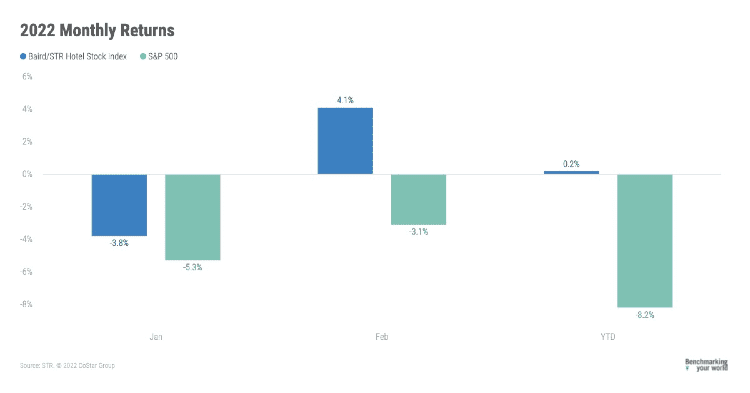

The Baird/STR Hotel Stock Index rose 4.1% in February to a level of 5,753. Year to date through the first two months of 2022, the stock index increased 0.2%.

The Baird/STR Hotel Stock Index rose 4.1% in February to a level of 5,753. Year to date through the first two months of 2022, the stock index increased 0.2%.

“Hotel stocks posted gains in February and were relative outperformers for the third consecutive month,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Despite increased stock market volatility and growing geopolitical concerns, investors remained focused on the reopening momentum and improving demand trends as Omicron-related disruptions are in the rearview mirror and corporations’ back-to-office plans are moving forward. A more normalized travel environment is expected to unfold over the next several months, in our opinion, and we are keeping a close eye on rising gas prices and any potential impact on near-term drive-to leisure demand.”

“The decline in Omicron cases and subsequent easing of mask mandates and restrictions is expected to have a positive impact on spring room demand in both the corporate and leisure segments,” said Amanda Hite, STR president. “Occupancy and room rates showed continued improvement in February with limited-service hotels displaying the most substantial gains toward pre-pandemic levels. While nominal ADR has been at or above 2019 comparables, inflation pressures continue to weigh on owner and investor minds as these healthy room rates are not translating to equally strong profit growth as expenses, especially labor costs, continue to rise.”

In February, the Baird/STR Hotel Stock Index outperformed both the S&P 500 (-3.1%) and the MSCI US REIT Index (-3.3%).

The Hotel Brand sub-index jumped 4.2% from January to 10,370, while the Hotel REIT sub-index increased 3.5% to 1,269.