As vaccines became available, travel demand surged in the early months of 2021. By summer of 2021, some hotels experienced unprecedented demand levels, with rates rising accordingly (Good job, revenue management!). While revenue generation was a good thing for cash-strapped property owners, an alarming and unprecedented drop in guest satisfaction emerged. The questions brands, owners and GMs are (or should be) asking is: What caused this guest satisfaction crisis? And more importantly, what can we do about it?

As vaccines became available, travel demand surged in the early months of 2021. By summer of 2021, some hotels experienced unprecedented demand levels, with rates rising accordingly (Good job, revenue management!). While revenue generation was a good thing for cash-strapped property owners, an alarming and unprecedented drop in guest satisfaction emerged. The questions brands, owners and GMs are (or should be) asking is: What caused this guest satisfaction crisis? And more importantly, what can we do about it?

Why hotel guest satisfaction dropped

ZS leveraged our AI-driven tool, ZS Atlas Intelligence: Market, to find the answer to this question. Atlas mines guest feedback at a detailed level, identifying the factors that matter to guests, understands the sentiment associated with them and then quantifies the impact they have on satisfaction (or any other key performance metric). With this detailed view, hoteliers can build programs to specifically address the factors that have the largest negative impact. In this case, we analyzed 1.85 million reviews from Feb. 2019 to Aug. 2021, representing 16,269 U.S. hotel properties. For a relevant comparison, we selected the same periods: Feb. to Aug. 2019 (pre-pandemic) and Feb. to Aug. 2021 (return to travel).

What drove hotel guest satisfaction declines?

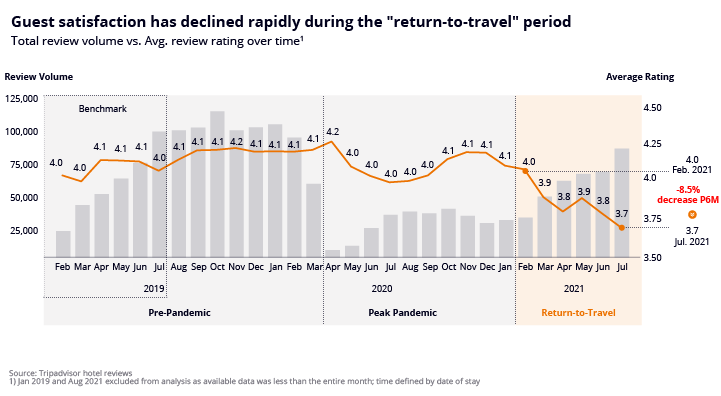

Our data found that travel had returned to pre-pandemic levels starting in Feb. 2021, as represented by review volume compared with the same period in 2019. Overall guest satisfaction, as represented by the TripAdvisor satisfaction score, had substantially declined in the return to travel period of Feb. 2021 to Aug. 2021.

Importantly, this satisfaction decline wasn’t universal. Although most hotels did experience some decline (65%), 23% of hotels increased their guest satisfaction compared to 2019, and 12% of properties remained relatively the same. This means it was possible for hotels to have maintained or gained their pre-pandemic performance. In fact, according to our analysis, the same factors that contributed to the decline of satisfaction for those properties that experienced it also contributed to the increase in satisfaction for those hotels that “got it right.”

Even though demand levels have returned to near pre-pandemic levels, the travel purpose, trip locations and segment mix is different. Given this, there are three possible reasons why satisfaction has declined:

- Travelers are selecting different hotels that might have lower satisfaction scores in general, so the hotel type drove the satisfaction decline.

- The travelers themselves have changed or the trip purpose has changed to one that tends to have lower satisfaction in general, so the traveler type drove the satisfaction decline.

- The service at the hotel has changed, so it’s something about the stay experience in general that is causing the decline.

