Something that many of us have felt and others have put into numbers is the megatrend of luxury hotel rates growing at an outsized pace relative to in-market comparisons from other budget, midscale and even upmarket hotels. The two of us have pointed to this difference on projects as a reason for owners and investors to consider either upleveling their existing property or in going through the extra effort to develop within luxury hospitality real estate versus other classes.

Something that many of us have felt and others have put into numbers is the megatrend of luxury hotel rates growing at an outsized pace relative to in-market comparisons from other budget, midscale and even upmarket hotels. The two of us have pointed to this difference on projects as a reason for owners and investors to consider either upleveling their existing property or in going through the extra effort to develop within luxury hospitality real estate versus other classes.

Even as we’ve felt this mounting divide in action – and especially since the pandemic – some historical morsels present themselves that let you take a deeper dive. In this case, a colleague was cleaning out some old files and came across a corporate rate sheet for Montreal, Canada hotels for 1983 (Corporate name removed):

What is most interesting here is the narrow gap between luxury, upscale and budget properties. While we may look at a $45 spread between the top and bottom of the market, the spread pales in comparison to current pricing. Of course, to put definitive numbers behind our argument that the spread between luxury and non-luxury is many multiples above where it was in 1983 belies at least a dozen hours of work to line up rates in excel, sample current ADRs, develop an inflation-adjusted market average and account for hotels that have since closed or rebranded. This is a task we perform when we’re hired for a feasibility study or competitive set analysis, so in the meantime you’ll just have to trust us!

What is most interesting here is the narrow gap between luxury, upscale and budget properties. While we may look at a $45 spread between the top and bottom of the market, the spread pales in comparison to current pricing. Of course, to put definitive numbers behind our argument that the spread between luxury and non-luxury is many multiples above where it was in 1983 belies at least a dozen hours of work to line up rates in excel, sample current ADRs, develop an inflation-adjusted market average and account for hotels that have since closed or rebranded. This is a task we perform when we’re hired for a feasibility study or competitive set analysis, so in the meantime you’ll just have to trust us!

What’s more important than getting an exact quantitative result that points to just what that luxury multiplier would be for a gateway market like Montreal is to understand why this trend is happening and why it won’t stop.

The shortest answer behind the why is what Gilmore and Pine dubbed ‘The Experience Economy’. In a world where time matters more than money, people with disposable income are willing to pay a premium for time well spent. And in the basic economics of supply and demand, as demand for exceptional experiences increases, if supply can’t keep pace, then the price goes up.

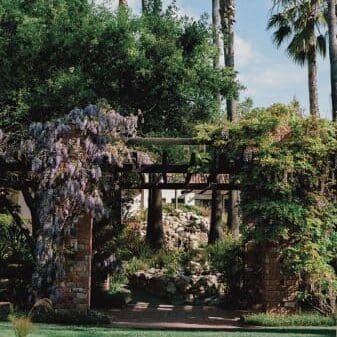

Luxury is privacy. Luxury is exclusivity. Luxury is anticipatory and personalized service. Luxury is seeing a destination through a lens that others are not privy to. Luxury is your mind put at ease. This is true hospitality, but it requires a lot of dedicated teams and FF&E capex to make a reality, so the costs are still considerable relative to operating in other categories. That said, luxury can have advantages with respect to total profitability if operations are managed effectively.

With so much emphasis on quarter-over-quarter returns, we can easily lose sight of the long-term trends that will influence rate growth over a five-year period or a multi-decade period when indexed against market comparisons and inflation. This rate card from 1983 helps to give that perspective so that you can get outside of your short-term thinking box. Luxury’s exclusivity and timelessness allow it to stand the test of time and maintain steady growth through practically any market conditions. It is time to consider upleveling or investing in luxury, and it all starts with unique experiences.

This article may not be reproduced without the expressed permission of the authors.