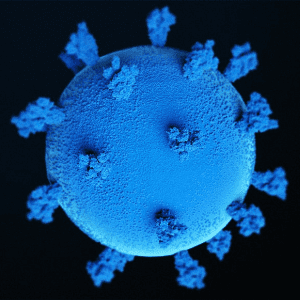

Canada’s hotel industry reported lower monthly performance levels amid the latest pandemic concerns, according to STR‘s year-end data.

Canada’s hotel industry reported lower monthly performance levels amid the latest pandemic concerns, according to STR‘s year-end data.

January 2022 (percentage change from January 2019)

- Occupancy: 32.4% (-35.9%)

- Average daily rate (ADR): CAD131.72 (-10.6%)

- Revenue per available room (RevPAR): CAD42.70 (-42.7%)

“The Omicron wave and the restrictions that ensued placed added pressure on performance recovery in January,” said Laura Baxter, CoStar Group’s director of hospitality analytics for Canada. CoStar Group is the parent company of STR.

“The largest impact was on occupancy, which dipped to levels not seen since summer 2021,” Baxter said. “It is, however, positive that the occupancy index to 2019 did not fall as much as it did during the second and third COVID waves. The most recent wave also had a negative impact on room rates, but not to the same extent as occupancy. Pre-pandemic, the typical seasonal trend indicated that rates fell an average of $8 between December and January, whereas this year, rates fell about $10. Overall, weekend rates were nearly fully recovered during the month, while weekday rates were not too far behind.

“Group demand was once again severely impacted by restrictions stemming from the rise in cases and hospitalizations. Now that those case counts and hospitalizations are falling and some restrictions are being lifted, we can expect to see gradual improvement in performance. Less stringent testing requirements to enter the country will allow for more international travel to take place, which should benefit the underperforming urban hotels.”

Among the provinces and territories, Saskatchewan recorded the highest January occupancy level (36.5%), which was 23.8% below the pre-pandemic comparable.

Among the major markets, Vancouver saw the highest occupancy (39.7%), which was a 38.6% decline from 2019.

The lowest occupancy among provinces was reported in New Brunswick (18.1%), down 55.4% against 2019. At the market level, the lowest occupancy was reported in Montreal (-54.5% to 23.3%).

Of note, Ottawa’s hotel industry saw increased performance levels due to the vaccine mandate protests that started on 28 January. The first weekend of protests lifted hotel occupancy in the market to roughly 80%. Weekday performance also benefitted, but not to the same degree as weekends.

“Due to the impact of the new COVID wave, STR’s 2022 occupancy forecast for the country has been downgraded,” Baxter said. “Meanwhile, the tremendous improvements in ADR through the final quarter of 2021, along with the resilience of the metrics throughout the Omicron wave, have contributed to upward revisions of the metric. The longer-term outlook remains similar to the previous forecast released in Q4 of 2021, with nominal RevPAR expected to come very close to 2019 levels in 2023. When adjusted for inflation, real ADR and RevPAR are anticipated to return to 2019 levels after 2025.”