Ever wondered what travel industry experts consider when booking their own trips? Sabre has surveyed its own global workforce to provide insights into possible industry traveller trends for 2024.

Ever wondered what travel industry experts consider when booking their own trips? Sabre has surveyed its own global workforce to provide insights into possible industry traveller trends for 2024.

As the pace of evolution in the travel ecosystem continues to accelerate, industry expertise is more valuable than ever. Combining the insights of hundreds of Sabre team members globally alongside Sabre’s data analytics, Sabre has taken a deep dive into how these individuals plan to travel in 2024.

For these team members, the survey results indicate:

- Increased confidence among travelers surveyed, with more people booking at least three months in advance for leisure trips.

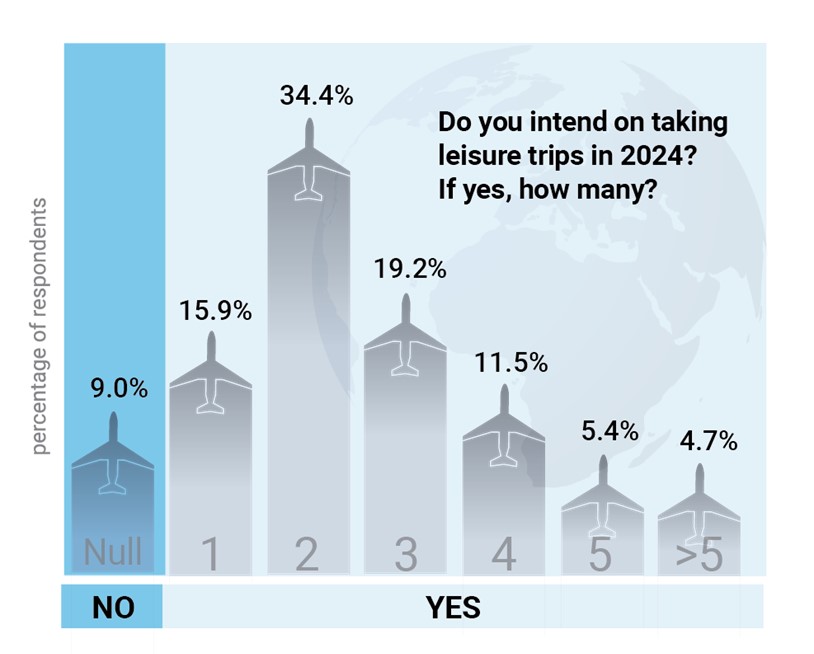

- More than three-quarters of travelers surveyed are planning at least two vacations and more than a fifth say they are taking four or five leisure trips.

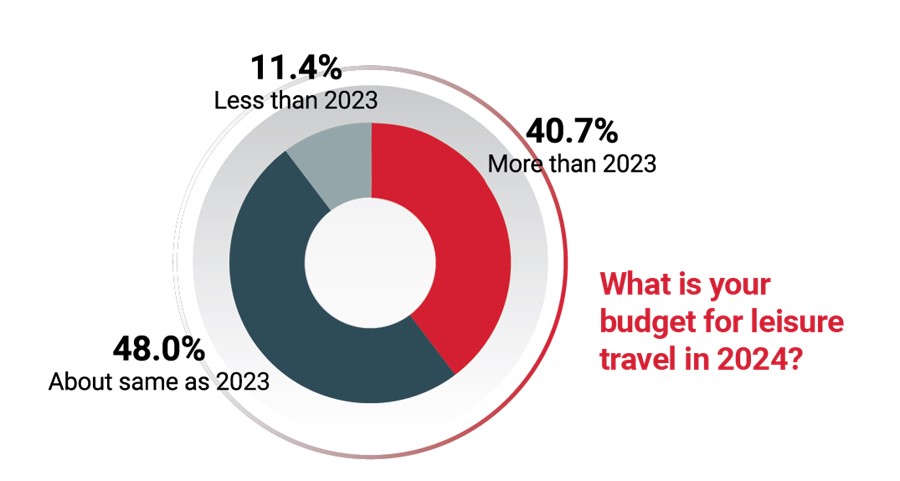

- Nearly 90% of travelers surveyed are spending about the same or more on travel than they did in 2023, with Gen Z increasing their budget the most.

- 2024 appears to be the year that revenge travel will come into its own for travelers surveyed in Asia Pacific.

- Long-haul is expected to be in the cards for more travelers in 2024, with more than half surveyed either choosing long-haul or saying distance doesn’t matter to them.

