With over 2.4 million confirmed cases and more than 165,000 deaths from COVID-19 globally as of 20th April, we are undoubtedly seeing significant impact across all industries around the world, including the travel industry.

Whilst no-one can anticipate the full impact of these exceptional circumstances, our data can provide some insight into how travellers are responding to the current situation, the more long-term impact that COVID-19 will have on destinations, and when the first signs of recovery start to appear.

Global Flight Searches and Bookings Continue their Plateau

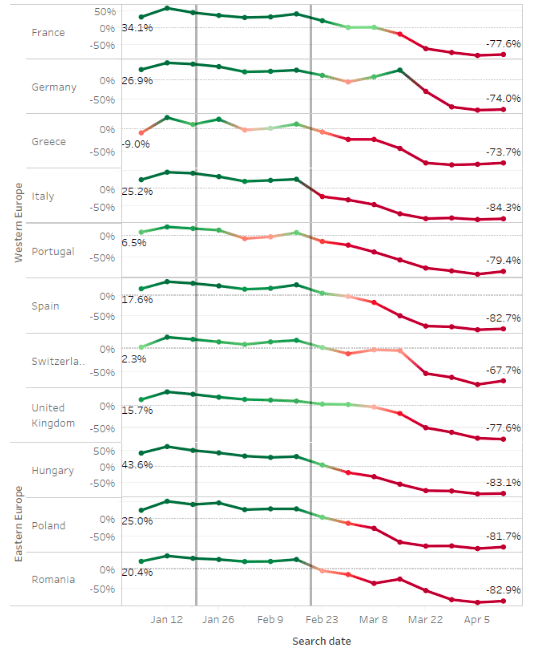

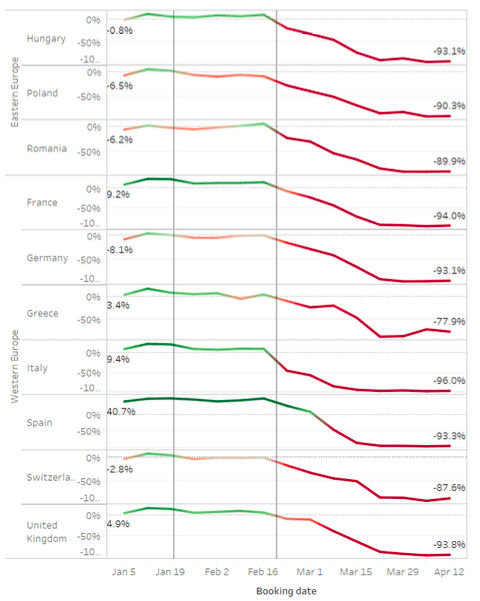

While there are signs that some European countries are looking to incrementally relax their lockdowns, global flight searches and bookings continue to plateau. There are some small upticks—such as flight searches to Switzerland, and flight bookings to Greece—but overall, all countries are showing that flight searches and bookings well down year over year.

The easing of lockdown restrictions currently includes the partial opening of some non-essential businesses, as well as schools, as a first step. We anticipate that travel will be one of the last industries that benefits from the easing of lockdown restrictions. This week, we’ve included several other European countries, including those in Eastern Europe, to show how far-reaching these declines, and at current, plateaus, remain.

Global Flight Searches to Key European Markets

Global Flight Bookings to Key European Markets

An Analysis of Hotel Searches and Bookings: Comparing the UK and Germany

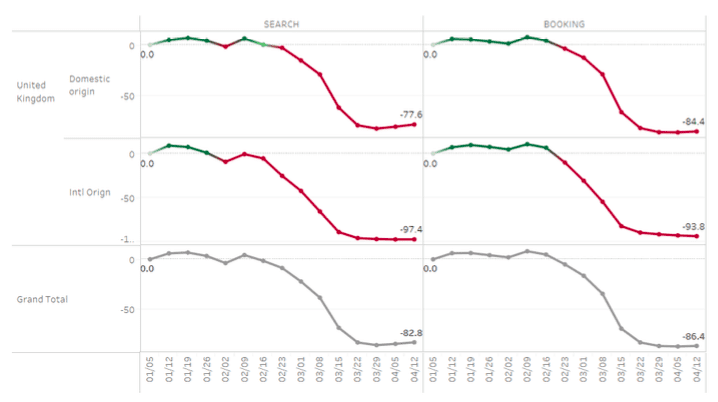

One of the European countries that will not be easing lockdown restrictions in the near future is the UK. The government announced a further three weeks of lockdown as there has been no evidence to show that the country’s infection rate has peaked. As such, we see that hotel searches and bookings are way down year over year, especially from International Origins.

