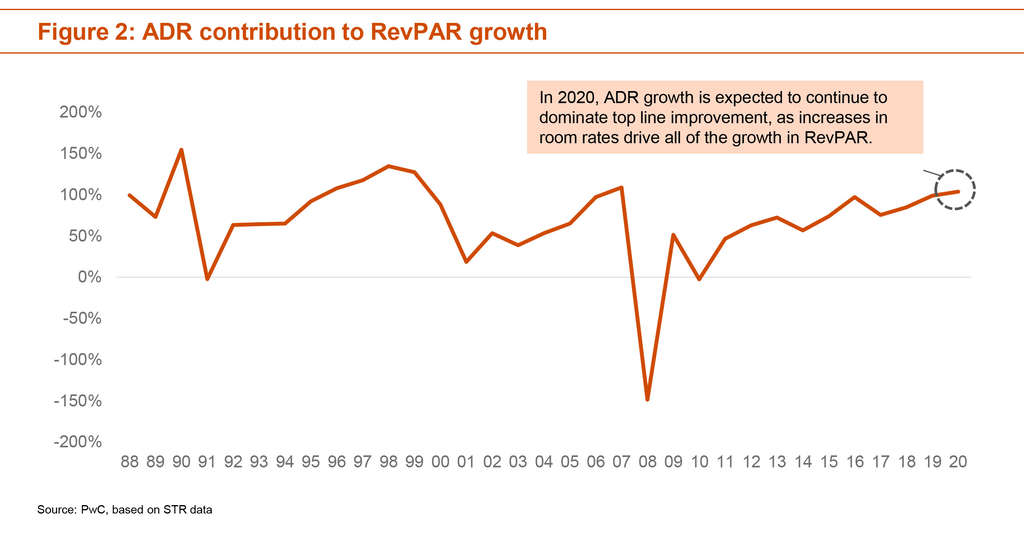

Second quarter results came in significantly below expectations – with ADR levels up 1.2 percent, and occupancy levels down 0.1 percent, resulting in a tepid RevPAR increase of 1.1 percent.

Mitigating a steep decline in group occupancy levels was mild growth in transient demand, as well as strong growth in the contract segment. Between flattening occupancy and an overall lack of pricing power, RevPAR grew at a modest level, as hotels traded occupancy for rate. US lodging performance continued to experience headwinds in July, characterized by anemic RevPAR growth.

The US lodging industry appears to be at an inflection point. Since the beginning of the economic recovery, RevPAR across the US grew at a compound annual growth rate of 5.4%. Last year, it grew by only 2.9%. For the first six months of this year, RevPAR is up just 1.2%. Recent weak performance and decelerating forward trends suggest a continued deceleration in top line performance through at least next year.

Looking ahead to the remainder of 2019, the near-term lodging outlook remains choppy, with unemployment expected to reach a cyclical low by the end of this summer at around 3.5 percent, decelerating GDP growth; and softening in consumer spending. In 2020, lodging supply and demand growth are expected to moderate, resulting in a very slight decline in occupancy. Rising inflation levels are expected to support marginal growth in ADR, resulting in an expected RevPAR increase of 1.0 percent, the lowest in a decade. The above outlook is challenged by continued trade tensions and effects from tariff-rate implementation, political uncertainty both domestically and abroad, slowing economic growth, and pressure on inbound leisure travel from China due to the devaluation of the Yuan.