In August 2021, Tranio joined forces with the International Hotel Investment Forum (IHIF) to conduct a joint survey on the impact the global COVID-19 pandemic has had on the hospitality sector since March 2020, and to zero in on what we can expect from the market going forward.

In August 2021, Tranio joined forces with the International Hotel Investment Forum (IHIF) to conduct a joint survey on the impact the global COVID-19 pandemic has had on the hospitality sector since March 2020, and to zero in on what we can expect from the market going forward.

The survey presented upwards of 160 industry professionals from across Europe with questions aimed at creating a comprehensive understanding of the appetite, sentiment and other factors underpinning international real estate investment since the start of the pandemic.

Most of the survey participants (59%) were real estate or hospitality professionals, 16% were hotel operators, 13% identified themselves as investors. The ‘Others’ category (12%) comprised other industry professionals, such as investment advisors, university professors and journalists.

The survey revealed that most experts expect the hospitality industry to recover in the next three years, although the situation in some countries will depend on vaccination rates. Respondents largely felt that the German, Spanish and Greek markets would prove more buoyant than others in terms of a swift recovery. In addition, nuances in respondents’ answers shed light on a mixed bag of perspectives currently at play on the market.

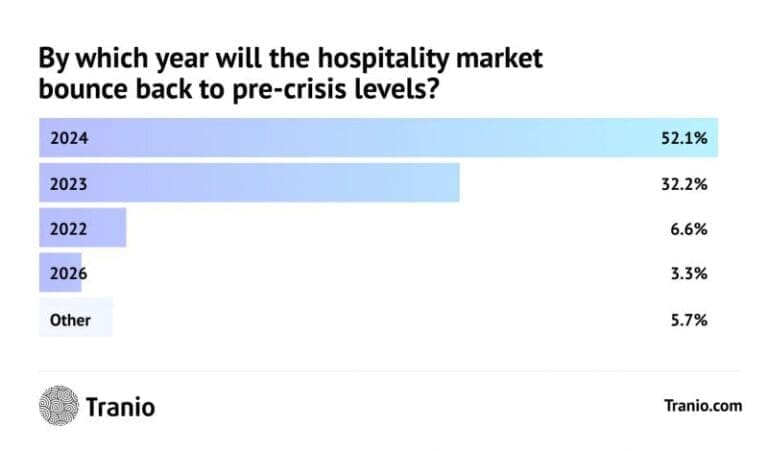

52% believe the hotel market will recover by 2024

The majority of the respondents expressed the belief that the hospitality market will recover to pre-crisis levels within a horizon of three years. More than half — 52% — of the participants predict a return to normalcy by 2024, while another 32% are optimistic that things will revert back to pre-pandemic levels by 2023.

Less than 7% expect a full recovery by 2022. One such respondent, Alexander Schneider from Nikki Beach Hotels and Resorts, expects that the leisure market will have one of its strongest years in 2022. But others are more cautious in their predictions. One respondent who didn’t disclose their name opined that hotels in massive tourism sector will only recover if prices increase and operational models change.

Notably, hotel operators appeared to be the most optimistic: 44% were split between expectations of a full recovery in 2023 or 2024, while 6% picked 2022 as the year when things would return to normal. Investors, on the other hand, were more cautious. The majority of investors (87%) expect a recovery in the next three years and no one believes it may happen in 2022.

Notably, hotel operators appeared to be the most optimistic: 44% were split between expectations of a full recovery in 2023 or 2024, while 6% picked 2022 as the year when things would return to normal. Investors, on the other hand, were more cautious. The majority of investors (87%) expect a recovery in the next three years and no one believes it may happen in 2022.

Among real estate and hospitality professionals, 51% expect the market will recover in 2024, while 35% believe it will happen a bit earlier, in 2023. About 5% expect the market to return to normal in 2022, while another 5% think it will happen between 2026 and 2030.

