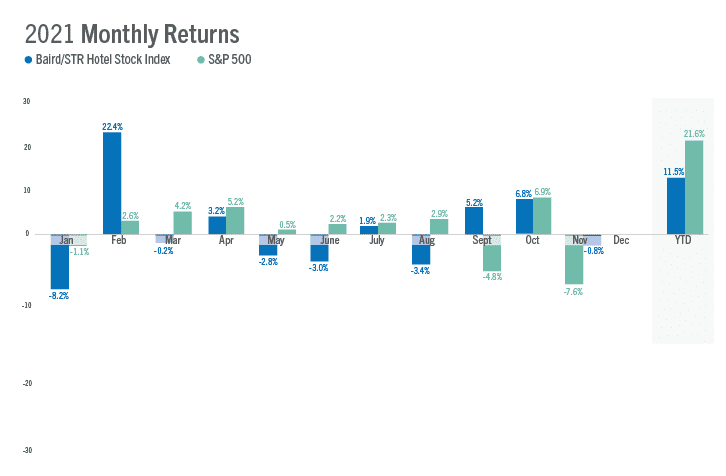

The Baird/STR Hotel Stock Index fell 7.6% in November to a level of 5,099. Year to date through the first 11 months of 2021, the stock index was up 11.5%.

The Baird/STR Hotel Stock Index fell 7.6% in November to a level of 5,099. Year to date through the first 11 months of 2021, the stock index was up 11.5%.

“Hotel stock price volatility continued in November with both the Hotel brands and Hotel REITs significantly underperforming their respective benchmarks,” said Michael Bellisario, senior hotel research analyst, and director at Baird. “Two different investment narratives drove stock price performance during the month: In early November, third-quarter earnings were better than expected, reopening optimism continued to gain momentum, and the hotel brands were hitting new all-time highs; but, by the end of the month, broader growth and inflation concerns surfaced, the Omicron variant spooked investors and impacted all travel-related stocks, and the hotel REITs were hitting new year-to-date lows.”

“The best Thanksgiving week performance on record reinforced the notion that U.S. travelers are buoyant about leisure trips while business travel, especially to attend group meetings, is still subdued,” said Amanda Hite, STR president. “Our new forecast with Tourism Economics projects that the industry will near 2019 levels of demand and room rates in 2022 with the overall recovery timeline moved up one year. We are of course monitoring for any potential impact from the Omicron variant, but if history is a guide, the impact will be most pronounced in international travel figures with much smaller effects on domestic travel patterns. Regardless, pressure on margins will continue to weigh on operators’ minds as increases in ADR may not be enough to make up for the higher wages across all chain scales.”

In November, the Baird/STR Hotel Stock Index lagged both the S&P 500 (-0.8%) and the MSCI US REIT Index (-0.9%).

The Hotel Brand sub-index dropped 7.2% from October to 9,178, while the Hotel REIT sub-index dipped 8.9% to 1,130.