The end of 2020 is not the end of the problems for the global hotel industry, but it does bring hope on the wings of a vaccine that, in time, could be a panacea for wait ails it: fear.

The end of 2020 is not the end of the problems for the global hotel industry, but it does bring hope on the wings of a vaccine that, in time, could be a panacea for wait ails it: fear.

The hotel industry does not perform well without its most significant ingredient: people. The pandemic has removed that element. In its place sit unused guestrooms, vacant restaurants and empty conference and meeting spaces. It’s a recipe for disaster, which is exactly what was concocted last year.

But the close of the calendar doesn’t automatically mean a brighter 2021. It will still take time.

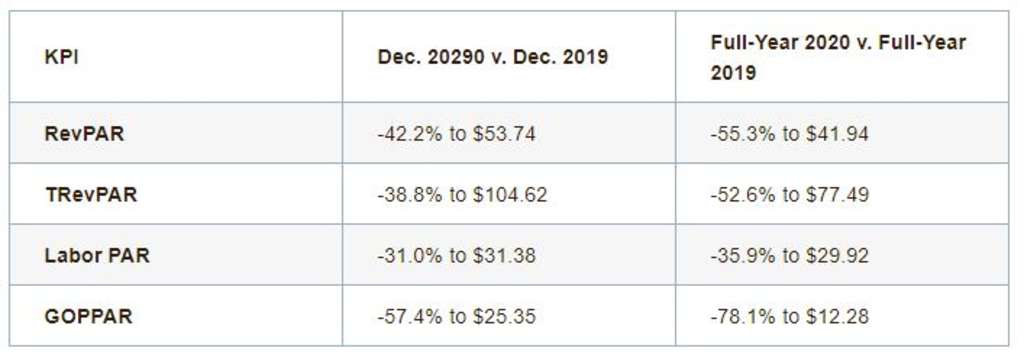

Last year ended on a high note for hotels in the Middle East with December gross operating performance per available room recorded at $38.31, the highest amount in all the regions tracked for this trends report. And though the amount is down 56.3% year-over-year, it’s still the highest GOPPAR for the region since February 2020 and 110% higher than the GOPPAR achieved in November 2020. The region has now had five consecutive months of positive profit.

GOPPAR for the year was recorded at $15.76, down 77.6% over 2019.

In a sign of optimism—though RevPAR was still down 41% YOY, the result of weak demand—average rate was only down 1.4% YOY, a propitious signal that once occupancy does return, rate will not need to catch up as much.

Total revenue or TRevPAR hit triple digits also for the first time since February. At $126.25, it was down 42% YOY, but up 30% over November. TRevPAR for the year was recorded at $91.87, a 53% decrease over 2019.

Expenses in December remained down YOY, including labor, which was down 34% on a per-available-room basis. It was down that same amount for the entire year over 2019.

Profit margin for the month checked in at 30.7%, which was 11 percentage points higher than November, but only 10 percentage points off the year prior.

Profit & Loss Performance Indicators — Total Middle East (in USD)

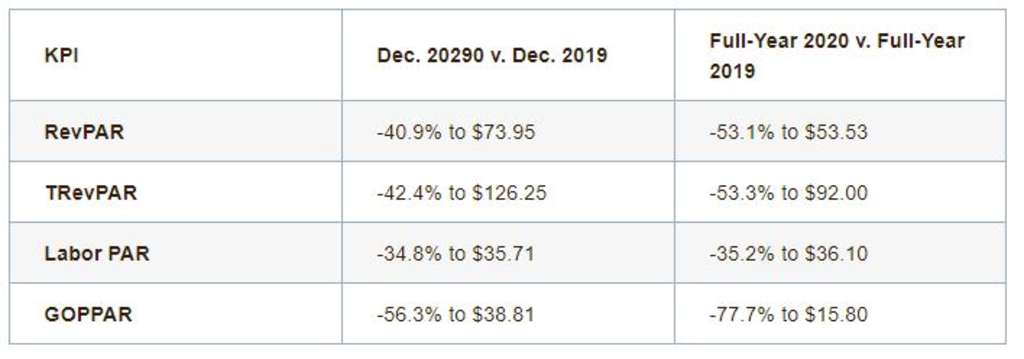

Europe’s Woe

Performance in Europe did not achieve the same success as the Middle East—the product of stricter restrictions and lockdowns that were ubiquitous across the region toward the latter part of the year. Europe was the one region that did not record positive GOPPAR in the month and at -€7.33 it was down 113% YOY. At -€0.71 GOPPAR for 2020, it was the only region to not either break even or record positive profit.

