Major economies in Europe, including the U.K. and those in the Eurozone, recently confirmed what we already suspected. Economies across the continent have entered an economic recession because of the impact of COVID-19—an impact that has been devastating for the hospitality industry.

The short-term effects of the COVID-19 recession are evident as hotel demand across Europe was down 55.3% for the August year-to-date period. However, even with negative projections in place, the depth of the long-term impact remains in question.

The short-term effects of the COVID-19 recession are evident as hotel demand across Europe was down 55.3% for the August year-to-date period. However, even with negative projections in place, the depth of the long-term impact remains in question.

To help develop answers, we look back at a lesser crisis, which may point to how hotel markets will recover in the coming years. The 2007-08 global financial crisis (GFC), caused by the bursting of the U.S. housing bubble, impacted financial institutions globally and led to the subprime mortgage crisis, European debt crisis and the Great Recession. During the Great Recession, the global economy witnessed its steepest declines since the Great Depression.

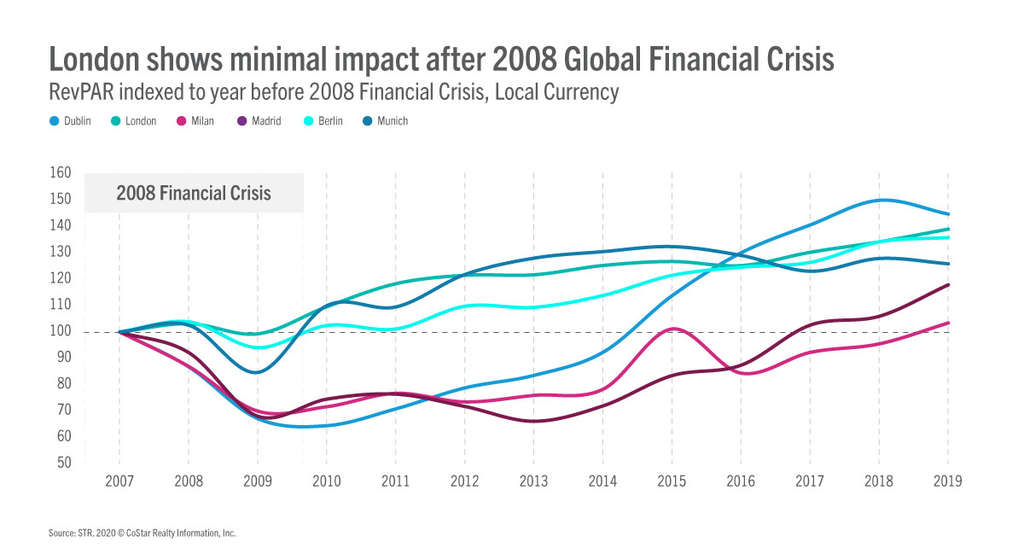

For this analysis, we indexed revenue per available room (RevPAR) to 2007 for various key markets across Europe. This can be used to understand how markets were impacted in the short-term during the crisis, in the aftermath of the crisis and even further in the long-term to understand when markets recovered.

So how did hotel markets around Europe react?

London weathered the storm

London showed strong fundamentals and proved to be resilient. In fact, RevPAR increased in 2008 before dipping slightly in 2009, but did not look back from there with strong year-over-year growth through 2019.

Hotel demand in the U.K. capital is currently at an all-time low as the market suffers due to a reliance on international travel, which is nearly non-existent due to restrictions and lockdown measures. However, once international travel does return, we can perhaps expect a quicker long-term recovery in London as the city has proven it can weather a storm.

German markets dipped but recovered quickly

Berlin and Munich experienced declines in RevPAR in the years following the GFC with Munich experiencing a larger decline in 2009. Both markets had risen to pre-GFC RevPAR levels by 2010, recovering in a remarkably short time following the crisis.

While other countries in Europe were being pulled further into crisis, Germany benefitted from its economic strength even during the crisis as well as being a mostly domestic market, which allowed hotel performance to recover quicker than others in Europe.

Economically, Germany remains a powerhouse in Europe, and its large domestic market has helped in boosting demand relative to other countries in Europe during this COVID period, so some optimism in a recovery can be taken regarding German markets.

Markets in weaker economies were more impacted

By 2009, hotels in Madrid and Dublin were among the most impacted. In the latter part of 2009, Spain and Ireland went through a debt crisis lasting several years leading to subdued economic growth in both countries as well as an increase in unemployment in Spain.

RevPAR in Madrid stagnated in the subsequent years following the GFC, and five years on from the crisis in 2012, RevPAR was almost 30% lower than pre-crisis levels. As the capital of Spain, Madrid sees substantial demand coming in the domestic corporate and leisure segment. A strong run of six consecutive years of RevPAR growth began in 2014 as Madrid benefitted from an increase in international arrivals and from hosting high-profile events, including the Champions League Final and COP 25 in 2019.

Madrid has stronger fundamentals and is more diversified than it was back in 2008, however, it will need to rely on a return of these lucrative segments to recover to pre-COVID levels.

RevPAR in Dublin five years on from the crisis in 2012 was just over 20% lower than it was pre-GFC as Ireland battled with suppressed economic growth domestically. Suppressed economic growth around the world impacted Dublin also as it is a market reliant on visitors from overseas.

RevPAR increased for eight years consecutively from 2011 through to 2018 as Dublin benefitted from substantial increases in international arrivals around the world, from the U.S. in particular, as well as close to no supply growth.

Future supply growth is expected to rise substantially as Dublin boasts a large pipeline of projects to enter the market. How Dublin responds to a current lack of demand as well as absorbing this new supply will be telling of its recovery. Dublin remains an attractive market for international visitors, and with plenty of new hotel offerings, it may recover from this current crisis quicker than it did during the GFC.

Conclusion

COVID-19 is a different crisis than what hotels faced during the GFC, as restrictions on travel and lockdown measures are severely impacting hotel demand. The GFC impacted performance, at a lesser rate, but key markets across Europe all eventually recovered. Some recovered faster than others due to a stronger economy or being domestic markets.

For markets to begin recovery, the threat of COVID-19 needs to be significantly mitigated. Once that happens, and destinations can begin to welcome to travellers to their hotels, we will see recoveries at different paces.