Although most investors do not expect speedy recovery, most of them are optimistic about the hotel sector in the coming years — a trend that is also clearly demonstrated by the Hospitality Insights report for the second quarter of 2021. A total of 85% of investors, according to the report, expressed a positive investment outlook for the hotel industry, while 13% were neutral and only 2% were pessimistic. Hospitality Insights has been monitoring buyer and seller sentiment in the hotel segment since the pandemic began. Hotels hold the top of the list for the third quarter in a row as the best investment opportunity over the next 12 months, followed by serviced apartments and resorts.

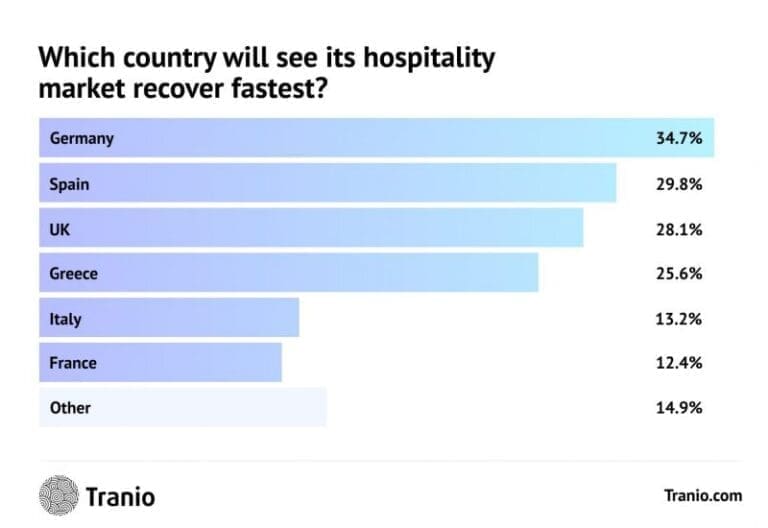

Professionals believe Germany and Spain will see the swiftest recovery in the hotel business

More than a third (35%) of respondents believe the German market will bounce back more quickly than others. Some 30% believe that the Spanish market will also recover quickly.

Among hotel operators, 31% chose Germany, and 25% each pointed to Greece, Italy, and Spain. More than a quarter, 27% of real estate or hospitality professionals think that Greece will be the fastest to recover but the majority still voted for Germany and Spain.

More than two-thirds of investors — 69% — expressed the most confidence in the UK market, while the rest referred to Germany and Greece. According to the latest report by STR, the UK hospitality sector shows the highest recovery rate in Europe, driven by leisure resort hotels.

Some of those respondents, who chose “other,” mentioned in the comments the United States, Asia in general, and Turkey and China in particular. Kirk Pankey, President and Senior Director at Lagundi Hospitality, opined that the most vaccinated countries would have the swiftest market recoveries.

Hotel prices have mostly remained unchanged

Purchase prices of hotels have remained unchanged or have fallen by 5% or less, according to a substantial majority (78.6%) of our respondents.

In terms of price changes, the opinions of the surveyed groups differ. Hotel operators comprised the most pessimistic group, with only 44% opining that prices have either not changed or have fallen by up to 5%. Meanwhile, 38% of operators believe that prices have fallen by more than 15% or even 20%. At the same time, 85% of real estate or hospitality professionals and 81% of investors are of the opinion that prices have not changed or have fallen by some 5%.

The quantitative data obtained in the poll was backed by Tranio’s managing partner George Kachmazov, who confirmed that it is practically impossible at the present moment to buy quality hotel properties in good locations at low prices, despite the ongoing crisis in the market.

“There are several drivers that impact prices: Liquidity in the market is off the charts in a broad sense, as a consequence of the monetary policy of the states. Banks, i.e. the owners of loans secured by hotel properties, are loyal to landlords. They often refrain from seizing collateral, while also providing loan deferments. In general, in order to buy a hotel property today at a solid discount (with a net development yield of 6% or higher), one should look at projects in non-ideal locations, not of an institutional size or in need of renovation. Also, properties with a significant share of MICE revenue can now be purchased at a discount of more than 10-20% off pre-sale prices. For large properties in top locations in good condition, the highest discount one can get at this point is 5-7%, according to our estimates,” Kachmazov said.