Hotel type

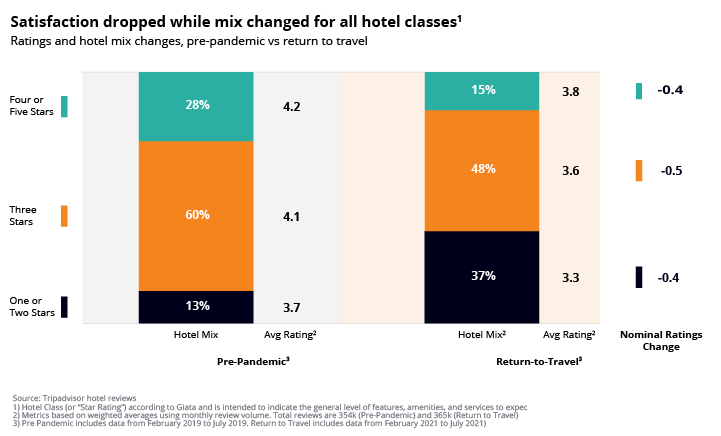

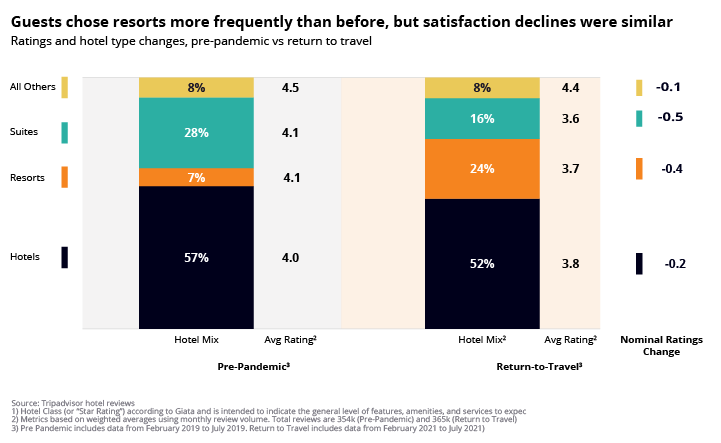

We analyzed hotel class (as represented by the star rating) and found that, while there was a shift in stays from four and five to three and below (represented by review volume), satisfaction did decline at every star level, although three-star hotels experienced a slightly greater decline. We used our proprietary natural language processing (NLP) algorithms to determine the type of hotel (hotel, resort, all suite, other). There was a shift in stay pattern (as represented by review volume) from hotels to resorts, but satisfaction also declined for every hotel type.

Traveler type

We analyzed trip purpose, using our proprietary NLP to isolate family travel from couples travel for leisure trips. While there was a spike in family travel during the return to travel period, the satisfaction declines held across family travel, couples travel and business travel—with business travelers experiencing the highest satisfaction decline.

It’s definitely a change in the hotel experience

After disproving the first two hypotheses, the explanation that remained was that something changed in the hotel experience that caused this satisfaction decline for two-thirds of the hotels in the U.S. The text analysis algorithms in ZS Atlas Intelligence: Market allowed us to isolate 31 higher-order topics represented by 1,600 underlying themes and more than 150,000 distinct guest talking points in the 1.85 million reviews we mined. We then determined the overall impact these topics had on the average rating of the hotel. The sum of the impacts will equal the overall average rating.

