2021 Highlights

2021 Highlights

Financial Results Well Above Forecast

- Full year 2021 revenue, net loss and Adjusted EBITDA, which include 2 months of Egencia ownership, totaled $763 million, ($474) million and ($340) million, respectively.1

- Full year 2021 revenue, net loss and Adjusted EBITDA, pro forma for 12 months of Egencia ownership, totaled $889 million, ($700) million and ($520) million, respectively. Pro forma revenue and Adjusted EBITDA exceeded the forecast provided in Apollo Strategic Growth Capital’s Registration Statement2 by $61 million and $37 million, respectively.

Corporate Travel Recovery Accelerating

- Transaction recovery in the last week of February 2022 reached 51% of 2019 levels, a 23 percentage point improvement versus mid-January, due to strong recovery from Omicron.

- Total Transaction Value (TTV)3 in the last week of February 2022 reached 45% of 2019 levels, which compares to a projected 49% for the full year 2022 previously disclosed in the Registration Statement2.

Egencia Synergies & Accelerated Small and Medium Enterprise (“SME”)4 Growth

- Completed the acquisition of Egencia, the leading B2B5 travel software platform, from Expedia. On track to achieve $109 million in total synergies, including $25 million in synergies in 2022, in line with expectations.

- Accelerated SME growth with recovery trends that have been 5-10 percentage points6 higher than Global Multinational Enterprises and 2021 SME new wins value7 representing 14% of 2019 pro forma SME TTV8.

Strengthened Customer Value

- In 2021, delivered $3.7 billion in total new wins value7, which represents 10% of 2019 pro forma TTV8, 95% customer retention9, 92% customer satisfaction9, and major wins including Hewlett Packard Enterprise, Standard Chartered and Palo Alto Networks. New wins year-to-date in 2022 include Raytheon Technologies and Ferrero Group.

- Accelerated technology investments in leading travel and expense software, Neo, including 500 new features and the introduction of our Neo1 proprietary expense management platform in the US.

March 07, 2022 08:00 AM Eastern Standard Time

NEW YORK–(BUSINESS WIRE)–GBT JerseyCo Limited (“American Express Global Business Travel”, “Amex GBT” or the “Company”), the world’s leading B2B travel platform, today announced preliminary and unaudited financial results for the fourth quarter and full-year ended December 31, 2021.

“2021 was a transformational year for Amex GBT with the acquisitions of Ovation Travel Group and Egencia and the launch of new, innovative travel and expense software solutions. We welcomed Expedia as a new investor and secured investment commitments from Sabre, Zoom, and Apollo as part of our pending business combination with Apollo Strategic Growth Capital and upsized, oversubscribed PIPE10. We enter 2022 with the leading value proposition in each of the customer segments we serve, strengthened relationships with our customers, and new sales momentum,” said Paul Abbott, Amex GBT’s Chief Executive Officer.

“We ended 2021 on a high note despite the Omicron impact in December, with financial results for the full year well ahead of our Adjusted EBITDA forecast driven by a 119% increase in fourth-quarter revenue and efficiencies from continued cost discipline. We believe the business travel recovery is well underway and is gaining momentum with transactions reaching 51% of 2019 levels in the last week of February 2022. We doubled our SME footprint, making nearly half our revenues attributable to the industry’s largest, fastest-growing and most profitable customer segment, and are well on track to deliver Egencia synergies that further strengthen our future earnings power. Our investments in unrivaled value, choice, and experiences for customers resulted in strong sales momentum that will sustain strong growth.

“Looking ahead, Amex GBT is uniquely positioned to lead and benefit from the industry’s continued recovery and long-term growth. We expect our pending business combination with Apollo Strategic Growth Capital to provide access to the capital required to continue to innovate and grow.”

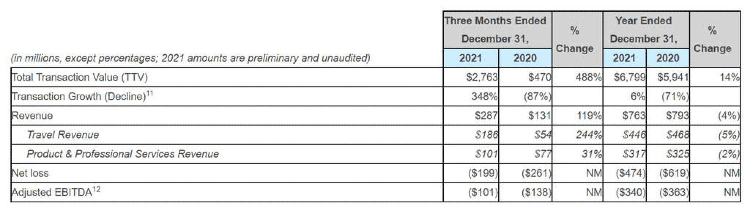

Fourth Quarter and Full Year 2021 Financial Summary1

Fourth Quarter 2021 Financial Highlights1

- TTV increased $2,293 million, or 488%, and total revenue increased $156 million, or 119%, versus the same period in 2020. Within this, Travel Revenue increased $132 million, or 244%, due to Transactions Growth driven by the recovery in travel from the COVID-19 pandemic, partially offset by lower yield. Product and Professional Services Revenue increased $24 million, or 31%, primarily due to increased management fees, product revenue and meetings and events revenue as COVID-19 restrictions were relaxed.