Hotel Searches and Bookings to the UK

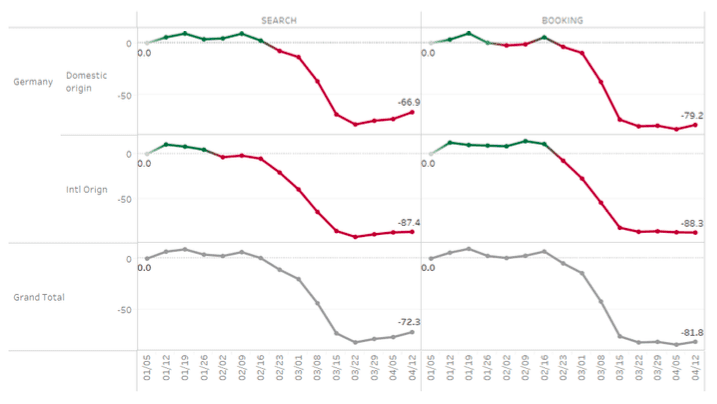

However, we do see hints at recovery when we look at Germany, whose government claims to have their outbreak ‘under control’. With their infection rate down to 0.7 as of April 17th, this means that each infected individual passed the virus to fewer than one other person. As a result of this, this week, they are starting to open smaller shops as a way of easing their lockdown.

When looking at hotel search and booking data for Germany, we see that there is a slight upward trend in both domestic searches and bookings for hotels in Germany. While still down year over year, this uptick is a positive sign, and aligns with our theory that travel recovery will begin first domestically, and then spread to regional and international travel.

It is important to note though, that Germany’s easing of lockdown restrictions remains very gradual. The government has issued a global travel warning until at least the end of April. Domestic tourism is forbidden, and restaurants remain closed. As such, the uptick in domestic searches and bookings are likely for dates further in the future.

Hotel Searches and Bookings to Germany

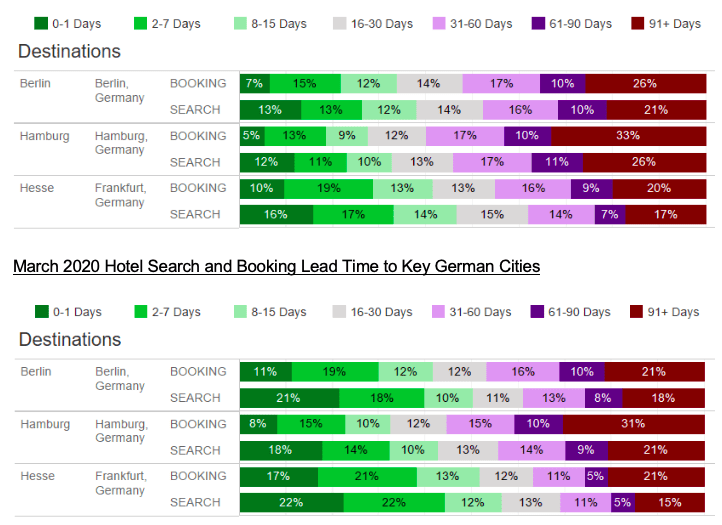

Last-minute Travel Searchers and Bookers Grow During Recovery in Germany

Let’s zoom into the domestic hotel trends we see in Germany, to see how the current situation has impacted search and booking lead times to key hubs (in this case, Berlin, Hamburg, and Frankfurt). When we look at January 2020 hotel search and booking data, and compare it to March 2020, we observe an increase in the number of searches and bookings that take place within a one-day window for all cities. We also see slight increases in the number of searches and bookings take place within two to seven days of travel.

Travellers appear hesitant to book travel for future months, and may potentially be leaving travel plans to the last minute before booking, in case there’s anything that could cause them to alter their plans. We will monitor these trends and see how they compare to other countries and cities in Europe as recovery starts to take hold.

January 2020 Hotel Search and Booking Lead Time to Key German Cities

While global flight searches and bookings remain down at present, we do see some European countries in a position to start easing their lockdown restrictions, which is having a positive impact on travel intent, at least domestically. These forward looking insights will hopefully help travel marketers shape their strategies when the industry starts to recover from this outbreak.

For the rest of the COVID-19 insights series click here.

*These insights are based on data collected on the 20th April, 2020. We will be reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. Sojern’s insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

About Sojern

Sojern is built on more than a decade of expertise analyzing the complete traveler path to purchase. The company drives travelers from dream to destination by activating multi-channel branding and performance solutions on the Sojern Traveler Platform for more than 8,500 customers around the globe. Recognized as a Deloitte Technology Fast 500 company six years in a row, Sojern is headquartered in San Francisco, with teams based in Berlin, Dubai, Dublin, Hong Kong, Istanbul, London, Mexico City, New York, Omaha, Paris, Singapore, and Sydney.