Sabre Corporation, a leading software and technology provider that powers the global travel industry, today released the results of its APAC-wide travel sentiment survey, revealing 6 key findings that the travel industry can leverage for Covid-19 recovery.

The new survey has provided insight into traveller state of mind across Asia Pacific as the industry looks to survival, recovery and, ultimately, growth in the “new normal” brought about by the current pandemic.

The new survey has provided insight into traveller state of mind across Asia Pacific as the industry looks to survival, recovery and, ultimately, growth in the “new normal” brought about by the current pandemic.

“As travel restrictions start to lift and pockets of the industry begin to recover, we are seeing traveller behavior adapt to the new normal,” said Todd Arthur, Vice President, Asia Pacific, Agency Sales Travel Solutions, Sabre. “Our findings show that, while consumer confidence in the safety of travelling is mixed, there is also a clear pent-up demand for travel among many people across APAC, as well as strong opportunities to be seized by all sectors of the travel ecosystem as we move forward.”

Below are the 6 major findings of the Sabre survey into APAC traveller sentiment:

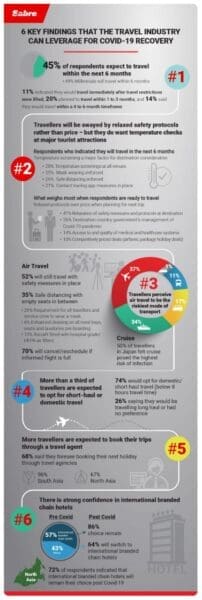

#Finding 1: 45% of respondents expect to travel within the next 6 months – with Millennials set to travel first

While more than a third of travellers (35%) said they wouldn’t be travelling anytime soon, or until a Covid-19 vaccine is available, there were also positive indications for the travel industry with 45% of respondents saying they planned to travel within 6 months (following the lifting of relevant travel restrictions).

Of all the age groups, the survey indicated that Millennials (i.e., those in the 20 to 39 age category) are the keenest to travel as soon as restrictions are lifted, with 49% saying they would travel within 6 months.

Of respondents in all age groups, 11% indicated they would travel immediately after travel restrictions were lifted while 20% said they planned to travel within 1 to 3 months, and 14% said they would travel within a 4 to 6-month timeframe.

Out of the regions in APAC, South Asia has the highest percentage of travellers who indicated that they are keen to travel within a year (73%)

The country with the most positive travel sentiment was Pakistan, with only 10% of travellers saying they aren’t keen to travel soon. Those in Singapore also demonstrated a strong pent-up demand for travel, with just 14% saying they had no plans to travel. 18% of respondents in Singapore said they would travel immediately, with a further 18% saying they would travel within 1 to 3 months.

#Finding 2: Travellers will be swayed by relaxed safety protocols rather than price – but they do want temperature checks at major tourist attractions.

Of the respondents who said they had no plans to travel anytime soon, or until a Covid-19 vaccine is available, the majority said that they would not be swayed by price once they do think about booking their next trip.

Only 10% said the main factor they would consider would be competitively priced deals such as airfares or package holiday deals, while the majority (41%) said their main consideration was a relaxation of safety measures and protocols at a destination, such as a lack of 14-day quarantine or contact-tracing measures.

Meanwhile, more than a third (35%) said they would consider the destination country government’s management of the Covid-19 pandemic and 14% said they would look at the access to and quality of medical and healthcare systems at their potential destination country.

Of those respondents who stated they would travel within six months, 28% said they would be extremely likely to travel to a destination which implemented temperature screening before entering places or interest, tourism spots and all venues including hotels and restaurants.

Meanwhile, a quarter (25%) of respondents who will travel within 6 months said they would be more likely to travel to a destination where mask-wearing is enforced, 26% said they would be more likely to travel where safe distancing measures were strictly enforced and 21% said they would be more likely to travel to a destination with contact tracing measures in place.

#Finding 3: Travellers perceive air travel to be the riskiest mode of transport

More than a third (37%) of respondents said they believed air travel posed the highest risk of infection when travelling during the current Covid-19 pandemic, with cruise ships deemed to be the next riskiest mode of transport for travellers in APAC (34%). More women than men deemed air travel to be risky. Out of those saying air travel was the riskiest mode of transport, 62% were female.

