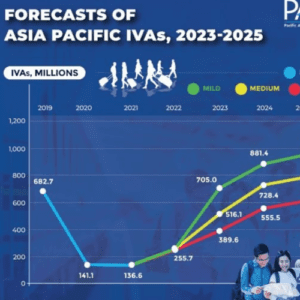

Updated forecasts for 39 Asia Pacific destinations, released by the Pacific Asia Travel Association (PATA) today, show a very strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025.

strong increase in aggregate international visitor arrivals (IVAs) under each of three scenarios in 2023, with robust annual growth continuing to the end of 2025.

Sponsored by Visa and with data and insights from Euromonitor International, this suite of reports builds on the current forecasts by delving deeper into the changing dynamics of travel and tourism into and across the Asia Pacific region at the single destination level facilitating the development of appropriate strategies over the next three years.

Predicted international arrival numbers in 2023 range from 705 million under the mild scenario to 516 million under the medium scenario, and almost 390 million under the severe scenario, equating to visitor numbers in 2023 that exceed that of pre-pandemic 2019 by 3.3% under the mild scenario, but still nearly 25% short of it under the medium scenario, and some 43% behind it under the severe scenario.

By the end of 2024, the 2019 benchmark level of IVAs will be exceeded even further under the mild scenario and by 6.7% under the medium scenario, with both positions increasing in strength to 2025. Under the severe scenario, however, IVAs in 2025 are still predicted to fall short of the 2019 level by some 10%.

In this just released series of the “Asia Pacific Destination Forecasts 2023-2025”, PATA covers each of 39 destinations in much greater detail, with a focus on source markets and air capacity changes in each case. One source market of particular interest of course, is mainland China and these most recent forecasts indicate that very strong annual growth rates are expected in 2023 under each of the three scenarios, but not passing the 2019 volumes until 2024 under the mild and medium scenarios.

Despite very strong annual increases in arrivals from mainland China to Asia Pacific destinations, under the severe scenario, that number is still expected to lag the 2019 peak by around six percent by the end of 2025.

As Peter Semone, Chair of the Pacific Asia Travel Association (PATA) points out “while these forecasts are extremely encouraging, hurdles still remain, and the travel and tourism sector will require ongoing vigilance and operational flexibility as these issues present themselves over the coming years. While the COVID-19 outbreak is no longer at the global pandemic stage for example, it has not disappeared entirely, and we must come to grips with living with it for some time yet.”

He adds “In addition, the conflict in Ukraine, a softening global economic outlook with rising inflation and the increased costs of international travel will all have to be dealt with in ways that satisfy the increasingly diverse demands of the traveller of both today and tomorrow.”

David Fowler, Head of Cross-border & Sales Excellence, Asia Pacific, Visa, said, “PATA’s forecasts offer the travel industry with a much-needed and renewed sense of optimism after almost three years of border closures. Nonetheless, many headwinds lie ahead as traveller habits and preferences have changed substantially in a post-pandemic and hyper-digitalised world. The travel industry needs to understand the unique needs of travellers, many who are digital natives, in order to offer the flexible, novel and personalised travel experiences that they have come to expect.”

“Building data capabilities will continue to be a key area of investment for the travel ecosystem as it navigates the shifts in travel patterns through data insights, and in turn respond with data-backed customer engagement strategies. Visa has recently set up a new Centre of Excellence for travel in Asia Pacific dedicated to help clients and partners use data insights to maximise opportunities in the travel space. It is now more critical than ever that the travel industry is well-informed through data, so enterprises – especially smaller ones – and local communities can react faster as travel recovery accelerates across Asia Pacific.”

What you will learn from this report:

Each of these 39 reports covers a specific destination in the Asia Pacific and individually provides:

-

Annual forecasts of visitor arrival numbers into each destination between 2023 and 2025 by scenario and source region;

-

Recovery rates for international visitor arrival (IVA) growth back to the 2019 benchmark;

-

Annual changes in relative visitor share by top source market, year, and scenario;

-

Seasonality pattern;

-

Quarterly changes in scheduled international inbound air seat capacity to 3Q 2022; and

-

Economic, income and expenditure outlook & trends, and domestic tourism.