As COVID-19 spreads further from Asia, shifting into Europe and North America, the travel industry has changed more than ever.

With our access to real-time traveler audiences and visibility into global travel demand, we’re in a unique position to share out the current travel trends at the forefront of marketers’ minds. Let’s take a look at the data in order to aid travel marketers in their assessment of this worldwide event. Our goal is to give marketers access to travel industry information on a regular basis so they can use these trends to inform their marketing strategies during this period and be prepared for the recovery once the situation stabilizes.

This week we take a look at travel in the U.S. The trends we’ve observed so far include: a jump in flight searches, a downturn in hotel searches, and increased distance dependent travel.

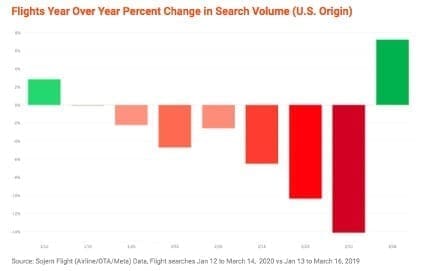

COVID-19 airline policies impacting search trends

Looking at U.S. origins we’ve seen a dramatic increase in flight searches in the last week and a half. Airlines have led this increase with drastically lowered prices and flexible ticket policies announced in the first week of March. Travelers are encouraged with no-risk tickets. The future threat of fees for cancellations and changes has emboldened searches for flights within the U.S. and internationally.

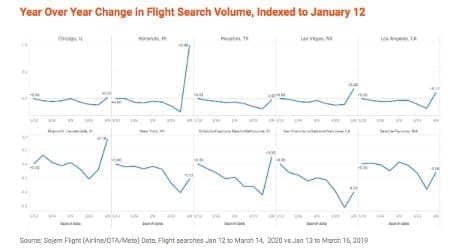

We’re seeing quite the change from last week’s insights around multiple travelers. Family and group travel is back on the rise, on an upward trend that is passing our data from before the outbreak of COVID-19. This can be attributed to a strong appetite for travel, but one that is contingent on accommodation for uncertainty. This of course, impacts both U.S. and international destination

This trend is evident throughout the country. Across the board, almost all metros in the U.S. experienced sharp increases in flight search.

This trend is evident throughout the country. Across the board, almost all metros in the U.S. experienced sharp increases in flight search.

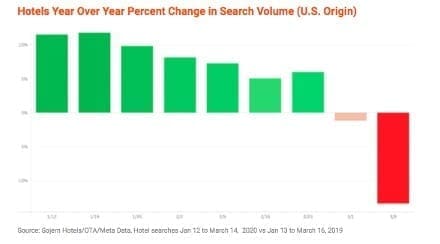

U.S. hotels showing weakness

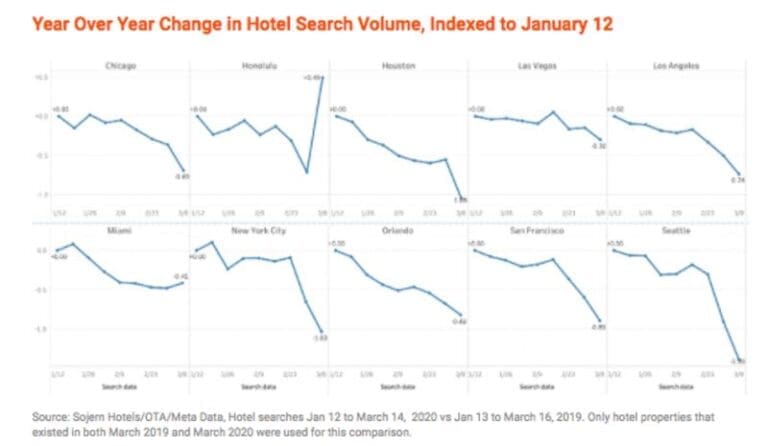

Hotels continue to decline. The significant interest we’re seeing in flights does not correspond with hotel searches yet. In fact, in the last week alone, hotel searches dropped steeply throughout the U.S., particularly with the more upscale brands. Most travelers tend to book airfare before hotels, so we’ll be keeping an eye out for a rise of hotel searches that could occur in the following weeks.

Hotels continue to decline. The significant interest we’re seeing in flights does not correspond with hotel searches yet. In fact, in the last week alone, hotel searches dropped steeply throughout the U.S., particularly with the more upscale brands. Most travelers tend to book airfare before hotels, so we’ll be keeping an eye out for a rise of hotel searches that could occur in the following weeks.

Hawaii however, has defied this trend. Besides Honolulu, other cities that have a stronger appeal for vacationers (Vegas, Miami, etc.) did not drop as steeply as other cities.

Hawaii however, has defied this trend. Besides Honolulu, other cities that have a stronger appeal for vacationers (Vegas, Miami, etc.) did not drop as steeply as other cities.

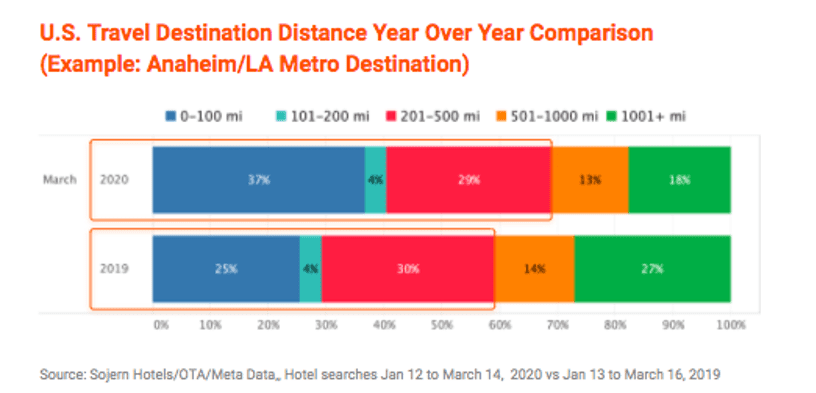

U.S. travel destinations are dependent on distance

It’s a good sign that we’re seeing an increase in flight searches, but there should be a continued emphasis on drive-markets this year. Despite the increase in flight searches we’re seeing a reduction in longer distance travel for leisure destinations within the U.S., trending towards distances that could be accomplished by car instead of air.

It’s a good sign that we’re seeing an increase in flight searches, but there should be a continued emphasis on drive-markets this year. Despite the increase in flight searches we’re seeing a reduction in longer distance travel for leisure destinations within the U.S., trending towards distances that could be accomplished by car instead of air.

We’ll be closely monitoring each region, country, and major destination every week to identify recovery patterns.

There is no doubt that marketers around the world will have to adjust their marketing strategies over the coming months. We’ll continue to share more insights as we monitor the situation and provide recommendations. For a copy of the shared insight charts click here.