Other respondents indicated that there exists a substantial bid-ask gap in hotel pricing. “Weaning owners off all government support will create a lot of capital stack realignment and pain to come through the sector. The transaction market is still in suspended animation,” said one of the investors.

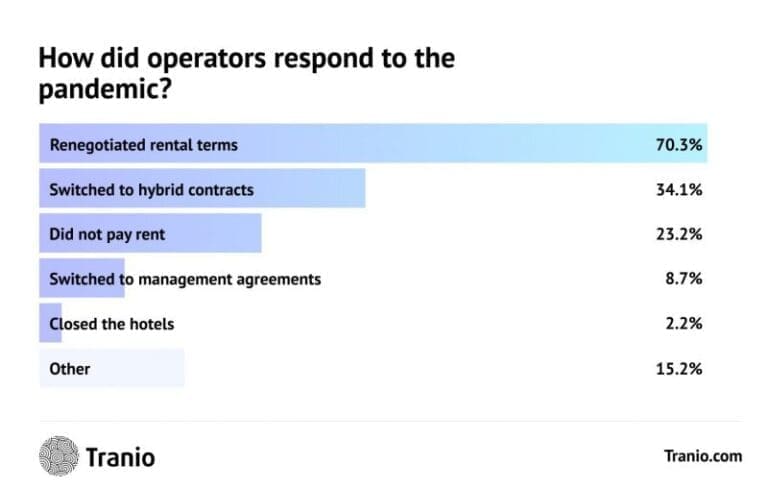

Most hotel operators polled said they had renegotiated their rental terms

This survey also reveals how the operators responded to the pandemic. The majority of those who participated in the survey (70%) indicated that operators have renegotiated rental terms. Operators themselves chose this option in about 59% of cases, according to our responses. For investors that figure was 63% and for real estate professionals it was 74%.

The results for the answer ‘Did not pay rent’ differ by almost a factor of two: operators themselves chose this answer in only 13% of cases, while investors and real estate professionals gave this answer in 26% and 25% of cases, respectively.

Popular solutions for operators during the pandemic were also switch to hybrid contracts and management agreements with owners, with 34% and 9% of all respondents giving these answers, respectively. At the same time, operators themselves chose these options in only 18% (switch to hybrid contracts) and 5% (management agreement) of cases.

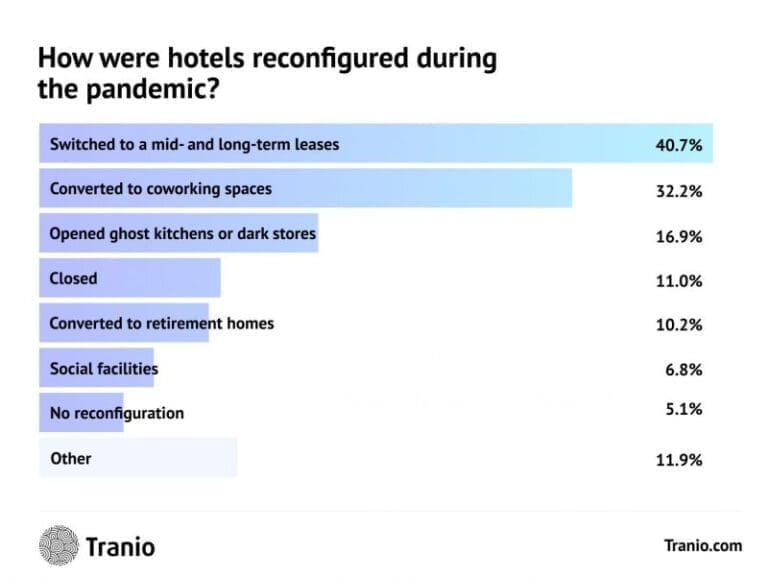

Many hotels switched to mid- and long-term leases during the pandemic

Nearly half, or 41%, of respondents believe that many hotels had come to favor mid- and long-term leases during the pandemic. In addition, 32% of the experts believed many hotels were converted into coworking space, and 17%, that they opened ghost kitchens or dark stores.