- Net loss improved $62 million, primarily due to increased revenue and a decline in restructuring charges related to cost savings initiatives implemented in 2020, partially offset by increased operating expenses and loss on early extinguishment of debt related to the Company’s December 2021 refinancing.

- Adjusted EBITDA improved $37 million, primarily due to revenue growth partially offset by increased cost of revenue to support the rise in the volume of transactions, higher general and administrative costs, increased technology and content investments and higher sales and marketing investments.

- All financial metrics presented were also impacted by the acquisition of Egencia on November 1, 2021 and therefore include approximately two months of revenue and earnings (losses) associated with Egencia.

Full Year 2021 Financial Highlights1

- TTV increased $858 million, or 14%, and total revenue decreased $30 million, or 4%, versus 2020. Within this, Travel Revenue decreased $22 million, or 5%, due to lower yield. This was partially offset by Transaction Growth driven by stronger travel volumes as the travel industry strengthened in the second half of 2021. Product & Professional Services Revenue decreased $8 million, or 2%, versus 2020 due to a decline in management fees and meetings & events revenues in the first half of the year due to the onset of travel restrictions in March 2020, offset by an increase in the revenues in the second half of the year driven by the recovery in travel.

- Net loss improved $145 million, primarily due to decreased operating costs including a decline in restructuring charges related to cost savings initiatives implemented in 2020, partially offset by lower revenue, loss on early extinguishment of debt related to the Company’s December 2021 refinancing and increased interest expense.

- Adjusted EBITDA increased by $23 million, primarily due to lower cost of revenues and lower technology and content expenses resulting from cost savings initiatives implemented in 2020, partially offset by the decline in revenue and higher general and administrative costs.

- All financial metrics presented were also impacted by the acquisition of Egencia on November 1, 2021 and therefore include two months of revenue and earnings (losses) associated with Egencia.

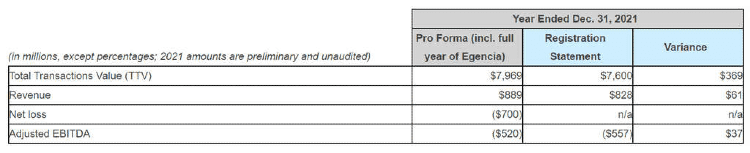

Pro Forma Full Year 2021 Financial Summary

Full year 2021 financial results above include two months of revenue and earnings (losses) from Egencia, which was acquired on November 1, 2021. The following table presents full year 2021 financial results pro forma for ownership of Egencia for the full year. These pro forma results are directly comparable to the forecast provided in the Registration Statement.

2021 Technology Highlights

- Accelerated technology investments in leading digital and e-commerce solutions, including expanded mobile and chat capabilities with the integration of WhatsApp and Google Chat.

- Expanded sustainability features and comprehensive content for customers, including new NDC13 content.

- Introduced over 500 new Travel and Expense features to Neo, Amex GBT’s proprietary Travel & Expense software platform, resulting in new enterprise customer wins and over 20% year-over-year growth in Amex GBT’s Neo transactions in 2021. Launched Neo1 in the US, a software solution for SME customers to manage all indirect spend, including travel.

2021 Transactions Highlights

- On December 2, 2021, Amex GBT entered into a business combination agreement with Apollo Strategic Growth Capital (NYSE: APSG) (“APSG”) providing for a transaction that is expected to provide up to approximately $1.2 billion of gross proceeds, comprised of APSG’s approximately $818 million of cash held in trust (subject to redemptions) and the upsized $335 million fully committed common stock Private Investment in Public Equity (“PIPE”) that includes key investors Apollo, Ares, HG Vora, Sabre and Zoom. New shareholders would join existing investors American Express Company, Certares and Expedia Group, Inc. The combination is expected to create the world’s largest publicly traded B2B travel platform, which upon closing is expected to be listed on the New York Stock Exchange under the new ticker symbol “GBTG”. The transaction is expected to close in the first half of 2022 subject to the satisfaction of customary closing conditions, including approval of the business combination by APSG’s shareholders.

- In December 2021, the Company bolstered its liquidity by establishing a $1 billion term loan facility under its amended credit agreement. Use of proceeds include the repayment of approximately $600 million of previously issued term loans, including pre-payment obligations and interest, and providing an incremental $400 million of financing for general corporate purposes, including to backstop potential redemptions of common stock requested by APSG’s shareholders.

Webcast Information

American Express Global Business Travel has posted a pre-recorded fourth quarter and full year 2021 investor conference call and related presentation materials on the Amex GBT Investor Relations website at investors.amexglobalbusinesstravel.com.

Investor Day

American Express Global Business Travel plans to host an investor day in New York City on Tuesday, April 12, 2022. A live webcast and replay of the event will be available on the Amex GBT Investor Relations website at investors.amexglobalbusinesstravel.com.