- Gen Z surveyed travelers in particular are concerned about losing their luggage, and are purchasing insurance to guard against it.

- Surveyed travelers in Europe, the Middle East and Africa are looking for family-orientated destinations while those in North America are focused on couples’ trips.

Increased confidence

Sabre’s survey found most Sabre team members are intending to travel in 2024, with most planning at least two leisure trips (Fig. 1.0).

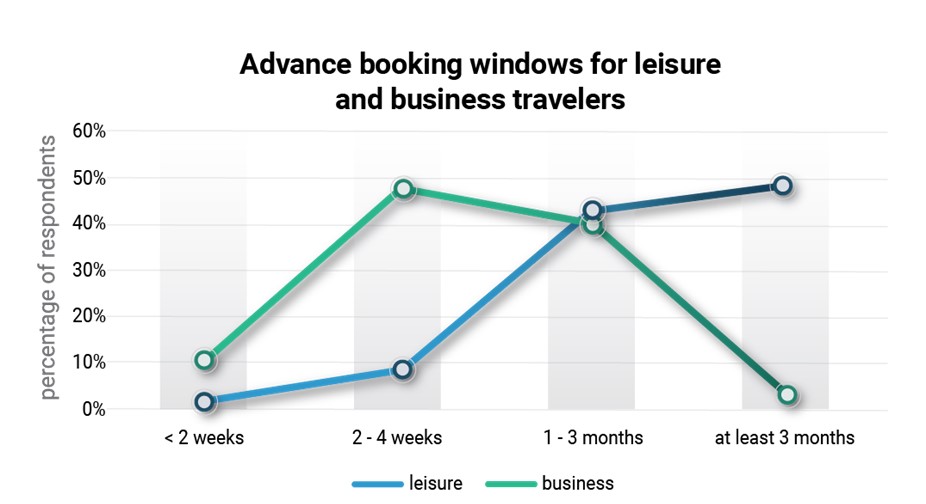

As compared to previous years, the survey indicates that travelers at Sabre are demonstrating higher travel confidence, with most air tickets for leisure travel purchased at least three months in advance. (Fig. 1.2). The results suggest that most respondents are showing they are no longer concerned about the kind of travel uncertainty experienced during the pandemic and are happy to make longer-term plans. Air ticket prices are also likely to be motivating travelers to buy further out to better plan their budgets and potentially cut costs.

People traveling for leisure tend to buy tickets earlier, mostly at least 3 months before the trip. However, corporate travel needs are different, according to the Sabre survey, with most tickets for business trips bought just 2 to 4 weeks before (Fig 1.2).

Gen Z are increasing their budget most

Respondents are willing to spend more on their travels in 2024. Our data shows that most Sabre travelers are planning to spend the same amount or even more than they did on air travel in 2023 (Fig 1.3). This is supported by a similar survey done by Skyscanner in 2023. Air fares reached a price tipping point in 2022 and have somewhat reduced, so the survey results indicate that this increase in budget is not simply down to respondents’ “having” to spend more but “wanting” to spend more to make the most of their trips.

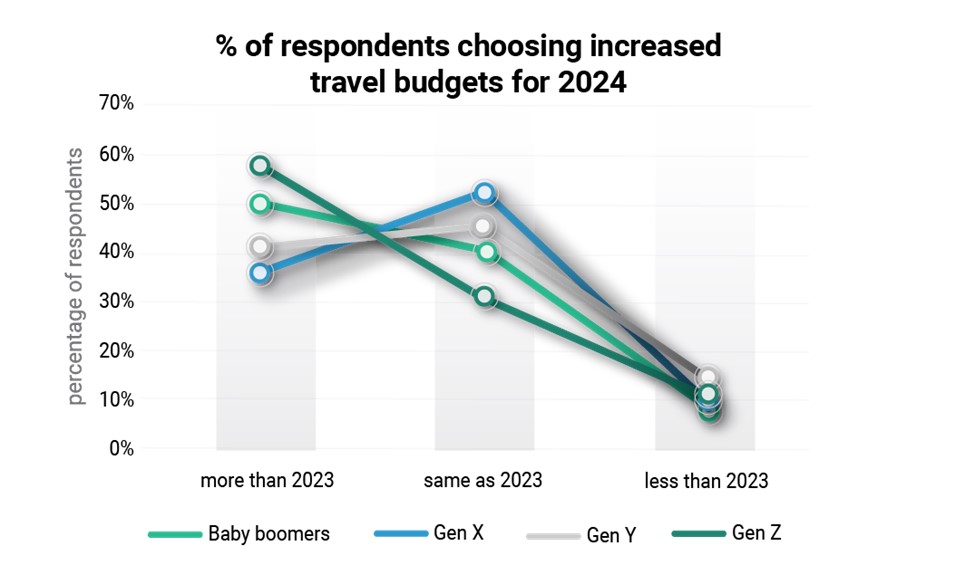

Gen Zs at Sabre, who perhaps have greater disposable incomes as they may be yet to have dependents of their own, indicated that they are willing to spend more, with most saying they would spend ‘slightly more than 2023’ compared to Baby Boomers, Gen X and Gen Y who mostly said they would spend ‘about the same as 2023’ (Fig 1.4).

