Online travel agencies (OTAs) operating in the European travel market find themselves in an interesting position in 2018. On the one hand, these intermediaries have been instrumental in the maturation of the region’s online travel marketplace, and the key players in the category are household names among European travelers.

Online travel agencies (OTAs) operating in the European travel market find themselves in an interesting position in 2018. On the one hand, these intermediaries have been instrumental in the maturation of the region’s online travel marketplace, and the key players in the category are household names among European travelers.

But increasingly, the landscape has shrunk to the point where, in the battle for OTA bookings, just one or two players compete, making it extremely challenging for smaller OTAs to stay in the game. As importantly, OTAs are now overshadowed in certain segments by the online supplier-direct channel, as a result of suppliers’ success in developing and promoting their own online booking platforms.

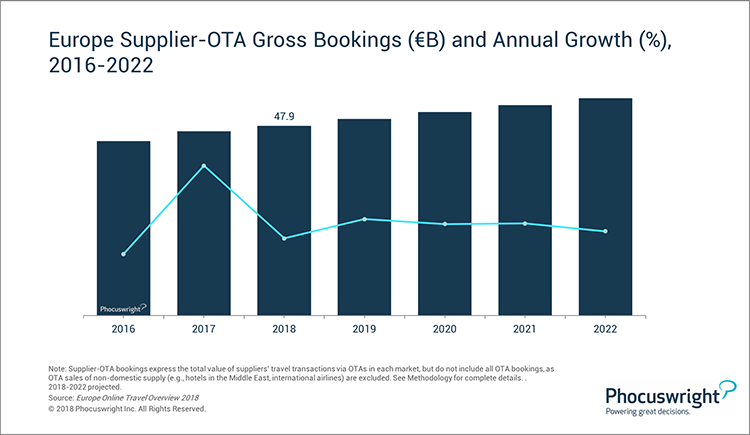

Despite the challenges, OTA bookings continue to climb in Europe. In 2018, the supplier-OTA channel reached €47.9 billion. Modest growth is projected for the next several years, as OTA bookings grow at roughly half the pace of the supplier-direct channel. More specifically, in terms of OTA channel distribution, growth has become uneven; while desktop bookings are projected to be flat for the next few years, OTA mobile bookings are projected to skyrocket. By 2022, more than a third of European supplier-OTA bookings will be transacted via mobile websites and apps.

Historically, OTAs have focused more on technology than have travel suppliers, and it is critical for them to maintain this focus to remain competitive with online direct bookings in some segments. This is particularly true with respect to the high-growth mobile channel.

Of course, not all travel segments are the same, and a range of factors contribute to the relative importance of OTAs in a particular category. For traditional airline carriers, the supplier-OTA channel captures a significant amount of online bookings. However, OTAs barely register a blip in terms of online low-cost carrier bookings. In the fragmented hotel segment, on the other hand, OTAs (led by market leader Booking.com) have been dominant.

Click here to read the full article at PhoCusWright.