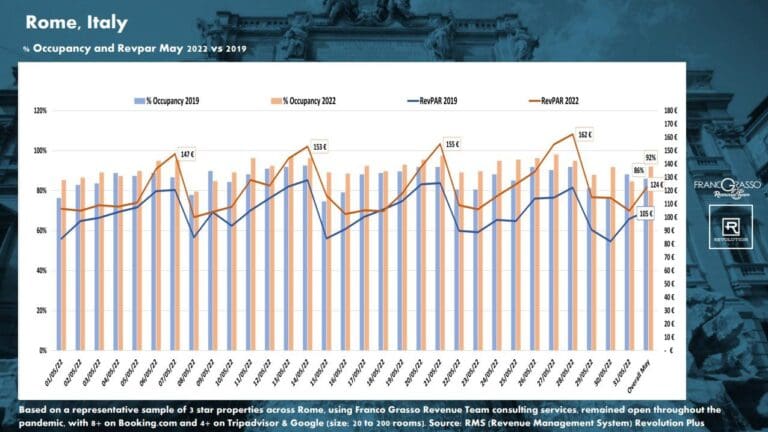

The May number reports show Saturdays continue to be the busiest day of the week in Rome. There’s peak occupancy and ADR. As the summer wears on, rates continue to increase weekly.

Turin and Milan data is also positive

Two other Italian cities, Turin and Milan, are enjoying the excitement of significant events. In Turin two occasions, in particular, have allowed certain hotels to push top rates and, in some cases, the highest these hotels have seen.

The two big events were a week apart in May. Saturdays 14 and 21. The first Saturday was the Eurovision Song Contest. If you’re familiar with the event, you know it’s one of the most-watched international music events worldwide. The final was on May 14, and many people flooded into Turin to watch.

The following Saturday was another busy day for Turin’s hotels. The city hosted the final of the Women’s Champions League. This football tournament featured Barcelona and Lyon, cities within easy distance of Turin, and sports fans came to cheer on their favorites. Hoteliers know that the Men’s Champions League Final is one of the most anticipated events for cities hosting the event.

Will the Women’s Champions League draw as big crowds in the future? Only time will tell. We know that in May 2022, the event filled the stadium and the hotels at higher-than-normal rates.

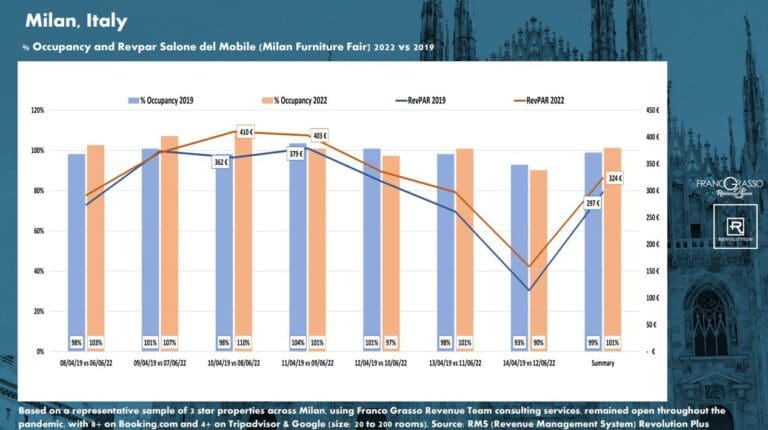

In Milan, nearly 400,000 designers and furniture makers visited for the 60th Salone del Mobile. This is the world’s largest furniture and design event, and 2022 was the first time it regained its splendor in two years.

This is the sort of event where every hotel within a nearby radius is at capacity, and even 3-star hotels can push rates usually reserved for 5-star hotels.

There was no Salone del Mobile in 2020, thanks to COVID, and in 2021, it was a scaled-back version. Typically, the event is in April, but in 2022, the organizers pushed it to June and held it in full glory. The below graph compares the week’s results, June 6-12, 2022, to its April week in 2019 (April 8-14.)

In 2022, the demand exceeded the supply. There were days occupancy expanded to 110%. Now, not every hotel reaches 100% occupancy organically. Some have help from overperforming hotels. They know which other hotels still have free rooms and can lend a portion of their extra occupancy to these underperforming hotels which help them reach 100% occupancy.

Done well; it works for everyone. The underperforming hotels reach full occupancy; the guests are happy because they have a comfortable place to stay and may leave positive reviews. Additionally, these overperforming hotels earn additional revenue because they leverage the price difference between the two hotels.

Do seasonal hotels see similar results?

Seasonal hotels like mountains, lakes, and beaches also see excellent results with revenue management.

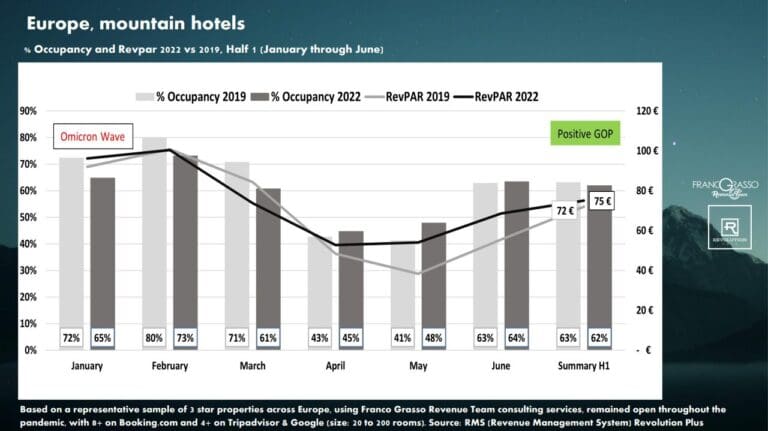

Take mountain hotels in Europe; they maintained the trend of Omicron-related cancellations at the beginning of the year and had lower occupancy rates than in 2019, yet, they still improved on 2019 Revpar thanks to higher ADR (average daily rate). Q2 is usually the low season for mountain resorts, yet they still managed to close H1 +5% from 2019.

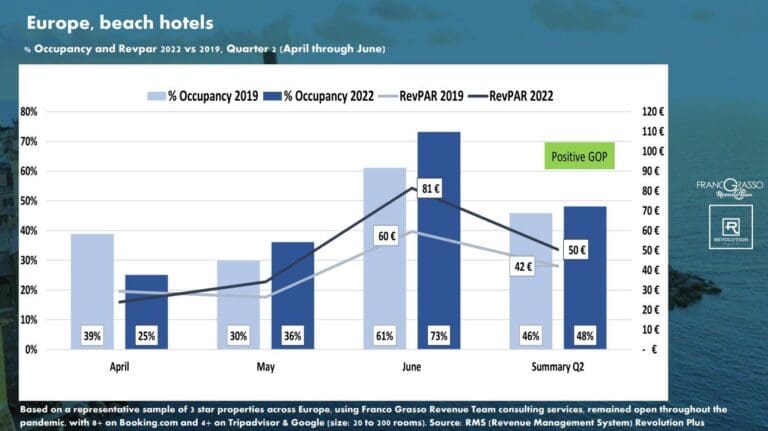

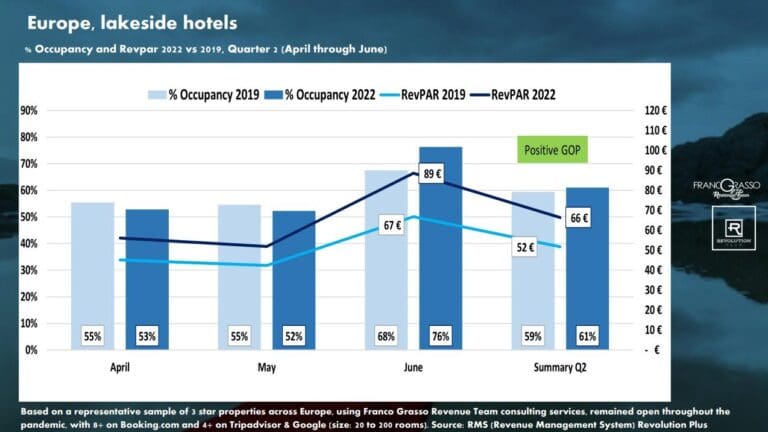

By April, summer properties in Europe start opening. They, too, recorded higher than 2019 numbers for the quarter. These properties showed higher numbers between 10% and 45%.

These numbers are indicative all over Europe and in South America too.

Argentina hotels showed increases too

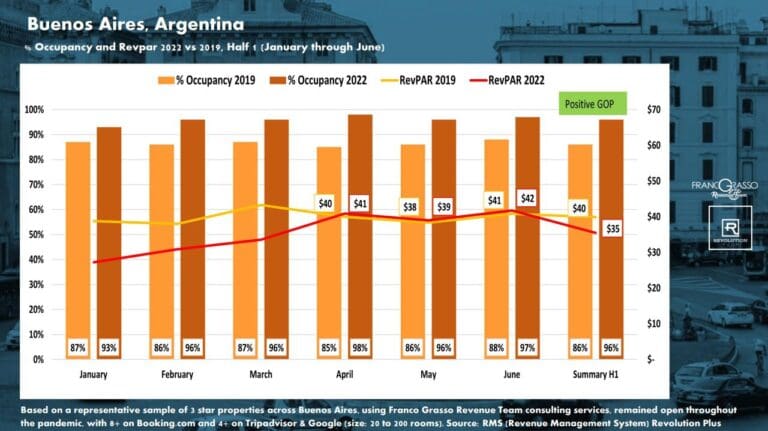

Argentina’s capital city Buenos Aires enjoyed high occupancy levels in the first six months of 2022. Yet, high demand doesn’t always correspond with RevPAR. Yet, in Q2, they did, thanks to travel restrictions easing.

The Q1 occupancy levels were higher than in 2019, yet the ADR faced a currency issue. Many of the guests were Argentinians, and the Argentinian peso was heavily devalued compared to 2019. Therefore, Q1 demand and occupancy rates were high. In fact, revenue and Revpar were more than double 2019 numbers in Argentinian pesos, yet the devalued currency reflects a limit to the actual revenue in US dollars. However, from April, more foreign travelers returned paying in US dollars. This currency change helped the ADR, Revpar, and profits to surpass 2019 numbers. This trend will likely continue for the rest of the year, helping the year to outperform 2019.

Outside of the cities, these results hold too.

Villa General Belgrano is a popular hilly destination in Argentina. Strong demand pushed the results past 2019 numbers both in high (Q1) and low season (Q2). As travel trends show, many travelers seek outdoor areas (countryside, mountains, rivers, forests etc.) for their vacations thanks to fewer crowds and fresh air.

As seen in a previous article, hotels have a powerful choice. Those that remained open during the pandemic and practiced revenue management as their default profitability strategy achieved positive cash flow and YoY results. This study of 400 hotels on two continents found each of them closed their mid-year books in a stronger position than in 2019, and they’re predicted to finish the year strong.

Wrap up

If you’re intrigued by revenue management, download this free ebook for more information and practical advice on implementing these principles in city, beach, mountain and countryside hotels.

Hopefully, these graphs demonstrate what’s possible. These hotels could close the year with increases between 15% and 40% over 2019, and strategic revenue management makes it possible.