Muted occupancy and rate thwarted RevPAR growth in the month, down 85% YOY to €15.50. For the year, RevPAR was recorded at €32.84, a decrease of 72.7% YOY. Weak rooms revenue coincided with difficulty generating revenue from other outlets, including food and beverage, which was down 70.6% in 2020 v. 2019 to €14.55. TRevPAR for December was recorded at €2.54, an 82.7% decrease YOY. For the year, TRevPAR clocked in at €53.48, down 70.1% YOY.

Lower costs coincided with the dearth in revenue. Total overheads for the year were down 41.7% for the entire year versus the year prior and labor costs fell 49.3% YOY, a product of shuttered hotels and large staffing cuts in hotels that did manage to keep the lights on.

Profit margin in December stayed negative for the third consecutive month at -24.7% and was negative for the entire year of 2020 at -1.3%.

Profit & Loss Performance Indicators — Total Europe (in EUR)

U.S. Sputters Along

The U.S. popped back to break-even profit in December, and at $0.89, it was only the second time since February that the country achieved positive GOPPAR. Profit was down 98.9% YOY. The bump in GOPPAR resulted in a slight 1.5% profit margin, also only the second time since February that the number was positive.

The U.S. recorded GOPPAR of $6.20 for the year. However, the positive number was a byproduct of January and February GOPPAR, $71.52 and $101.12, respectively. Removing those normalized numbers, GOPPAR for the year would have been -$9.52.

RevPAR for the year was down 68.5% to $53.50, the result of occupancy down 47.5 percentage points YOY and average rate decreasing 17.9%. Weak rooms revenue further dragged down TRevPAR, which amounted to $84.85 for the year, a YOY decrease of 68.3%. The drop in corporate business helped fuel the decrease in RevPAR, with corporate rates down 24% YOY. Leisure, however, saw a slight uptick in volume mix, up 4.6 percentage points over 2019.

Costs for the year, like revenue, were down. Labor on a per-available-room basis was down 52.4% YOY; meanwhile, total overhead costs came down 43.2%. Efficiencies that hoteliers found and implemented in the face of the pandemic are likely to carry forward in 2021 and, potentially, beyond. Think labor structure and changes in F&B service and procurement.

Profit & Loss Performance Indicators — Total U.S. (in USD)

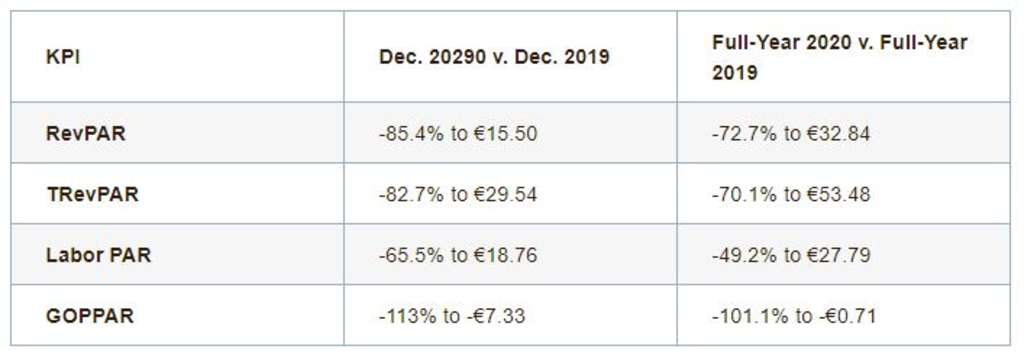

APAC Chases Normalcy

Asia-Pacific was the first to feel the ghastly impact of COVID-19. It also performed the most admirably in the face of it.

The region continued its demand drive, hitting almost 50% occupancy in December, a rate that has stayed fairly consistent since August. RevPAR for the year was recorded at $41.94, a 55.3% drop over 2019. TRevPAR for the year checked in at $77.49, a 52.6% decrease over 2019.

GOPPAR for the year hit $12.28, a 78% YOY decline. GOPPAR to end the year hit $25.35 in December, the second-highest total of the year when January is removed. Profit margin remained steady in December at 24.2%.

Profit & Loss Performance Indicators — Total APAC (in USD)