The launch of TriO Capital, the dedicated investment and asset management arm of the Ovolo Group, will facilitate the acceleration of its expansion efforts, with an initial focus on Asia Pacific. TriO, named after the three O’s in Ovolo, will have Tim Alpe, the group’s former COO for Hong Kong and Indonesia, at the helm supported by a dedicated team of acquisitions and investment experts including newly minted Vice President Kyu Baek Kim, a long-standing team member with an intricate understanding of feasibility and expert investment analysis across the region.

acceleration of its expansion efforts, with an initial focus on Asia Pacific. TriO, named after the three O’s in Ovolo, will have Tim Alpe, the group’s former COO for Hong Kong and Indonesia, at the helm supported by a dedicated team of acquisitions and investment experts including newly minted Vice President Kyu Baek Kim, a long-standing team member with an intricate understanding of feasibility and expert investment analysis across the region.

TriO is a strategic milestone for the group, providing a dedicated platform for the purpose of working with third party capital, to unlock value in underperforming hotel assets across the region and deliver strong returns for its investors. It will enable the group to engage in aligned joint ventures and strategic partnerships whilst recycling its own capital and enhancing its asset management functions. TriO will work with with funds, developers and real estate owners who are looking to not only rebrand or refurbish their properties, but dive deeper into unlocking the full potential of each asset.

TriO will source opportunities, conduct feasibility analyses, conceptualise the best use of the target asset and manage the entire project development process through to trading commencement. TriO aims to bridge the gap between equity and operator, which at times can erode the return potential of assets, remaining nimble, creative, and more engaged than larger asset management platforms. With access to a preferred operating partner in Ovolo Hotels to deliver desired outcomes and required investment flexibilities, TriO will also look to asset manage non-Ovolo branded products to drive preferential returns.

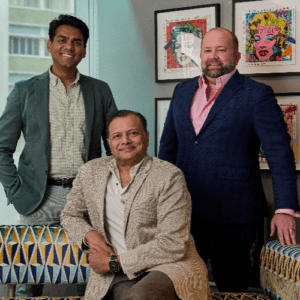

“I am excited to establish TriO Capital, to optimise hospitality real estate through effective capital expenditure and strategic asset enhancements,” said Tim Alpe, Managing Director of TriO Capital. “Our experience as owners and operators means we can effectively enhance cash flows, increase the value of our investments, and deliver long-term returns for our partners, be it Ovolo branded or otherwise.”

TriO is currently preparing to sell one of its boutique designer Sydney hotels, 1888 by Ovolo, in a move to fund the group’s continued growth. Alpe continues, “The sale forms part of our strategic plan to recycle capital to further grow throughout Australia, New Zealand, and selected Asia Pacific target markets. We have tripled our room count in the past five years, including adding two assets during the pandemic, which included a new build in Melbourne, Australia and an extensive refurbishment and rebranding in Bali, Indonesia”

“TriO was formed to offer the market a refreshed model to seize and deliver on impending opportunities across the region, all whilst still having skin in the game,” said Girish Jhunjhnuwala, Founder and Executive Chairman of Ovolo Group. “As trading fundamentals for the industry return, we have the expertise to unlock the full value of any asset and deliver stronger yields and enhanced returns.”

Ovolo has proven its operational excellence over 20 years and is actively sourcing opportunities in Australia, New Zealand, and Southeast Asia, with a long-term goal to take the brand global.

Dave Baswal, CEO Ovolo Hotels says, “As one of Asia Pacific’s most beloved lifestyle brands and hotel collections, Ovolo is a name that stands out from the competition through our rock ’n’ roll attitude and guest-centric focus. Our team is best-in-class in guest experience, branding, and technology and we are fully invested in finding the right partners to join us on our growth journey for Ovolo Hotels and beyond.”