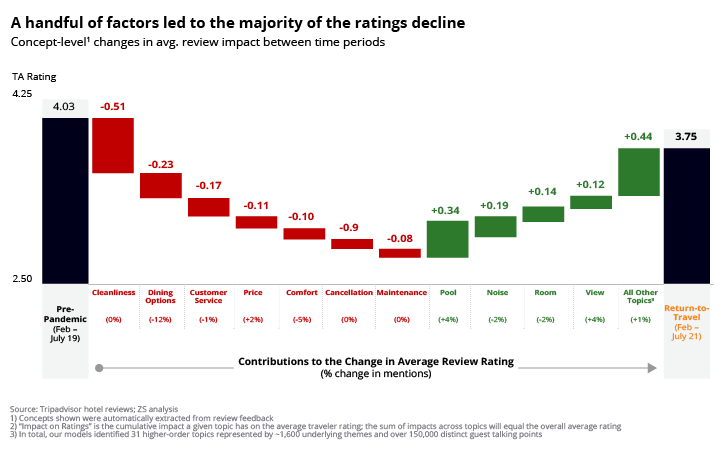

Looking at the overall US hotel data set, when comparing the satisfaction decline from pre-pandemic (4.03 stars) to return to travel (3.75 stars), the biggest drags on satisfaction were cleanliness (-0.51 stars), dining options (-0.23) and customer service (-0.17). The pool drove the largest positive impact on satisfaction (0.34), followed by noise (0.19), room (0.14) and view (0.12).

We can see that travelers did appreciate the opportunity to get out of their homes and enjoy the outdoors and the hotel amenities that were available to them. Unfortunately, the problems they encountered during their stay outweighed any satisfaction gains from being able to enjoy the pool and a quiet room with a view.

Overall guest satisfaction dropped only 0.28 stars. If hotels fixed either the issues with cleanliness or dining options, they could raise guest satisfaction to pre-pandemic levels. Fixing issues with customer service would recover half the satisfaction decline.

The next step is to figure out exactly what went wrong within the areas that declined the most so operators can put targeted programs in place to improve guest experiences. Diving deeper into the subtopics under these main drivers can provide insights into exactly what was going wrong.

Cleanliness

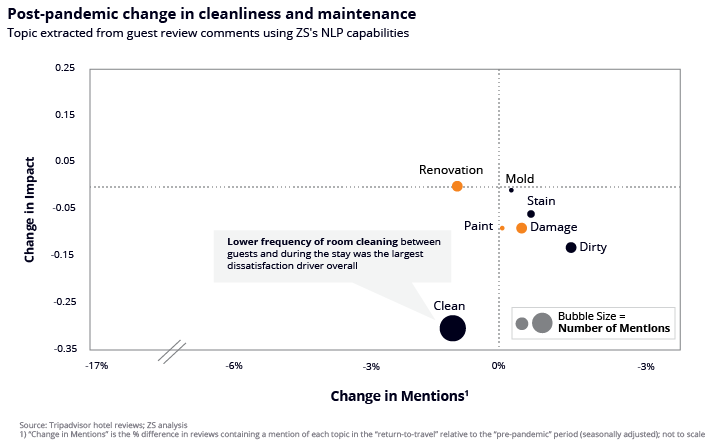

The figure shows the pre-pandemic to return to travel change in impact on the y-axis and change in mentions on the x-axis. The size of the bubble represents the number of mentions.

By far, the largest number of mentions and largest satisfaction decline was within the subtopic “clean,” referring not to the opposite of dirty, but rather, to the act of cleaning itself. Since the pandemic, many hotels have cut back on housekeeping visits during the stay and guests have noticed, remarking that sheets and towels weren’t replaced, and trash built up in the room. The concept of a dirty room had the next-largest decline in satisfaction and also an increase in mentions. Guests were noticing things like stains or mold. This seems to indicate that hotels were not doing general upkeep on the property during the slower periods, and the guests noticed this when they returned to travel.

Unfortunately, due to current labor conditions, most hotels are experiencing a shortage of housekeepers, so many hotels are prioritizing post-stay cleaning so they can resell the room. This makes sense from a revenue perspective, but a balance needs to be achieved to drive revenue while maintaining satisfaction. Hotels should consider a process using minimal housekeeping hours to provide additional towels, change linens on request and solve the issue of trash building up in the room. All housekeeping policies should be clearly and transparently communicated in advance of the stay to properly set expectations, especially if they are different than what guests were used to pre-pandemic.

Many hotels are considering permanently eliminating housekeeping during the stay or offering it by request only. This will reduce the cost of the stay, driving profit, but many guests notice and value during-stay housekeeping. Operators should carefully consider this change before implementing it, and if they do, they need to proactively communicate the policy as guests are making their booking decisions.

