Wyndham Hotels & Resorts (NYSE: WH) announced results for the three months ended March 31, 2021. Highlights include:

Wyndham Hotels & Resorts (NYSE: WH) announced results for the three months ended March 31, 2021. Highlights include:

- Diluted earnings per share was $0.26, and adjusted diluted earnings per share was $0.36.

- Net income was $24 million and adjusted net income was $33 million.

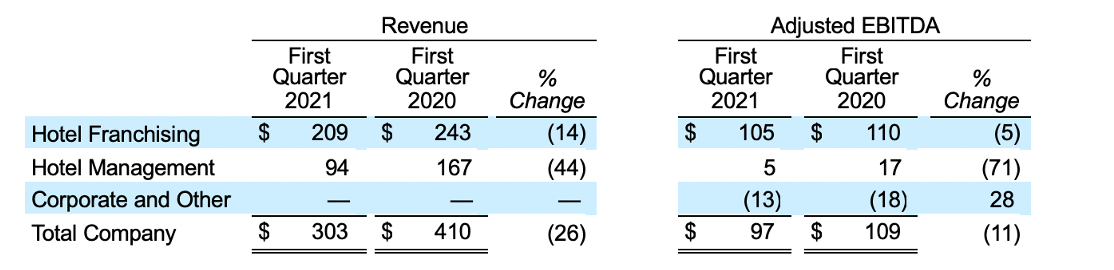

- Adjusted EBITDA was $97 million.

- Generated $64 million of net cash provided by operating activities and $59 million of free cash flow.

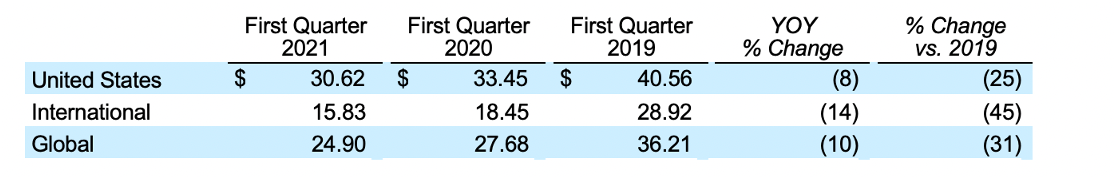

- Global RevPAR declined 11% compared to first quarter 2020 and 31% compared to first quarter 2019 in constant currency.

- Paid quarterly cash dividend of $0.16 per share.

- Redeemed all $500 million aggregate principal amount of its outstanding 5.375% Senior Notes due 2026 on April 15, 2021.

- Company updates its previous 2021 projections.

“Wyndham’s select-service franchise business model delivered a strong start to 2021 as leisure customers hit the road at a pace not experienced since the pandemic started and demand from our everyday business travelers continued to accelerate,” said Geoffrey A. Ballotti, president and chief executive officer. “We were very pleased to see our development pipelines grow sequentially, both domestically and internationally, and our room openings and deletions improve year-over-year. We were also encouraged to see conversion room openings increase year-over-year, representing over 70% of total openings this quarter.”

Revenues declined from $410 million in the first quarter of 2020 to $303 million in the first quarter of 2021. The decline includes lower pass-through cost-reimbursement revenues of $55 million in the Company’s hotel management business, which have no impact on adjusted EBITDA. Excluding cost-reimbursement revenues, revenues declined $52 million primarily reflecting an 11% decline in constant-currency global RevPAR.

The Company generated net income of $24 million, or $0.26 per diluted share, compared to $22 million, or $0.23 per diluted share, in the first quarter of 2020. The increase of $2 million, or $0.03 per diluted share, was a result of the Company’s COVID-19 cost mitigation plan implemented in April 2020, lower volume-related expenses and the absence of restructuring and transaction-related expenses, which were partially offset by the global RevPAR decline.

The following discussion of first quarter operating results focuses on the Company’s key drivers as well as revenue and adjusted EBITDA for each of the Company’s segments. Full reconciliations of GAAP results to the Company’s non-GAAP adjusted measures for all reported periods appear in the tables to this press release.

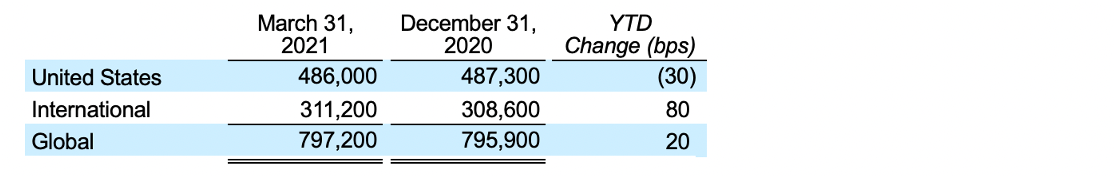

System Size

During the first quarter of 2021, the Company’s global system grew 20 basis points reflecting strong growth in the Company’s direct-franchising business in China, primarily offset by the impact from supply chain delays on new construction openings in the United States. As expected, terminations normalized in the first quarter and the Company remains solidly on track with its goal of achieving a 95% retention rate for the full year 2021.

During the first quarter of 2021, the Company’s global system grew 20 basis points reflecting strong growth in the Company’s direct-franchising business in China, primarily offset by the impact from supply chain delays on new construction openings in the United States. As expected, terminations normalized in the first quarter and the Company remains solidly on track with its goal of achieving a 95% retention rate for the full year 2021.

RevPAR Global and International RevPAR began to lap the onset of the COVID-19 pandemic in January 2021 while the U.S. began to lap its onset in March 2021. As such, comparisons to 2019 (on a two-year basis) are more meaningful when evaluating trends. On this basis, global RevPAR declined 31% reflecting a 25% decline in the U.S. and a 45% decline internationally. The 25% decline in the U.S. represents continued sequential improvement compared to a decline of 31% in the fourth quarter of 2020. The 45% decline internationally is consistent with the fourth quarter 2020 performance.