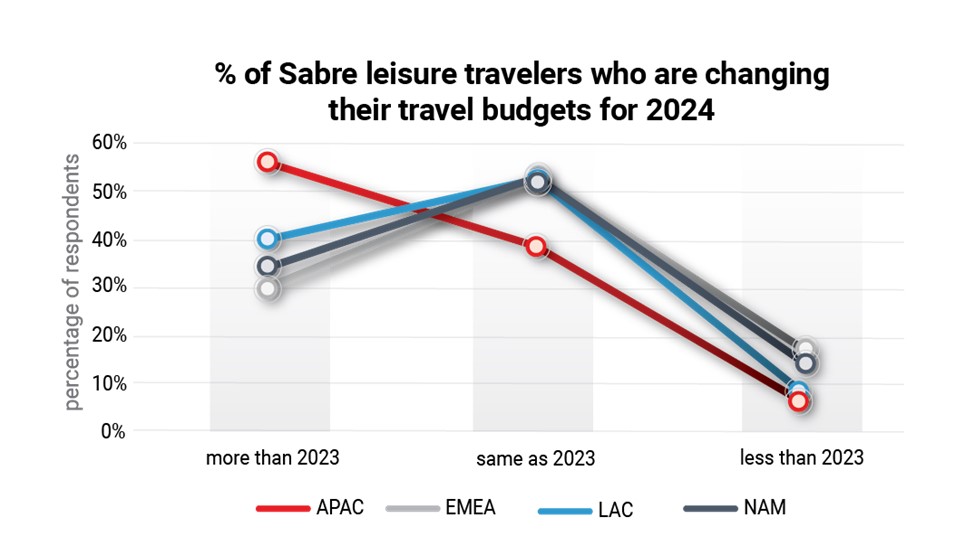

Respondents in Asia Pacific (APAC) said they had a higher budget and more plans for 2024 leisure travels (Fig 1.5) as compared to other regions. This could be because parts of APAC were slower to ease pandemic-related travel restrictions than other global destinations. Unlike the rest of the world which has already experienced “Revenge Travelling”, 2024 may be the year where we see APAC countries enjoy spikes in revenge travel.

Travel companions

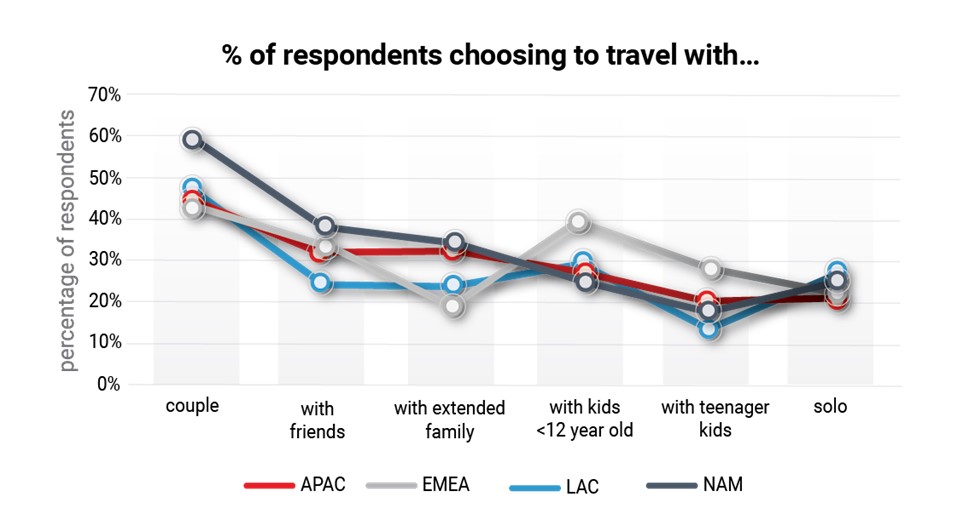

Trips for couples are the most popular among respondents for 2024, followed by trips with friends. However, survey results indicate that there is a significantly higher percentage of people in Europe and the Middle East (EMEA) looking at trips with kids under 12 years old as compared to the rest of the world, though they all have couple trips ranked at first (Fig 2.0). Based on the survey results, it seems that travelers in EMEA have family-orientated destinations in mind for 2024, while others have romantic, couples’ locations on their wishlist.

