Key Mainland China hotel markets are projected to report performance growth in 2020 despite a challenging macroeconomic environment, according to the latest forecast from STR and Tourism Economics.

“China’s economy, and by extension its hospitality industry, remains strong even with concerns around the trade war with the U.S. and an overall global economic slowdown,” said Christine Liu, STR’s Regional Manager, North Asia. “A decline in Chinese departures to other countries, combined with significant government investment in infrastructure is driving domestic demand in key markets. However, the country’s resiliency to difficult macroeconomic situations will be tested if the trade war continues to decelerate economic growth.”

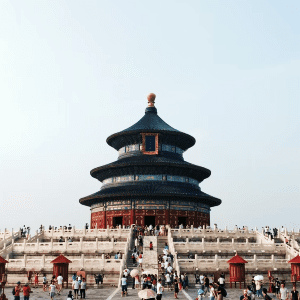

At the market level, Beijing should continue on its growth trajectory with a forecasted increase of 3.7% in revenue per available room (RevPAR). The average daily rate (ADR) is expected to continue to grow (+1.8%) after a strong 2019 in the metric.

“Demand growth is key for Beijing as supply continues to increase at a healthy rate,” Liu said. “The newly opened Beijing Daxing International Airport projected to be one of the busiest in the world; and Beijing preparing for the 2022 Winter Olympics, highlight potential growth for the tourism and hospitality sector.”

After a challenging 2019, Chengdu is forecasted for ADR growth of 1.4%. The market is projected to report the country’s second-largest supply growth rate (2.8%) with close to 18,000 rooms in the development pipeline. Demand will be helped by China’s high-speed train system and subsequent meetings, incentives, conferences and exhibitions (MICE) business.

As the international trading center and comprehensive transportation hub of China, Guangzhou is expected to show RevPAR growth of 3.4% with solid increases in both occupancy and ADR.

Hangzhou, known for welcoming a mix of leisure and business travelers, is set to see its run of performance growth end in 2020 (RevPAR: -2.4%). Among key markets in Mainland China, Hangzhou should see the largest increases in supply (+4.1%) and demand (+4.7%).

Following three years of occupancy declines caused by the impact of new supply, 2020 is expected to be Shanghai’s year of recovery. RevPAR growth is expected to reach 2.5% as the market is likely to pick up displaced demand caused by continued protests in Hong Kong.