Global and International RevPAR began to lap the onset of the COVID-19 pandemic in January 2021 while the U.S. began to lap its onset in March 2021. As such, comparisons to 2019 (on a two-year basis) are more meaningful when evaluating trends. On this basis, global RevPAR declined 31% reflecting a 25% decline in the U.S. and a 45% decline internationally. The 25% decline in the U.S. represents continued sequential improvement compared to a decline of 31% in the fourth quarter of 2020. The 45% decline internationally is consistent with the fourth quarter 2020 performance.

Business Segment Results Hotel Franchising revenues decreased $34 million year-over-year reflecting the global RevPAR decline, while adjusted EBITDA declined $5 million as the impact of the RevPAR decline was almost entirely offset by the Company’s COVID-19 cost mitigation plan implemented in April 2020 and lower volume-related expenses.

Hotel Franchising revenues decreased $34 million year-over-year reflecting the global RevPAR decline, while adjusted EBITDA declined $5 million as the impact of the RevPAR decline was almost entirely offset by the Company’s COVID-19 cost mitigation plan implemented in April 2020 and lower volume-related expenses.

Hotel Management revenues decreased $73 million year-over-year reflecting a $55 million reduction in cost-reimbursement revenues, which have no impact on adjusted EBITDA. Absent cost-reimbursements, Hotel Management revenues decreased $18 million due to the global RevPAR decline and lower termination fees. Adjusted EBITDA declined $12 million year-over-year reflecting the revenue decrease, partially offset by lower volume-related expenses.

Development

The Company awarded 112 new contracts this quarter compared to 115 in first quarter 2020 and 124 in first quarter 2019. At March 31, 2021, the Company’s development pipeline consisted of approximately 1,400 hotels and approximately 187,000 rooms, growing sequentially by 120 basis points, 70 basis points domestically and 150 basis points internationally. Approximately 64% of the Company’s development pipeline is international and 75% is new construction. Approximately 34% of the new construction pipeline under development has broken ground.

Cash and Liquidity

The Company generated $64 million of net cash provided by operating activities in the first quarter of 2021 compared to $17 million in first quarter 2020. Free cash flow was $59 million in the first quarter of 2021 compared to $10 million (which included $15 million of special-item cash outlays) in first quarter 2020.

At March 31, 2021, the Company had $531 million of cash on its balance sheet and $1.3 billion in total liquidity. In April 2021, the Company redeemed all $500 million aggregate principal amount of its outstanding 5.375% senior notes due 2026, which also reduced the Company’s total liquidity to approximately $750 million. The Company expects this redemption to reduce its annual cash interest expense by approximately $27 million. Coupled with the issuance of 4.375% senior notes in August of 2020, this redemption effectively returns the Company to pre-pandemic debt and liquidity levels while extending $500 million of maturity by approximately 2.5 years at a 100 basis point (or 19%) lower interest rate.

Dividends

The Company paid common stock dividends of $15 million, or $0.16 per share, in the first quarter of 2021.

2021 Projections

The Company is not providing a complete outlook for full-year 2021 given the RevPAR uncertainties ahead; however, the Company is updating the projections provided in February:

- Net rooms growth of 1% to 2%, consistent with February’s projection.

- Every point of RevPAR change versus 2020 is now expected to generate approximately $2.8 million of adjusted EBITDA change versus 2020 (increased from $2.5 million per point in February).

- License fees are expected to be $70 million reflecting the minimum levels outlined in the underlying agreements, consistent with February’s projection.

- Marketing, reservation and loyalty expenses are not expected to exceed marketing, reservation and loyalty revenues, consistent with February’s projection. As such, the Company expects no meaningful impact to full-year 2021 adjusted EBITDA from the marketing, reservation and loyalty funds.

- The Company does not expect any meaningful special-item cash outlays in 2021, consistent with February’s projection.

More detailed projections are available in Table 8 of this press release. The Company is providing certain financial metrics only on a non-GAAP basis because, without unreasonable efforts, it is unable to predict with reasonable certainty the occurrence or amount of all of the adjustments or other potential adjustments that may arise in the future during the forward-looking period, which can be dependent on future events that may not be reliably predicted. Based on past reported results, where one or more of these items have been applicable, such excluded items could be material, individually or in the aggregate, to the reported results.

Conference Call Information

Wyndham Hotels will hold a conference call with investors to discuss the Company’s results and outlook on Thursday, April 29, 2021 at 8:30 a.m. ET. Listeners can access the webcast live through the Company’s website at www.investor.wyndhamhotels.com. The conference call may also be accessed by dialing 877 876-9174 and providing the passcode “Wyndham”. Listeners are urged to call at least five minutes prior to the scheduled start time. An archive of this webcast will be available on the website beginning at noon ET on April 29, 2021. A telephone replay will be available for approximately ten days beginning at noon ET on April 29, 2021 at 800 723-0549.

Presentation of Financial Information

Financial information discussed in this press release includes non-GAAP measures, which include or exclude certain items. These non-GAAP measures differ from reported GAAP results and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors as an additional tool for further understanding and assessing the Company’s ongoing operating performance. The Company uses these measures internally to assess its operating performance, both absolutely and in comparison to other companies, and to make day to day operating decisions, including in the evaluation of selected compensation decisions. Exclusion of items in the Company’s non-GAAP presentation should not be considered an inference that these items are unusual, infrequent or non-recurring. Full reconciliations of GAAP results to the comparable non-GAAP measures for the reported periods appear in the financial tables section of this press release.