After more than one year of global pandemic, we are yet to grasp all the different ways in which the virus has changed our lives. Indeed, the impact of an event of such magnitude can only be measured in hindsight, with enough time and perspective to understand all the cascading consequences.

After more than one year of global pandemic, we are yet to grasp all the different ways in which the virus has changed our lives. Indeed, the impact of an event of such magnitude can only be measured in hindsight, with enough time and perspective to understand all the cascading consequences.

Zooming on the hospitality industry, we know that many of the strings that held the market together snapped under the impact of the virus. The upheaval of several long-agreed-upon principles acted as a sort of renewal for some of the unhealthier aspects of the industry; among them the online booking monopoly. For various reasons which will be detailed later in this article, the COVID-19 outbreak loosened the grip Online Travel Agencies held over the online hospitality market. This paradigm shift provided hotels with a unique opportunity to reclaim control over their digital distribution. However, even though direct bookings are on the rise, OTAs are likely to want to earn back their lost market shares as soon as international travel resumes. Going forward, it will take hotels time, resources, and dedication if they want to keep challenging OTAs at the top of the online booking game.

In this article, we will see, through concrete analysis and numbers, how the online booking world changed under the influence of the COVID-19 pandemic. Then, we will explore possible reasons behind this mutation and reflect on the new roles for each stakeholder. Finally, we will look ahead and speculate on what direction the hospitality industry might be taking in the long term and what hoteliers should do to thrive in this new environment.

Shifting tides

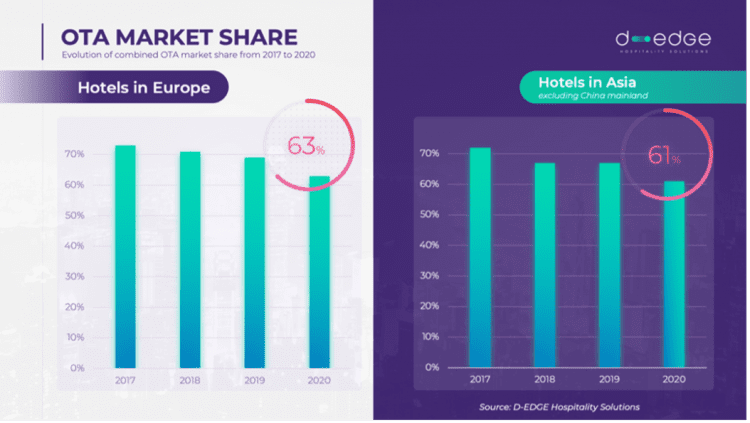

A recent study by D-Edge Hospitality Solutions highlighted how the pandemic accelerated a mild decline trend that is symptomatic of an exacerbated outcry for change. Whilst OTAs had remained relatively unchallenged during the past few years, the COVID-19 outbreak put their global hegemony in jeopardy. In Asia, powerhouses such as Expedia and Agoda lost as much as 40% market shares, while only Booking.com managed to remain stable despite the crisis. Europe paints a similar picture, with huge losses to show for pretty much every major OTA apart from Booking.com.

As a result, direct bookings are clawing their way back up hotels distribution mix. This trend seems to be global, although it is more pronounced in Asia, a region with a track record of driving more direct revenue. In Asia, web direct in 2020 accounted for a whopping 36% of all online acquisition (up 7 points from 2019) while in Europe it managed to grow 33%, from 21% all the way to reach 28% total direct bookings. Even though direct bookings are not quite reaching OTA figures yet, the current exponential growth is more than encouraging.

Skift research also stated that direct bookings held especially strong during the COVID-19 outbreak. So much so that, as a result, the whole hotel distribution landscape has been reshaped.

Moreover, in addition to the direct bookings surge, new players such as Google are threatening to make a grand entrance on the online market. As lines between distribution channels are getting more and more blurred, the relative balance that was reached in recent years has been upended. Today, it is difficult to predict where the new equilibrium will lie; only one thing remains certain: the next few months will define the distribution landscape for years to come.

If hotels want to keep the momentum going, they first need to understand the reasons behind this sudden shift. Indeed, analyzing what caused OTA market shares to plummet is the first step in the process of building a long-term direct revenue flow.

Behind the numbers

We know by now that COVID’s ramifications stretch much further than what originally met the eye. Behind the market share numbers, are complex mechanism and chains of consequences linked to the pandemic that added up to tumble the OTA monopoly. Here are a few of the possible explanations behind the new dynamics we identified above.

Dwindling customer trust

In the wake of the first lockdowns and travel restrictions, OTAs suddenly had to manage and reimburse thousands of online bookings which could not be fulfilled. The poor unraveling of this complicated and unprecedented process led many customers to lose trust in these platforms and eventually to stop using them altogether. As travel started to resume, a lot of people previously loyal to OTAs decided to change their booking channel, mainly in favor of hotels’ websites.

Global drop in online advertisement

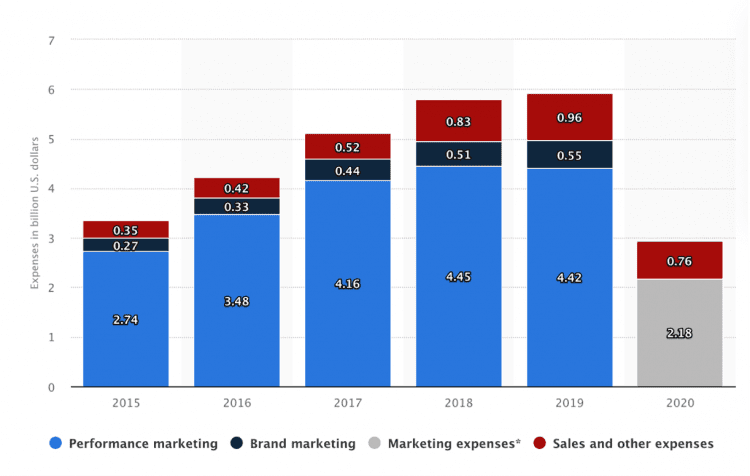

Prior to the pandemic, major OTAs dominated almost all travel related queries on search engines. As soon as countries started enforcing travel restrictions, all major OTAs decided to put their digital campaigns with Google and other similar actors on hold. This concerted decision relieved some of the pressure for hotels to compete with million dollar budgets on search engines and social media.