Travel preferences and priorities

Respondents are focused on practicality. Our survey shows that destination, activity available and cost are the most important factors people consider when planning 2024 leisure trips. Meanwhile, sustainability was also a consideration for many, with all respondents saying they would pay up to 5% more for a more sustainable option, and a significant proportion saying they would be happy to pay up to 15% more to carbon offset their journey.

Seat selection and guarding against lost luggage

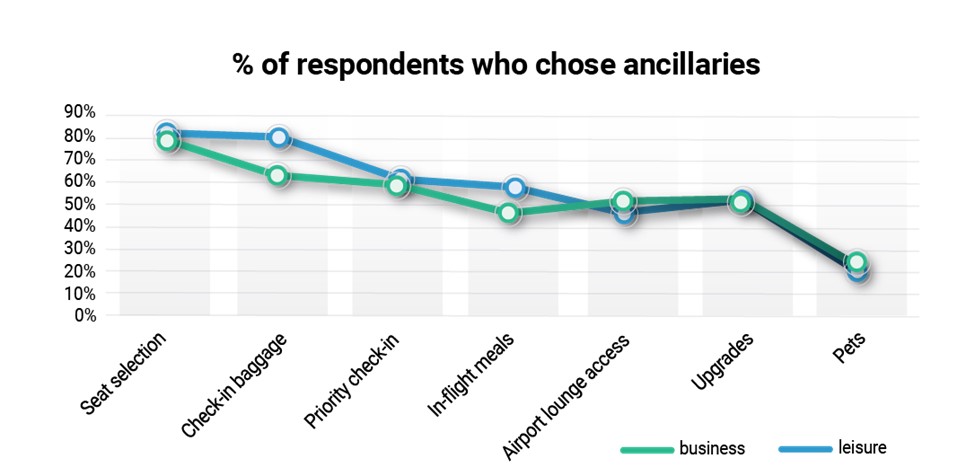

Leisure and business respondents have different priorities when it comes to ancillaries. The survey results indicate that corporate travelers prefer to travel light so check-in luggage is less important to them, while in-flight meals are more important to leisure travelers. (Fig 3.0). Seat selection was ranked the most important for survey respondents for both business and leisure travel as comfort is a universal preference for many. Most survey respondents prefer having aisle or window seats as they believe it gives them more freedom of space compared to middle seats. For leisure travelers, respondents prefer to sit with family members, while business travelers are often keen to sit towards the front of the plane so they can get off quickly.

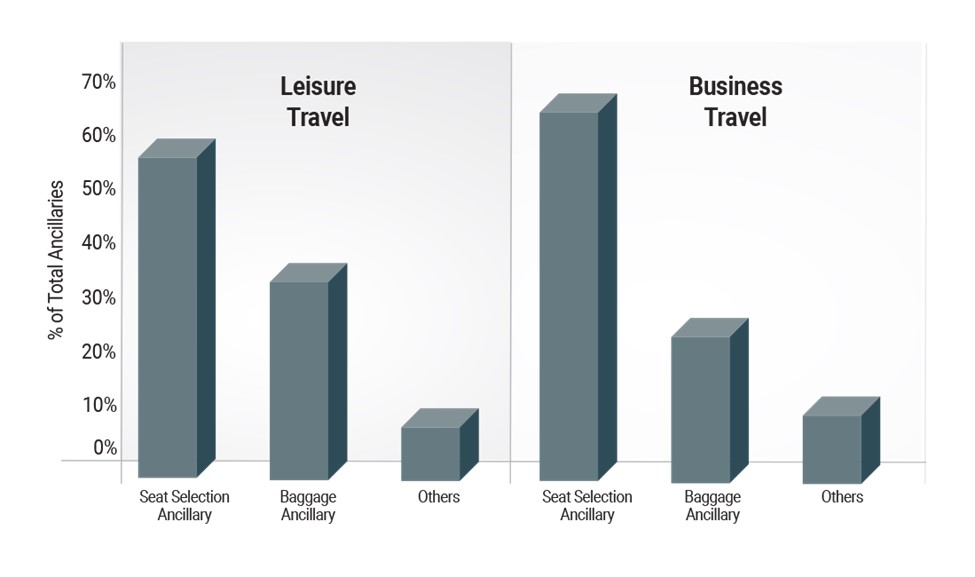

Sabre data corroborates this finding with analysis showing a greater percentage of leisure travelers choose to purchase baggage ancillaries, compared to business travelers for whom seat selection is by far the most important extra.

