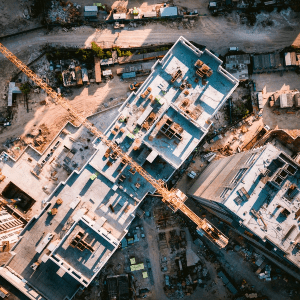

According to Lodging Econometrics’ (LE’s) Construction Pipeline Trend Report for Q1 2023, the hotel construction pipeline in Latin America, quarter-over-quarter, has increased 2% by projects and 3% by rooms. The Latin America hotel construction pipeline, at the close of Q1 2023, stands at 546 projects/90,139 rooms, however, down slightly 3% by projects and 2% by rooms year-over-year (YOY). Of the 546 projects/90,193 rooms, 226 projects/40,034 rooms are under construction throughout Latin America. Projects scheduled to start construction in the next 12 months stand at 160 projects/25,887 rooms, up 8% by projects and 17% by rooms YOY. Early planning is up 11% by projects and 15% by rooms YOY to stand at 160 projects/24,218 rooms at the close of the first quarter. New project announcements stand at 30 projects/5,330 rooms at Q1, up 5% by rooms YOY. The top countries in the Latin America construction pipeline, at Q1 2023, are Mexico with 210 projects/35,295 rooms, Brazil with 89 projects/15,456 rooms, the Dominican Republic with 28 projects/6,538 rooms, Peru with 27 projects/3,326 rooms, and Puerto Rico with 17 projects/2,658 rooms. Other countries with 17 projects include Costa Rica and Argentina, with 1,884 rooms and 1,832 rooms, respectively. Cities in Latin America with the largest construction pipelines include Mexico City, Mexico with 24 projects/2,899 rooms; Riviera Maya, Mexico with 17 projects/2,350 rooms; Lima, Peru with 15 projects/2,056 rooms; Sao Paulo, Brazil with 12 projects/2,848 rooms; and Georgetown, Guyana with 11 projects/1,408 rooms. Marriott International leads hotel franchise companies in Latin America’s construction pipeline with 105 projects/17,344 rooms. Hilton Worldwide follows with 103 projects/14,198 rooms, then Accor with 73 projects/9,164 rooms. These three companies, combined, are responsible for 51% of the projects and 45% of the rooms in the region’s total construction pipeline. LE analysts report that the top brands for these hotel companies at the Q1 close are Accor’s midscale and economy Ibis brands with 48 projects/5,974 rooms, Hilton’s upscale Hilton Garden Inn brand with 24 projects/3,062 rooms, and Marriott’s upscale Courtyard by Marriott brand with 13 projects/1,801 rooms. Renovation projects increased substantially in Latin America during the first quarter, closing with 62 projects/11,716 rooms. Brand conversions rose 22% by projects and 6% by rooms YOY, to stand at 67 projects/9,464 rooms. Combined, brand conversions and renovation projects increased 63% YOY, while rooms increased 43% YOY, for a combined total of 129 projects/21,180 rooms at the Q1 close. At the end of Q1 ’23, luxury and upper upscale renovations and conversions accounted for 47 projects/8,741 rooms, or 36% of the renovation and conversion projects and 41% of the renovation/conversion rooms in the region. On a percentage basis YOY, the renovation and conversion activity in these two chain scales, has increased 56% by projects and 29% by rooms. In the first quarter of 2023, Latin America had 13 new hotels, accounting for 2,053 rooms, open throughout the region. LE analysts forecast another 83 new hotel projects with 16,015 rooms to open thorough Q2 – Q4, for a total of 96 new hotel projects/18,068 rooms expected to open by year-end 2023. For 2024, LE forecasts 100 new hotel projects/15,007 rooms to open in Latin America.

quarter-over-quarter, has increased 2% by projects and 3% by rooms. The Latin America hotel construction pipeline, at the close of Q1 2023, stands at 546 projects/90,139 rooms, however, down slightly 3% by projects and 2% by rooms year-over-year (YOY). Of the 546 projects/90,193 rooms, 226 projects/40,034 rooms are under construction throughout Latin America. Projects scheduled to start construction in the next 12 months stand at 160 projects/25,887 rooms, up 8% by projects and 17% by rooms YOY. Early planning is up 11% by projects and 15% by rooms YOY to stand at 160 projects/24,218 rooms at the close of the first quarter. New project announcements stand at 30 projects/5,330 rooms at Q1, up 5% by rooms YOY. The top countries in the Latin America construction pipeline, at Q1 2023, are Mexico with 210 projects/35,295 rooms, Brazil with 89 projects/15,456 rooms, the Dominican Republic with 28 projects/6,538 rooms, Peru with 27 projects/3,326 rooms, and Puerto Rico with 17 projects/2,658 rooms. Other countries with 17 projects include Costa Rica and Argentina, with 1,884 rooms and 1,832 rooms, respectively. Cities in Latin America with the largest construction pipelines include Mexico City, Mexico with 24 projects/2,899 rooms; Riviera Maya, Mexico with 17 projects/2,350 rooms; Lima, Peru with 15 projects/2,056 rooms; Sao Paulo, Brazil with 12 projects/2,848 rooms; and Georgetown, Guyana with 11 projects/1,408 rooms. Marriott International leads hotel franchise companies in Latin America’s construction pipeline with 105 projects/17,344 rooms. Hilton Worldwide follows with 103 projects/14,198 rooms, then Accor with 73 projects/9,164 rooms. These three companies, combined, are responsible for 51% of the projects and 45% of the rooms in the region’s total construction pipeline. LE analysts report that the top brands for these hotel companies at the Q1 close are Accor’s midscale and economy Ibis brands with 48 projects/5,974 rooms, Hilton’s upscale Hilton Garden Inn brand with 24 projects/3,062 rooms, and Marriott’s upscale Courtyard by Marriott brand with 13 projects/1,801 rooms. Renovation projects increased substantially in Latin America during the first quarter, closing with 62 projects/11,716 rooms. Brand conversions rose 22% by projects and 6% by rooms YOY, to stand at 67 projects/9,464 rooms. Combined, brand conversions and renovation projects increased 63% YOY, while rooms increased 43% YOY, for a combined total of 129 projects/21,180 rooms at the Q1 close. At the end of Q1 ’23, luxury and upper upscale renovations and conversions accounted for 47 projects/8,741 rooms, or 36% of the renovation and conversion projects and 41% of the renovation/conversion rooms in the region. On a percentage basis YOY, the renovation and conversion activity in these two chain scales, has increased 56% by projects and 29% by rooms. In the first quarter of 2023, Latin America had 13 new hotels, accounting for 2,053 rooms, open throughout the region. LE analysts forecast another 83 new hotel projects with 16,015 rooms to open thorough Q2 – Q4, for a total of 96 new hotel projects/18,068 rooms expected to open by year-end 2023. For 2024, LE forecasts 100 new hotel projects/15,007 rooms to open in Latin America.

The Backend of the Latin America Hotel Construction Pipeline grows and renovations and brand conversions tick upward

Media,

Related Articles

Related Courses

You might also like:

Join over 60,000 industry leaders.

Receive daily leadership insights and stay ahead of the competition.

Leading solution providers: