The COVID-19 pandemic has changed the way people live, work and socialize, accelerating demand for innovation, as retailers, consumer goods, and travel companies shift from reacting to the crisis to reinventing products and services, according to findings of a new global survey from Accenture.

The COVID-19 pandemic has changed the way people live, work and socialize, accelerating demand for innovation, as retailers, consumer goods, and travel companies shift from reacting to the crisis to reinventing products and services, according to findings of a new global survey from Accenture.

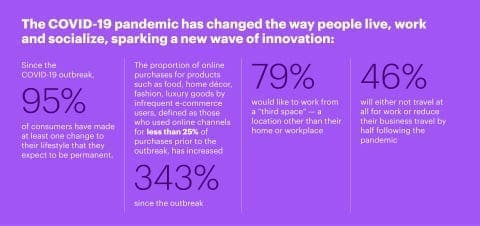

After a year of lockdowns, 95% of survey respondents said they made at least one change to their lifestyle that they expect will be permanent. Working from home, changing travel patterns, and a growing desire to shop locally are challenging industries to fundamentally rethink how they cater to the pandemic-adapted consumer. The latest survey of more than 9,650 people in 19 countries supports Accenture’s previous findings that many changes in behavior will likely be long-term.

“The ripple effects of the pandemic will be felt for some time and serve as a powerful illustration of the need for consumer-facing companies to be agile, resilient, and responsive to change,” said Oliver Wright, senior managing director and head of Accenture’s global consumer goods industry group. “Born out of disaster and necessity comes opportunity; the pandemic has sparked a new wave of innovation. As companies fundamentally rethink ways of doing business that delivers growth, many are using advanced analytical capabilities to spot, respond, and target changing consumption trends. For instance, a British beer company, Brewdog, responded with agility and creativity throughout the crisis —shifting to produce hand sanitizer, creating virtual bars, setting up the Brewdog Drive-Thru, and repurposing physical locations to create co-working space with Desk Dog.”

COVID-19 has led to compressed transformation, with companies simultaneously transforming multiple parts of the enterprise and reskilling people in what previously would have been longer-term step-by-step programs. Many consumer-facing companies have re-platformed their businesses in the cloud, addressed cost pressures, and continued to build resilience and security, putting the infrastructure in place to enable innovation and position them for future success.

Dawn of the “third space”

The pandemic forced a rapid shift to employees working from home, with many expressing that they want flexibility in how and where they work moving forward. More than three-quarters (79%) of respondents said they would like to occasionally work from a “third space” — a location other than their home or place of employment — and more than half said they would be willing to pay up to US$100 per month out of their own pockets to work from a café, bar, hotel, or retailer with a dedicated space. This highlights a potential opportunity to grow revenue for the hospitality and retail industries.

The desire to work from a “third space” is accompanied by a shift in attitudes towards business travel. Half (46%) of respondents said they have no business travel plans post-pandemic, or they intend to cut previous business travel by half. How long this view will hold firm remains to be seen, but the current outlook indicates that the return to travel will resume principally within the leisure market, pushing the industry to adapt and become even more efficient to make up for lost income.

“The pandemic has forced ‘creative pragmatism’, especially for travel and hospitality firms grappling to find additional revenue streams during the crisis,” said Emily Weiss, managing director and head of Accenture’s global travel industry group. “Some hotels turned rooms into pop-up restaurants while others experimented with offering temporary office space to customers seeking a ‘third space’ to work. While there has been experimentation with innovation in select pockets, companies need to scale these new services and address travelers’ renewed focus on health and safety, for example, by using the cloud to help enable fully contactless interactions.”

Shifts in consumer habits are here to stay

Not only do people think some of their work habits and travel plans have likely permanently changed, many also think their shoppi ng habits have evolved for the long haul. The latest research supports Accenture’s previously released findings that the dramatic rise in e-commerce is likely to remain or accelerate further. For instance, the proportion of online purchases for products such as food, home décor, fashion, and luxury goods by previously infrequent e-commerce users — defined as those who used online channels for less than 25% of purchases prior to the outbreak — has increased 343% since the outbreak.

Jill Standish, senior managing director and head of Accenture’s global retail industry group said, “Leading retailers were quick to adapt to the surge in e-commerce and are using technology to serve customers in new ways. Many adopted disruptive technologies such as augmented reality to recreate the physical store experience and help shoppers better visualize a room of furniture or an outfit, while others repurposed closed stores into local fulfillment centers with picking and packing technology. Even in a post-pandemic world, companies will need to satisfy consumers’ appetite for online shopping with fast delivery and get more intentional about the investments they will make in their people, supply chains, physical stores, and digital channels to be well-positioned to drive growth.”

About the research

Accenture’s COVID-19 Consumer Research is tracking the changing attitudes, behaviors, and habits of consumers worldwide as they adapt to a new reality during the COVID-19 outbreak. The latest waves of this survey were conducted November 28 — December 10 2020 and 25 February – March 5 12,487 and 9,653 consumers respectively, in 19 countries across five continents: Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Russia, Saudi Arabia, South Korea, Spain, Sweden, Switzerland, the UAE, UK, USA.