To give a few figures, Expedia stated that the company cut its marketing budget by more than 80% in 2020. Meanwhile, Booking.com more than halved its marketing related expenses, dropping from 5 billion to about 2.2 billion Euros.

Hoteliers acting through technology

Since many hotels had to either close doors or operate on extremely low occupancy, managers had some time to sit and think about their digital strategy. Indeed, as hoteliers are often nose to the grindstone, it can be difficult for them to reflect on the different technology solutions available on the market. This relatively short time off was the perfect opportunity for them to work on their digital presence and especially their website by implementing more direct booking tools and improving the overall user experience. As hotels started to reopen, those who were able to rethink and improve their digital offering immediately started reaping the fruit of their efforts.

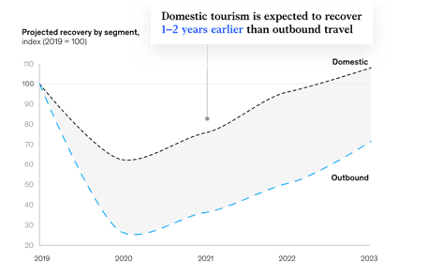

Surge in local travel

As it became more and more difficult to travel abroad, most people had to settle for domestic destinations, which heavily favors booking direct. Indeed, without the language barrier and with better knowledge of the different available hotels, local travelers are much more likely to book their stay directly through the hotel rather than using the services of an OTA.

Keeping the momentum going

Even though the pandemic helped hotels to start turning the tides, OTAs are silently waiting for the perfect time to make their come back. As we saw, some of the reasons behind the mutation of the industry are temporary by essence; indeed, both international travel and marketing campaigns will eventually resume. Thus, if hotels want to keep growing their direct bookings, they need to capitalize on what has been proven to give them an edge against OTAs on the long term: guest relation and technology.

Fostering customer relationships and building trust

One time-tested strategy to build customer trust is the implementation of a guest loyalty program. In the past few years, loyalty programs have been a key strategic point for major hotel chains such as Hilton (Hilton Honours) or Mariott (Bon Voy) and one of the best ways to keep up with OTAs. Even at the scale of a smaller and/or independent hotel, the importance of a loyalty program should not be overlooked.

By communicating regularly and offering discounts at strategic times, hotels can generate a significant amount of recurring revenue. Since acquiring a new customer can be 10 times as expensive as incentivizing a previous customer to return, focusing on the latter can save hotels a significant amount of money in the long run. Moreover, studies also show that returning customers generate more revenue: on average, they spend as much as three times more per transaction than first-time guests.

Besides, to avoid getting the same kind of backlash OTAs received at the start of the pandemic, it is paramount for hotels to offer good customer service pre- and post-booking. By staying flexible, for example, in the face of cancellation, hotels can build a solid reputation which will incentivize guests to book direct rather than going through an OTA.

Finding the right tools to compete with OTAs

If they want to become a true alternative to OTAs, hotel websites need to provide guests with additional value through a more diversified offering. The likes of Booking.com and Expedia excel in delivering a standardized booking experience whatever the destination. However, since these platforms have become so big, they lack the ability to rapidly adapt to what guests want. Therefore, one of the key advantage hotel websites hold over OTAs is their flexibility: they can easily update their digital offer to the current market trends.

For example, amidst the pandemic, we saw many hotels starting to adapt their business model to their new-found environment. Innovative finds such as day-use stays, and ancillary services came in clutch to fill the gap left by the lack of international travelers. As most OTAs were unable to provide this kind of service on their platform, all these sales were made directly through hotel websites, thanks to innovative white brand solutions such as PrivateDeal providing the necessary technology.

Another great way for hotels to differentiate their offer is by building a more personal booking experience. Whilst OTAs treat all their users in the same relatively robotic way, hotels have the liberty to provide their guests with a more customized and unique experience on their website. For instance, by using upselling tools (i.e Oaky, Revinate, …) or dynamic/personalized pricing solutions (Ideas, RoomPriceGenie, PrivateDeal, …), hotels’ conversion rate can easily outperform that of OTAs and serve as a great incentive for guests to book direct. Chatbots are also a great option to stay close to your users even while they are navigating your website.

Parting thoughts

In this article, we saw that the online booking landscape has drastically evolved during the pandemic. With the OTA monopoly weakened hotels have a unique chance to climb their way near the top of the online booking industry. However, Booking.com, Expedia, and other major booking platforms are simply biding their time before an inevitable comeback. As international travel slowly starts to resume, OTAs’ marketing efforts will soon be in full swing and hotels must be prepared to meet them with solid direct acquisition strategies.

Moving forward, the future of online bookings is still uncertain, although the ball is in hotel’s courts: either hoteliers choose to go back to their old pre-COVID ways and watch OTAs take over the online market once again, or they decide to give themselves the means for their ambitions. Fortunately, hoteliers are not alone in that fight. By teaming up with the right technology providers and by staying close to their guests, they can succeed where OTAs failed and keep on growing their businesses online.