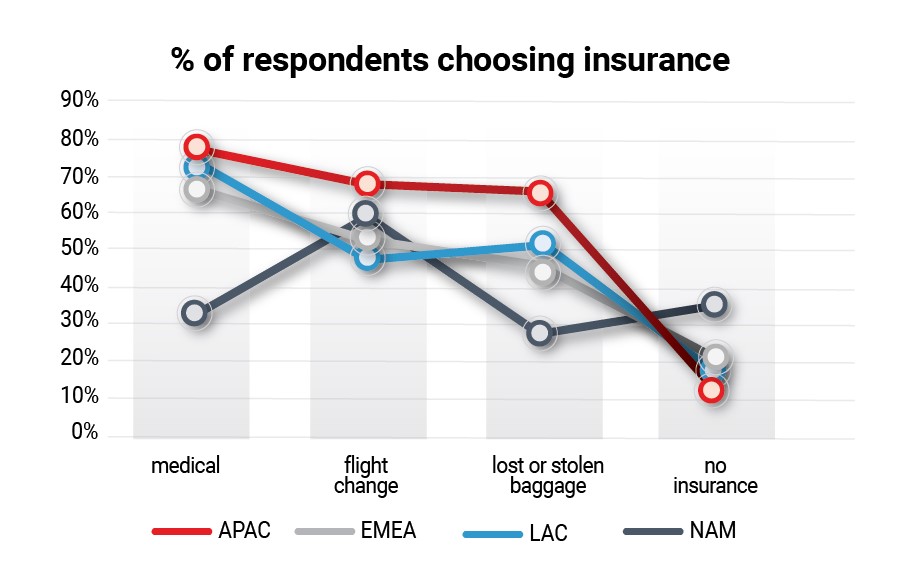

There are also geographical differences. Respondents in the US are more inclined to buy insurance for flight changes and cancellation and not medical insurance, whereas the majority of the world is more inclined to buy medical insurance (Fig 3.2).

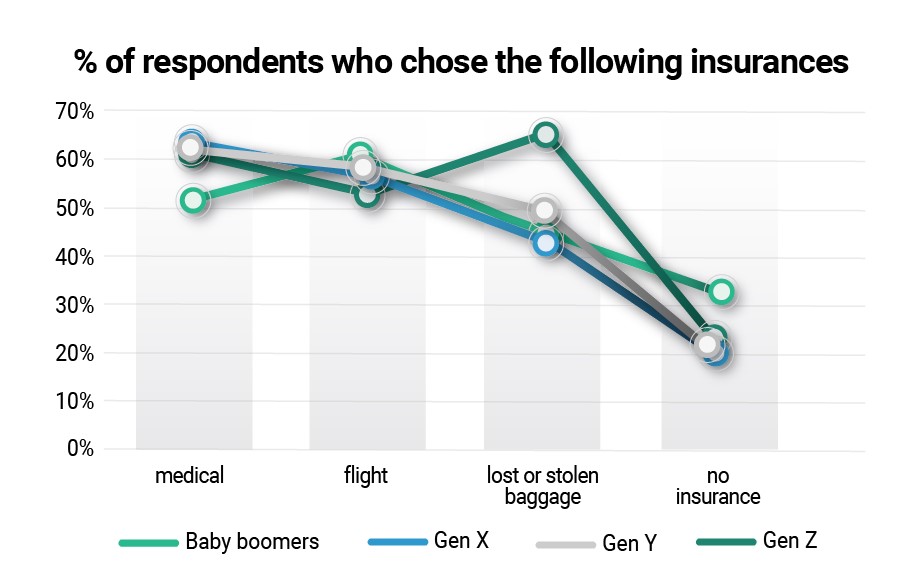

As for Gen Z respondents, they have different concerns, namely regarding lost or stolen baggage. This could be due to increased instances of lost baggage after the pandemic, with public consciousness of the issue increasing. (Fig 3.3).

With increased travel confidence, more trips, bigger budgets and careful planning, Sabre travelers are looking forward to where the rest of 2024 takes them.

*Online traveler sentiment survey comprising 25 questions with responses from over 700 global Sabre team members of various age groups, along with in-person interviews for deeper perspectives. Additional insights from Sabre data.