In these challenging times, it is easy for hotel investors to overlook the most important cornerstone of the capital markets: that expected returns are (and should be) greater for more risky assets.

In these challenging times, it is easy for hotel investors to overlook the most important cornerstone of the capital markets: that expected returns are (and should be) greater for more risky assets.

Hotel investors commonly believe, implicitly if not explicitly, that they are getting a higher expected return without assuming greater risk. If a hotel investor wants a higher return, the investor must generally accept more risk.

The extra return for a given level of risk is the ‘risk premium’ that is necessary to induce investors to invest their money in a hotel whose cash flows are less certain.

The investor who understands the intersection between risk and return relies on the concept of a risk-adjusted return, a measure of an investment’s return after taking into account the degree of risk that was taken to achieve it. The purpose of risk-adjusted return is to help investors determine whether the risk taken was worth the expected reward. Too often, the quantification of risk is left to hunch, intuition and gut feel or at best a “sensitivity analysis” or a “best-case. worst-case” analysis. Without a probabilistic estimate of risk, the estimate of a risk-adjusted return is problematic.

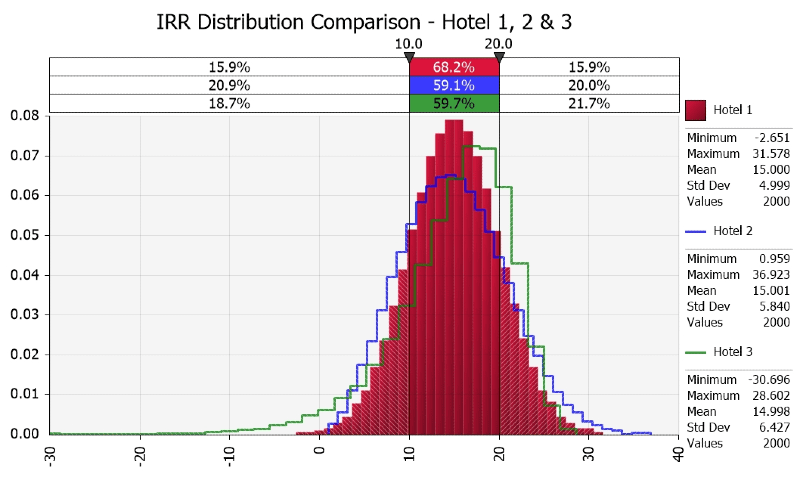

The graph below illustrates the IRR distribution for three hotels, derived from a simulation model. The expected mean return for each hotel is 15%, however, the distribution of IRR’s varies widely. Measures of dispersion, such as the standard deviation, indicate the spread of the distributions and the risk associated with the prospective return.

Apart from the standard deviation we use the:

- Coefficient of Variation – the ratio of the standard deviation to the mean and

- Semi Standard Deviation – returns the standard deviation of the data values below the mean. This is useful for measuring down-side risk when the distribution is highly skewed as illustrated in the graph.