However, even though respondents said they thought air travel posed the highest risk, more than half (52%) said they would still travel via air, provided that certain safety measures were put in place.

- 35% of all respondents said “safe social distancing with empty seats between passengers” was the most important measure to help them to feel safe to travel via air.

- Other important measures for potential air passengers were a requirement for all crew members and passengers to wear a face mask, as well as enhanced cleaning for meal trays, seats and lavatories before boarding.

- However, even with safety measures in place, 70% of respondents who said they would travel via air would prefer to cancel or reschedule their flight if they were informed that the flight was completely full.

In contrast with the overall APAC results, the majority of travellers in Japan ranked cruise as the riskiest mode of transport in a finding. 50% of respondents in Japan stated cruise posed the highest risk of infection, with 73% indicating they would avoid travelling via this mode of transport completely.

#Finding 4: More than a third of travellers (74%) are expected to opt for short-haul or domestic travel

While travellers across APAC remain cautious about travelling, of the 44% who indicated they will travel within the next six months, 41% said they would opt for short-haul travel (below 8 hours travel time), while 33% said they would choose domestic travel, with the remaining 26% saying they would be travelling long haul or had no preference.

- More than a third (38%) of respondents from Pakistan who do want to travel said they would go for short-haul trips (below 8 hours).

- In Japan, of the 49% of respondents who indicated they will travel in the next year, 61% of those said they will choose domestic travel.

- Meanwhile, of the 37% in Taiwan who indicated they will travel, 46% said they will opt for short-haul travel (below 8 hours).

#Finding 5: More travellers are expected to book their trips through a travel agent

Travellers who previously booked their trips independently say they are more likely to book via travel agents in future.

Of those surveyed, 68% said they foresee booking their next holiday through travel agencies to save the hassle of pre-travel research. The results varied across markets in APAC.

In South Asia, 96% of respondents indicated they will book through travel agents, while the figure was even higher in Pakistan, with 100% of respondents surveyed saying they will opt to book through travel agents. In North Asia, 67% of respondents indicated they will book their next trip through travel agents.

#Finding 6: There is strong confidence in international branded chain hotels

The survey revealed good news for international branded chain hotels, with 57% of respondents saying they had previously preferred to stay in international branded chain hotels, and 86% of those indicating that this will remain their top choice post Covid-19.

This sentiment is particularly strong in North Asia, where 72% of respondents indicated that international branded chain hotels will remain their choice post Covid-19.

Meanwhile, 64% of respondents whose choice before Covid-19 were home stays, boutique hotels, motels or other forms of accommodation and who said they would now change their preferred type of stay indicated their new choice would be international branded chain hotels.

The biggest reasons for sticking to, or making a switch to, branded chain hotels were assurances of enhanced sanitation and cleaning as well as the use of new cleaning technologies.

Survey Methodology

The Asia Pacific (APAC) travel sentiment survey aims to gain insight into the mindset of travellers across APAC as the industry looks to survival, recovery and, ultimately, growth in the “new normal” brought about by the current pandemic. The survey comprised a total of 23 questions and was hosted on online survey software Qualtrics. It was made available in three languages – English, Traditional Chinese and Japanese. The survey was distributed to travellers across APAC via Sabre APAC and Sabre Australia and New Zealand’s social media channels including Facebook, LinkedIn, Twitter and WeChat, over the time period from June 3, 2020 to June 30, 2020. To enhance outreach, a sponsored Facebook ad ran for six days from 13 to 18 June. Additional survey distribution support was received from regional media as well as from Sabre’s joint venture partners who publicized it on their Facebook channels. A total of 618 responses were gathered and used to formulate the insights outlined in this press release

About Sabre Corporation

Sabre Corporation is a leading software and technology company that powers the global travel industry, serving a wide range of travel companies including airlines, hoteliers, travel agencies and other suppliers. The company provides retailing, distribution and fulfilment solutions that help its customers operate more efficiently, drive revenue and offer personalized traveller experiences. Through its leading travel marketplace, Sabre connects travel suppliers with buyers from around the globe. Sabre’s technology platform manages more than $260B worth of global travel spend annually. Headquartered in Southlake, Texas, USA, Sabre serves customers in more than 160 countries around the world. For more information visit www.sabre.com.