While many hotel investors claim to use a portfolio management approach to maximize returns and reduce risk, the question needs to be asked, “Are they harnessing the power of mean-variance optimization (MVO), a complex mathematical procedure, to construct efficient portfolios that provide the highest return for a given level of risk or the lowest possible risk for a given level of return?”

While many hotel investors claim to use a portfolio management approach to maximize returns and reduce risk, the question needs to be asked, “Are they harnessing the power of mean-variance optimization (MVO), a complex mathematical procedure, to construct efficient portfolios that provide the highest return for a given level of risk or the lowest possible risk for a given level of return?”

While MVO has been applied to both hotel market selection and asset allocation in recent years, many hotel investors continue to employ intuitive diversification strategies. Such strategies call for investing in a number of different types and locations of hotels in the hope that the variance of the expected return on the portfolio is lowered. By using MVO however, investors can increase returns and reduce risk by either fine-tuning or repositioning their portfolios.

What’s more, adding hotels with lower returns and higher risk to a portfolio may actually boost performance, if the pattern of those returns is sufficiently different from the other hotels in the portfolio.

It may sound crazy that investing in a hotel with lower returns and higher risk can lead to better portfolio performance! Yet that is precisely what makes diversification such a powerful strategy and MVO such a powerful tool!

UNDERSTANDING MEAN-VARIANCE OPTIMIZATION

Hotel market selection and asset allocation play an important role in determining the overall performance of hotel portfolios. What most hotel investors don’t realize, however, is that the foundation for a sound market selection and asset allocation strategy is built upon a widely accepted mathematical technique called mean-variance optimization (MVO).

The MVO process combines hotel investments with different characteristics into portfolios that provide the highest portfolio returns for a given level of risk or the lowest possible risk for a given level of return based on a set of assumptions about risk, return and correlations. These hotel portfolios are known as efficient or optimal portfolios.

THE EFFICIENT FRONTIER

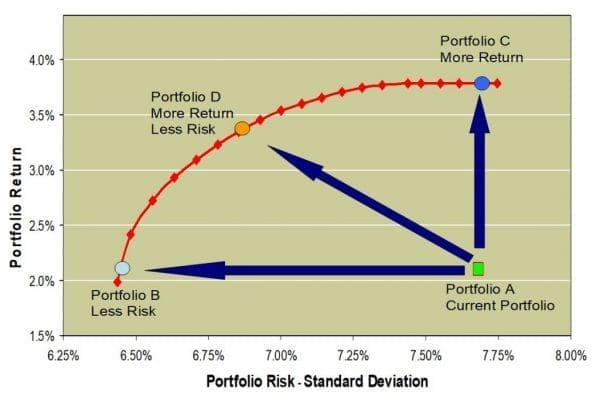

The line connecting all efficient portfolios is known as the efficient frontier as illustrated in Exhibit 1. Portfolio A is an investor’s current portfolio. Portfolio B is an efficient portfolio that has less risk, but the same level of return. Portfolio C has the same level of risk, but with a higher rate of return. In either case, both Portfolio B and Portfolio C are superior alternatives to Portfolio A.

EXHIBIT 1: THE EFFICIENT FRONTIER: OPTIMIZATION THROUGH INPUTS

PORTFOLIO OPTIMIZATION AND INPUTS

The challenge facing hotel investors can be seen in the annual rankings of markets by RevPAR growth rates over the past twenty-seven years as shown in Exhibit 2. The highest RevPAR growth markets in one year have often become the lowest RevPAR growth markets several years later, and vice versa. That is why the common habit of buying recent ‘winners’ and selling recent ‘losers’ has often been a recipe for disappointing hotel returns for many investors. To avoid this trap, investors need a strategy that takes advantage of volatility—rather than being whipsawed by it.

EXHIBIT 2: WINNERS & LOSERS IN TOP 10 AUSTRALIAN HOTEL MARKETS FOR 5-YEAR HOLDING PERIODS – REVPAR GROWTH RATES 1993 – 2019

The key to this strategy is portfolio optimization – the process of designing and constructing efficient portfolios that provide the highest return for a given level of risk or the lowest possible risk for a given level of return and as a result match each investor’s particular risk and return objectives.

The inputs necessary to find and develop an efficient frontier consist of three crucial inputs:

- Expected returns

- Risk, or volatility of returns

- The cross correlations among the returns

Forecast returns on a hotel-by-hotel or market- by-market basis are needed to calculate these inputs. It is essential that this data be consistent across time and locations because idiosyncratic information does not cut it when market selection and asset allocation are the goals. These crucial inputs help explain the behavior of each hotel or market under different market conditions and provide the groundwork for creating specific combinations of hotels and markets that are more efficient than others.

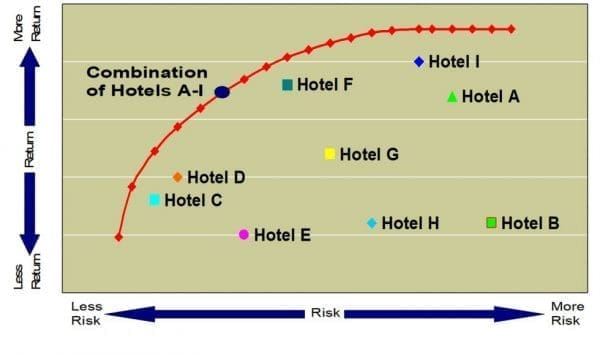

Exhibit 3 illustrates the different risk/return relationships among a small portfolio of hotels. Although each asset is unique, when combined using MVO techniques, superior investment mixes are identified in the form of an efficient frontier.

EXHIBIT 3: RISK, RETURN AND THE EFFICIENT FRONTIER

Efficient frontiers describe the highest attainable hotel portfolio returns associated with each level of risk. Each point on a frontier represents a portfolio allocated in a specific way over all the hotel investments in the model. The frontier is called “efficient” because it provides insight on the highest return for each level of risk and the least risk for each level of return. There are many non-efficient hotels portfolios, but they are less desirable since the same return could be earned while assuming less risk, or for the same level of risk a greater return could have been achieved.

By blending markets in the correct proportions, it is possible to construct diversified portfolios appropriate for a range of hotel investors, from the most conservative to the most aggressive. Even hotels with lower returns and higher risk may actually boost portfolio performance, if the pattern of those returns is sufficiently different from other hotels in the portfolio.

In this way efficient portfolios may be tailored to match the risk and return requirements of different investors, from the most conservative to the most aggressive. In each case, the goal is to deliver the maximum possible return for a defined level of portfolio volatility. MVO provides hotel investors with a powerful framework for asset allocation and diversification. Using optimization can take the emotion out of financial decision-making and help hotel investors make better, more informed decisions