Dining options

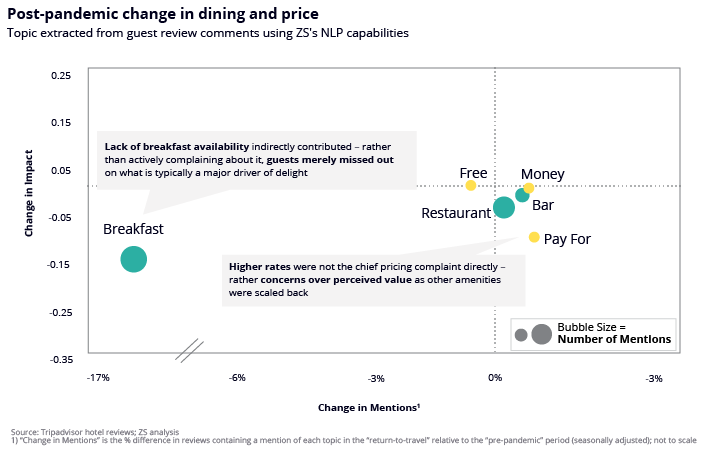

By far, the most frequently mentioned topic (although mentioned less than pre-pandemic) was breakfast, and breakfast drove a large decline in satisfaction. Many hotels, due to COVID-19 regulations, staffing restrictions and cost-cutting measures ended up reducing or eliminating breakfast options. Guests noticed and reacted negatively.

Price

The “pay for” subtopic drove the slight decline in satisfaction under the price topic. Despite the fact that hotels were charging near-record rates in some cases, guests weren’t complaining about high prices per se. They were complaining that they didn’t receive the value they expected for the price. They were willing to pay the price, but they expected things like housekeeping and breakfast, and didn’t know that those services were limited.

We are not suggesting that you lower price because services are limited. Hotels should continue to manage rates according to demand, but they need to set the right expectations of service levels. If dining hours are limited or housekeeping isn’t available, guests should know prior to arrival so their expectations will be aligned to the hotels’ offerings.

Customer service

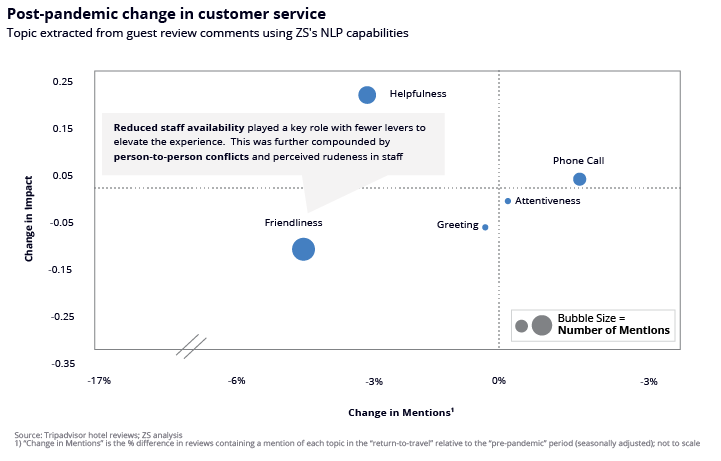

Customer service is typically the most important driver of satisfaction, and it declined quite a bit during return to travel. Perceived friendliness (or lack thereof) was a drag on satisfaction. Guests perceived rudeness at times and these interactions negatively impacted their overall satisfaction. Interestingly, helpfulness had a positive impact on satisfaction compared to pre-pandemic. It seemed that guests did appreciate the pressure staff was under with COVID-19 restrictions and increased demand, so when they perceived the staff as being helpful it had a more positive impact on their overall satisfaction.

This is an area that hotels can address immediately. Reinforce training with the staff that empowers them to be helpful and positive. Remember, stress levels have certainly increased due to the danger and uncertainty associated with pandemic-era travel!

