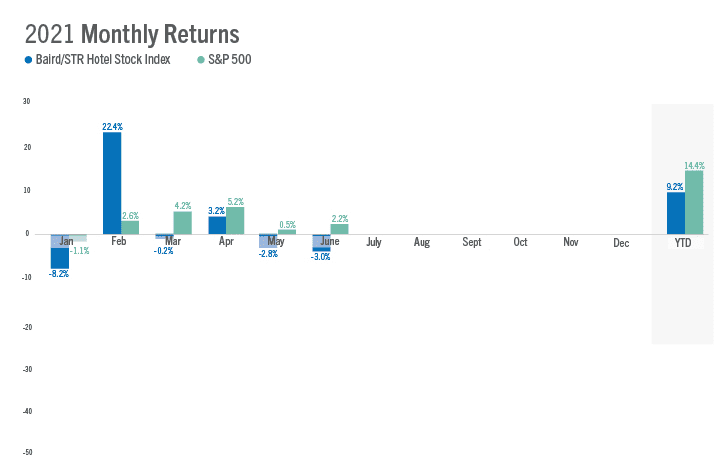

The Baird/STR Hotel Stock Index dropped 3.0% in June to a level of 4,993. Year to date through the first six months of 2021, the stock index was up 9.2%.

The Baird/STR Hotel Stock Index dropped 3.0% in June to a level of 4,993. Year to date through the first six months of 2021, the stock index was up 9.2%.

“Hotel stocks declined again in June and continued their relative underperformance versus the benchmarks for the fourth consecutive month,” said Michael Bellisario, senior hotel research analyst, and director at Baird. “Despite continued sequential fundamental improvement and strengthening demand trends, especially domestically, hotel stocks have been laggards since the reopening momentum peaked in March. Investors remain focused on stock valuations, the near-term outlook for business travel, and the non-linear and still-uncertain broader global recovery.”

“It is somewhat surprising that hotel stocks still underperformed in June considering the upward movement in U.S. industry fundamentals,” said Amanda Hite, STR president. “If aligning industry performance with investor sentiment, it would seem there is less focus on the uptick in leisure-driven segments and more concern around the persistent lack of business travel and group demand. While leisure markets are reaping the benefits of the U.S. summer travel surge, the major metros and big-box hotels are still stuck near the recovery start line—that is preventing more substantial recovery for the industry as a whole. There are indicators for improvement in those segments later this year.”

In June, the Baird/STR Hotel Stock Index fell behind both the S&P 500 (+2.2%) and the MSCI US REIT Index (+2.2%).

The Hotel Brand sub-index decreased 3.9% from May to 8,516, while the Hotel REIT sub-index dipped 0.4% to 1,294.

As of 16 June 2021, Ashford Hospitality Trust (AHT) replaced Extended Stay America (STAY) in the Index. In addition, STAY was removed from the Brand Sub-Index and AHT was added to the REIT Sub-Index.

About the Baird/STR Hotel Stock Index and Sub-Indices

The Baird/STR Hotel Stock Index was set to equal 1,000 on 1 January 2000. Last cycle, the Index peaked at 3,178 on 5 July 2007. The Index’s low point occurred on 6 March 2009 when it dropped to 573.

The Hotel Brand sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 3,407 on 5 July 2007. The sub-index’s low point occurred on 6 March 2009 when it dropped to 722.

The Hotel REIT sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 2,555 on 2 February 2007. The sub-index’s low point occurred on 5 March 2009 when it dropped to 298.

The Baird/STR Hotel Stock Index and sub-indices are available exclusively on Hotel News Now. The indices are cobranded and were created by Robert W. Baird & Co. (Baird) and STR. The market-cap-weighted, price-only indices comprise 20 of the largest market-capitalization hotel companies publicly traded on a U.S. exchange and attempt to characterize the performance of hotel stocks. The Index and sub-indices are maintained by Baird and hosted on Hotel News Now, are not actively managed, and no direct investment can be made in them.

As of 30 June 2021, the companies that comprised the Baird/STR Hotel Stock Index included: Apple Hospitality REIT, Ashford Hospitality Trust, Chatham Lodging Trust, Choice Hotels International, DiamondRock Hospitality Company, Hersha Hospitality Trust, Hilton Inc., Host Hotels & Resorts, Hyatt Hotels, InterContinental Hotels Group, Marriott International, Park Hotels & Resorts, Inc., Pebblebrook Hotel Trust, RLJ Lodging Trust, Ryman Hospitality Properties, Service Properties Trust, Summit Hotel Properties, Sunstone Hotel Investors, Wyndham Hotels & Resorts, and Xenia Hotels & Resorts.