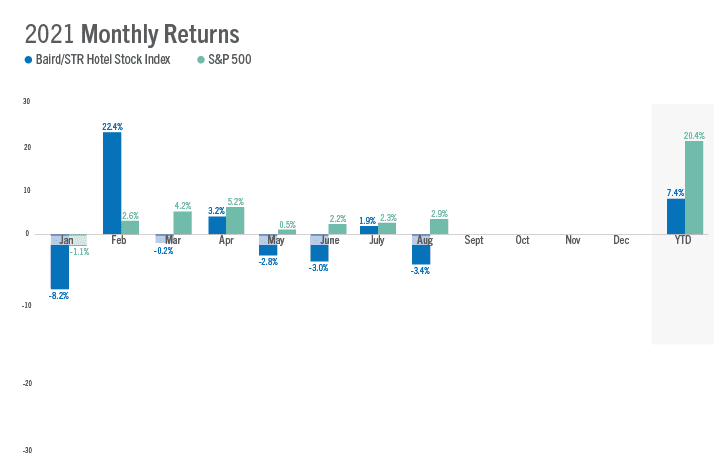

The Baird/STR Hotel Stock Index dipped 3.4% in August to a level of 4,911. Year to date through the first eight months of 2021, the stock index was up 7.4%.

The Baird/STR Hotel Stock Index dipped 3.4% in August to a level of 4,911. Year to date through the first eight months of 2021, the stock index was up 7.4%.

“Hotel stocks continued their streak of relative underperformance in August as investors remained focused on the impact of the Delta variant and the likely changes to post-Labor Day business travel trends,” said Michael Bellisario, senior hotel research analyst and director at Baird. “The near-term trajectory of the recovery has flattened; however, investors appear to have priced in near-term downside scenarios, in our opinion, and they continue to look to 2022 and 2023 when the broader travel environment should be more normal versus today.”

“August performance, still shaped by continued strong demand from the American leisure traveler, came in lower than the July peak but still at a healthy level overall,” said Amanda Hite, STR’s president. “With the summer of travel behind us, all eyes are now on the fall season, which traditionally has been buoyed by corporate group demand. Unfortunately, the Delta variant has already caused major meetings cancellations, and it seems that the industry will have to wait a bit longer for that segment to return at a significant level. Whereas last year leisure travelers continued to generate room demand well into the fall, we expect softer demand this year with schools back in-person.”

In August, the Baird/STR Hotel Stock Index fell behind both the S&P 500 (+2.9%) and the MSCI US REIT Index (+1.8%).

The Hotel Brand sub-index fell 5.4% from July to 8,506, while the Hotel REIT sub-index increased 2.5% to 1,221.

About the Baird/STR Hotel Stock Index and Sub-Indices

The Baird/STR Hotel Stock Index was set to equal 1,000 on 1 January 2000. Last cycle, the Index peaked at 3,178 on 5 July 2007. The Index’s low point occurred on 6 March 2009 when it dropped to 573.

The Hotel Brand sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 3,407 on 5 July 2007. The sub-index’s low point occurred on 6 March 2009 when it dropped to 722.

The Hotel REIT sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 2,555 on 2 February 2007. The sub-index’s low point occurred on 5 March 2009 when it dropped to 298.

The Baird/STR Hotel Stock Index and sub-indices are available exclusively on Hotel News Now. The indices are cobranded and were created by Robert W. Baird & Co. (Baird) and STR. The market-cap-weighted, price-only indices comprise 20 of the largest market-capitalization hotel companies publicly traded on a U.S. exchange and attempt to characterize the performance of hotel stocks. The Index and sub-indices are maintained by Baird and hosted on Hotel News Now, are not actively managed, and no direct investment can be made in them.

As of 31 August 2021, the companies that comprised the Baird/STR Hotel Stock Index included: Apple Hospitality REIT, Ashford Hospitality Trust, Chatham Lodging Trust, Choice Hotels International, DiamondRock Hospitality Company, Hersha Hospitality Trust, Hilton Inc., Host Hotels & Resorts, Hyatt Hotels, InterContinental Hotels Group, Marriott International, Park Hotels & Resorts, Inc., Pebblebrook Hotel Trust, RLJ Lodging Trust, Ryman Hospitality Properties, Service Properties Trust, Summit Hotel Properties, Sunstone Hotel Investors, Wyndham Hotels & Resorts, and Xenia Hotels & Resorts.

This communication is not a call to action to engage in a securities transaction and has not been individually tailored to a specific client or targeted group of clients. Research reports on the companies identified in this communication are provided by Robert W. Baird & Co. Incorporated, and are available to clients through their Baird Financial Advisor. This communication does not provide recipients with information or advice that is sufficient on which to base an investment decision. This communication does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this communication as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this release.