Targeted strategies to improve guest satisfaction

Hotels should consider the following steps to improve guest satisfaction:

- If the shortage of housekeepers is affecting the hotel’s ability to perform during-stay cleaning, consider processes that will at least enable sheet and towel changes and garbage removal.

- Many guests value daily housekeeping. So carefully consider the impact on your guests if you are making changes to that service.

- Maintain general cleaning and maintenance standards so guests don’t perceive the property as dirty or worn down.

- Breakfast is a highly valued service. Rolling back pandemic-cuts will help improve satisfaction.

- Be transparent about what services are available to set the right expectations. Guests are willing to pay relatively high rates commanded by demand levels, but their expectations need to be met. Proactive communication can help to control expectations.

- Reinforce guest service training to improve the positivity and helpfulness of guests’ interactions with staff.

Given the constraints the hospitality industry is still facing, broad-stroke solutions are not possible, nor will they likely be effective. Yet if hotel operators don’t do something now, they run the risk of damaging their reputation over the long term. Detailed insights from mining guest feedback can help pinpoint interventions that will be most successful in improving and maintaining satisfaction.

About the authors

Kelly McGuire, Russell Evans, Eric Swank, Alex Tutt, Alanna Perez and Matthew Guglielmetti from ZS.

Kelly McGuire is a Principal, ZS Washington, D.C. Kelly has two decades of experience helping hospitality and gaming companies realize their vision of data-driven decision-making through strategic investment in technology, people and business process redesign. As managing principal (hospitality), she continues her work with leading global hospitality companies. Kelly’s areas of expertise center on optimizing the commercial function in hospitality. She has experience guiding organizations through the people, process and technology changes associated with modernizing and automating commercial areas. She has a strong background in practical implementations of advanced analytics, AI and machine learning.

Kelly McGuire is a Principal, ZS Washington, D.C. Kelly has two decades of experience helping hospitality and gaming companies realize their vision of data-driven decision-making through strategic investment in technology, people and business process redesign. As managing principal (hospitality), she continues her work with leading global hospitality companies. Kelly’s areas of expertise center on optimizing the commercial function in hospitality. She has experience guiding organizations through the people, process and technology changes associated with modernizing and automating commercial areas. She has a strong background in practical implementations of advanced analytics, AI and machine learning.

Prior to ZS, Kelly worked at MGM Resorts International, where she was the senior vice president and handled the hotel’s revenue management and distribution transformation, implemented new technology, redesigned business processes and developed a focused talent management strategy. She has also been associated with Wyndham Destination Network as a vice president of advanced analytics. Kelly has an MMH and Ph.D. from Cornell University’s School of Hotel Administration, where she focused on revenue management analytics, non-traditional applications of revenue management techniques, and the intersection of consumer behavior and pricing practices.

Russell Evans is ZS Principal in Chicago. Russell is a principal in the marketing analytics practice at ZS. He has extensive experience leveraging data and customer insight as a foundation for developing actionable growth strategies, new products and services, user experiences, and cross-channel customer engagement programs. Russell has worked across a number of industries, including financial services, consumer technology, retail and hospitality. He helps clients with solutions including customer engagement strategy, personalization, customer journey mapping, customer segmentation, demand-driven innovation, campaign/tactic executional strategy and program measurement.

Russell Evans is ZS Principal in Chicago. Russell is a principal in the marketing analytics practice at ZS. He has extensive experience leveraging data and customer insight as a foundation for developing actionable growth strategies, new products and services, user experiences, and cross-channel customer engagement programs. Russell has worked across a number of industries, including financial services, consumer technology, retail and hospitality. He helps clients with solutions including customer engagement strategy, personalization, customer journey mapping, customer segmentation, demand-driven innovation, campaign/tactic executional strategy and program measurement.

Prior to joining ZS, Russell was an associate partner in the consulting practice at Rosetta (a leading customer engagement agency within the Publicis network), where he led strategic engagements for a number of Fortune 100 brands. Russell holds a degree with highest honors in ecology and evolutionary biology from Princeton University.