The big change to come out of the pandemic has been the rise of long-stay accommodation with major chains tweaking their offerings to accommodate long-term guests,” said one of the survey participants.

The big change to come out of the pandemic has been the rise of long-stay accommodation with major chains tweaking their offerings to accommodate long-term guests,” said one of the survey participants.

Only 10.2% assessed that many hotels had been converted into retirement homes, despite the recent growing demand for senior housing. According to Tranio specialists, converting hotels into retirement homes is rarely possible due to differing technical requirements or unsuitable locations.

Some of the real estate or hospitality professionals among our respondents pointed out that hotels switched to homeless shelters, provided accommodation for healthcare workers or opened COVID testing centres. “Most hotels remained closed, and just a few provided public services,” said Joan E. Capella, Director M&A for Iberolat Consulting & Investment.

Improved vaccination rates will drive the recovery of the hotel market

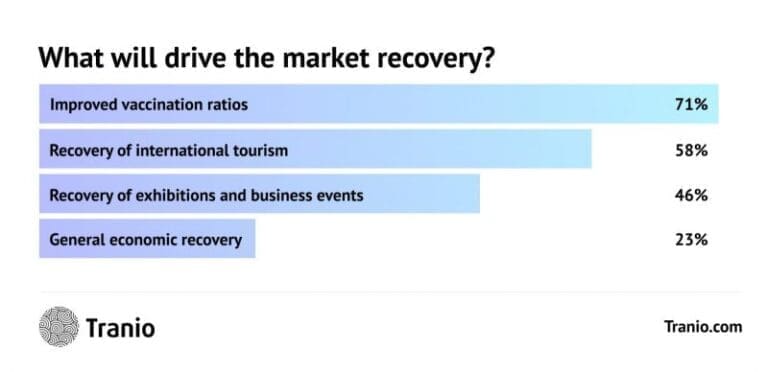

Asked what they thought would drive post-pandemic recovery, respondents resoundingly pointed to vaccination rates. Although there were several possible answers to this question, 71% of respondents argued that vaccination rates would be the most meaningful factor. The revivals of international tourism and the global economy were the next most popular answers, accounting for 58% and 46%, respectively. In addition, 23% believe that the hotel market will get a boost from the reintroduction of exhibitions and business events. One of the experts mentioned that business tourism will only recover “once travel restrictions are lifted and if the number of people vaccinated exceeds 80%.”

One of the respondents mentioned touchless technology and AI as among the tools that could alter ‘the tourism and hospitality mindset for goods’.

One of the respondents mentioned touchless technology and AI as among the tools that could alter ‘the tourism and hospitality mindset for goods’.

Some participants indicated that government support, particularly in Ireland and Slovenia, have helped the hospitality sector survive hard times. A representative of the Slovenian real estate agency Investmond mentioned that in Slovenia citizens received state coupons that allowed local hotels to be 100% full. “The real estate market in Slovenia saw prices increase by 40% from January to August 2021,” they commented.

“In my opinion, in addition to the general economic recovery, increasing national tourism in the respective countries will contribute to an accelerated recovery of the hotel market from 2022,” said Detlef Lauterbach from DELA.

About the authors

Tranio is a real estate investment platform with in‑house development expertise. With a network of 700 partners worldwide and a catalogue of more than 120,000 listings in 64 countries, we build bridges to the property our clients are seeking. We also have our own development and hospitality projects across Europe. Our offices are located in Berlin, Alicante, Athens and Moscow.

We at Tranio are also optimistic about the recovery of the hotel business and are looking for an opportunity to buy small hotels in need of renovation at a discount and prepare them for the time of market recovery – to renovate, optimise and digitalise services.

The International Hospitality Investment Forum is s the global voice of authority in hospitality investment, development and operations. It is the meeting place for dynamic, forward-thinking and progressive leaders. In early September 2021, the IHIF brought the industry together to rethink approaches, plans and strategies in the wake of the events of the past two years, bringing over 1,200 senior leaders in global hospitality investment and development together for the first time in 18 months.