Leisure travel continues to be particularly strong in the U.S. as spring kicks into gear, and the biggest hotel performance wins recently have come in those U.S. markets that are traditional Spring Break destinations. At the same time, major urban centers are seeing some return of transient business demand along with increases in group bookings.

Leisure travel continues to be particularly strong in the U.S. as spring kicks into gear, and the biggest hotel performance wins recently have come in those U.S. markets that are traditional Spring Break destinations. At the same time, major urban centers are seeing some return of transient business demand along with increases in group bookings.

Since last month’s update, travelers have continued to seek relief and respite in warmer or winter-fun locales, as shown by hotel performance data for the four weeks ending 12 March 2022. This is an especially good sign for the industry as the largest percentage of K-12 students are not expected to be on vacation until Easter weekend (16-17 April), according to STR’s School Break Report.

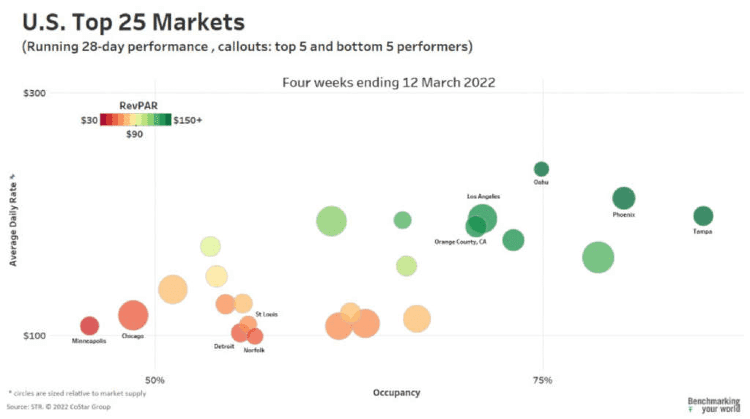

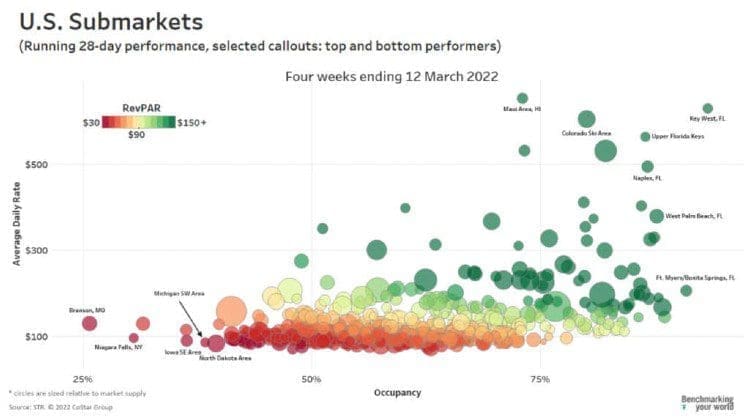

For the most recent four weeks, market leaders and laggards are highlighted in STR’s “bubble” charts below.

Fourteen of the Top 25 Markets have recently outpaced their 2019 comparable. Miami had the top four-week average revenue per available room (US$284) and a RevPAR index of 135 (or 35% above 2019). During the previous four-week period, Miami’s RevPAR was US$203, indexing at 104.

Still in second position, Oahu’s RevPAR increased US$33 from February’s update to US$178 (index: 89). Tampa’s 84.4% occupancy for the four weeks led to a stellar RevPAR index (152).

When visualizing results for all 651 STR-defined U.S. submarkets, a clear picture emerges where sun and sand destinations still dominate the overall leaderboard. Of the 30 top average RevPAR markets the last four weeks, 16 were in the state of Florida. An additional five were in Hawaii. Popular drive-to markets also remain among the nation’s best in outperforming their 2019 RevPAR comps, including Bozeman/Yellowstone Area MT (228), Portland Surrounding, ME (201) and Sandusky, OH (197).

For the larger picture, check out our weekly updates in STR’s Market Recovery Monitor.