With our access to real-time traveller audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds.

With our access to real-time traveller audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds.

In this blog series, we’ll take a look at the data in order to aid travel marketers in their assessment of this worldwide event. They can use these trends to inform their marketing strategies during this period, as the industry stabilises.

These insights are based on data collected on 12 January, 2021. We are reviewing our data on a regular basis in order to provide an accurate view of trends and patterns in consumer behaviour. Sojern’s insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

Upcoming Travel Trends for Asia Pacific and Lunar New Year

Domestic travel will lead the way during the upcoming Lunar New Year (LNY/Chinese New Year) period. We analysed the travel trends and insights looking at countries within Asia Pacific (APAC) that typically have the strongest Lunar New Year seasonality – Singapore, Taiwan, Thailand, Malaysia and Hong Kong.

What we found is that the demand for travel is predominantly domestically driven, with the exception of Hong Kong where more than 50% are looking at exploring international travel – if it translates into actual bookings will depend on the status of travel restrictions. The dates of travel are between 11th – 14th February coinciding with the LNY dates. At least 40% of travellers started to search a month prior to LNY with the exceptions of Japan, Thailand and Malaysia – all of which are seeing a surge in COVID-19 cases with lockdowns and state of emergencies having been declared. In Hong Kong, more than 10% of travellers are looking to book trips of at least four days. Travel marketers should be planning to target APAC travellers now, and again two weeks prior to LNY to capitalise on the demand.

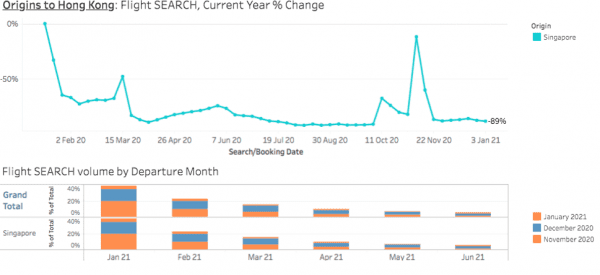

Inter-country travel between Hong Kong and Singapore is showing a peak in demand between LNY (Feb 2021) and the March 2021 school holidays. (Reference Chart 1 below).

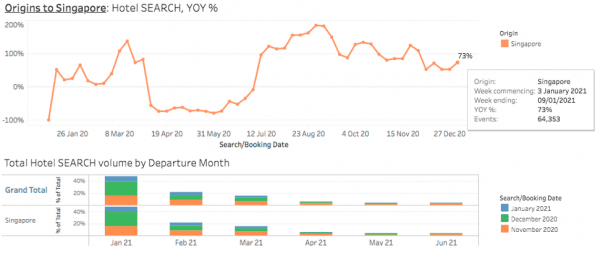

When looking at Singapore’s domestic trends, we see that pre-planning has started for LNY, Valentine’s Day and the March school holidays. Our data shows that the domestic hotel search demand has improved drastically with a 73% year-over-year (YoY) uplift (Reference Chart 2 below). It will be interesting to keep an eye on the future international travel intent to Singapore with the announcement that World Economic Forum’s (WEF) 2021 will be taking place in May in Singapore as opposed to Davos-Klosters, Switzerland.

Chart 1 – Hong Kong Inbound flight searches from Singapore

Chart 2 – Domestic Hotel Searches and Future Dates In Singapore

Domestic Travel Intent for Australia and New Zealand

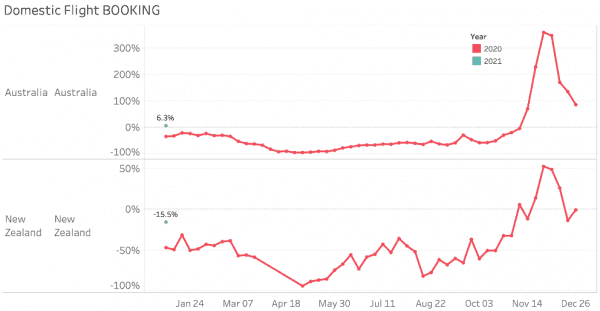

Domestic flight bookings for Australia and New Zealand indicate that domestic travel trends continue to peak in both countries. Travel within Australia saw a 300% increase at the end of November and into December 2020 (Reference Chart 3 below). With Qantas planning for international travel from July 2021, it will be interesting to see if the Australian Government eases travel restrictions at that time along with the status of the vaccine rollout.

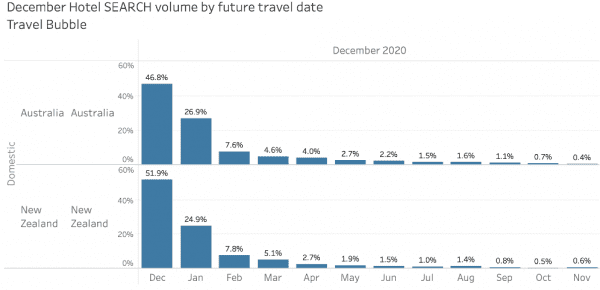

When analysing the future dates of hotel searches domestically in Australia and New Zealand, we see that the lead time is short with travellers looking to book hotels from now until the start of the second quarter of the year, up until April 2021 (Reference Chart 4 below). It is clear that travellers are dreaming of future travel and hotel holiday stays.

Chart 3 – Domestic Flight Booking – Australia and New Zealand

Chart 4 – Domestic Hotel Searches and Future Dates – Australia and New Zealand

Travel Bubble Between Australia and New Zealand

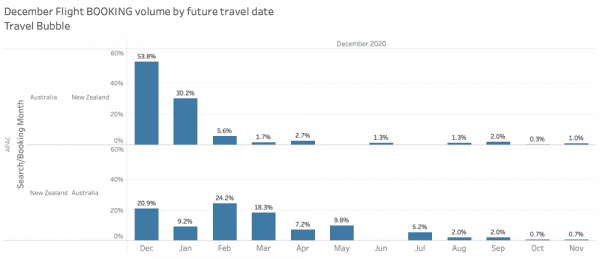

Australia and New Zealand were among the first countries in Asia Pacific to open up international travel (Trans-Tasman, but one way from New Zealand to Australia). The Australian Government announced a Safe Travel Zone with New Zealand, allowing travellers from New Zealand to enter the country quarantine-free. However, upon their return, New Zealanders have to quarantine and bear the financial cost. Contrary to reports, when looking at our data from December 2020 onwards, we see that New Zealand to Australia travellers were looking to travel in February (24.2% increase) up until May (almost 10%).

Subsequently, Australia to New Zealand is also seeing some traction. Last year in December 2020 (53.8%) and now in January 2021 (30.2%) we are noting an increase in flight bookings.

Chart 5 – Flight Booking and Future Dates – Australia and New Zealand Travel Bubble

Conclusion

The findings this month include an analysis of travel intent within APAC indicating a peak in domestic travel. The Lunar New Year is seeing that in Hong Kong, more than 50% are looking at exploring international travel, and there is also a peak of travel between Singapore and Hong Kong. Singapore’s domestic hotel stays continue to be popular. Lastly, we have explored domestic travel within Australia and New Zealand and the Trans-Tasman travel bubble. As the vaccine is rolled out more comprehensively across the globe, travel restrictions and quarantine requirements are bound to change. We will continue to share more insights as we monitor the situation.These insights will hopefully help travel marketers shape their strategies as the industry recovers.

For the rest of the COVID-19 insights series click here. View more real-time insights on our custom COVID-19 dashboard.