Since 2011, STR has analyzed the top-line hotel performance impact for the Super Bowl host city, both in terms of absolute performance and year-over-year change. As usual, STR also made a prediction about Los Angeles hotel performance weeks before the event, forecasting revenue per available room (RevPAR) of US$396 for the weekend of the big game (Friday-Sunday).

Since 2011, STR has analyzed the top-line hotel performance impact for the Super Bowl host city, both in terms of absolute performance and year-over-year change. As usual, STR also made a prediction about Los Angeles hotel performance weeks before the event, forecasting revenue per available room (RevPAR) of US$396 for the weekend of the big game (Friday-Sunday).

With actualized data now processed, that RevPAR projection was an overestimate as weekend RevPAR reached just US$310 RevPAR. Fortunately, that RevPAR level was still a 272% increase from the comparable weekend last year, which was obviously lower because of the pandemic. L.A.’s recorded weekend occupancy of 80.5% was nine points lower than projected, suggesting the sweep of the Omicron variant may have played the part of “spoiler” for the event.

The hometown Rams being one of the Super Bowl teams also could have played a small role in the underperformance. However, the “average fan” is mostly priced out of the Super Bowl experience, limiting the amount of team-specific fan travel from other parts of the country. Fans who attend the Super Bowl are usually attending regardless of the matchup.

Despite the underperformance, some areas of L.A. posted far higher levels, so for that reason, we dive into analysis by the following locations:

- Overall Los Angeles market

- The submarkets: Hollywood/Beverly Hills, Long Beach, Los Angeles Airport, Los Angeles CBD, Los Angeles East, Los Angeles North, Los Angeles Southeast, Pasadena/Glendale/Burbank, Santa Monica/Marina Del Rey, South Bay

- The City of Los Angeles

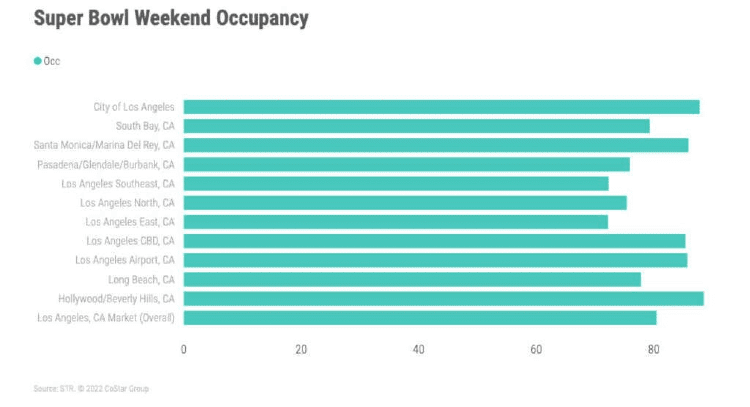

Occupancy

The Hollywood/Beverly Hills submarket, with just over 15,000 rooms, achieved the highest occupancy at 88.5% for the Friday, Saturday, and Sunday nights of Super Bowl weekend, which was lower than what the entire Miami market achieved for the 2020 Super Bowl (92.8%). Though a smaller market, Miami is somewhat similar to L.A. in terms of typical occupancy levels experienced in February. Miami, in particular its luxury segment, also carried similar rate upside for VIP travelers.

Occupancy levels were moderate-to-strong across the entire L.A. market, including a weekend occupancy of 85.7% for the Los Angeles Airport submarket, where SoFi Stadium is located. Altogether, the Los Angeles market achieved a 17-point occupancy increase versus the same weekend in 2021 but was actually about seven occupancy points lower than the pre-pandemic weekend in 2020.

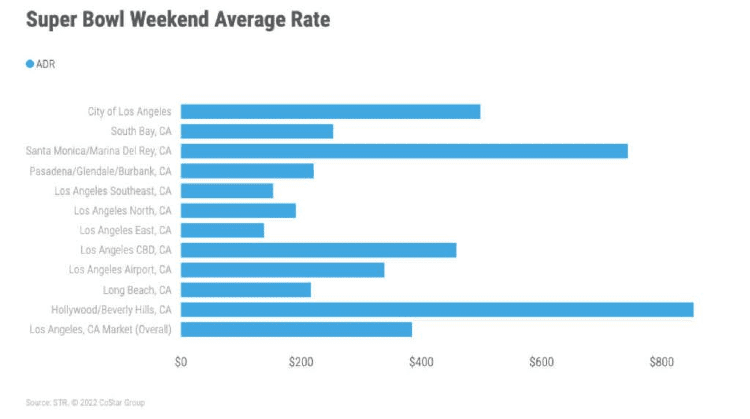

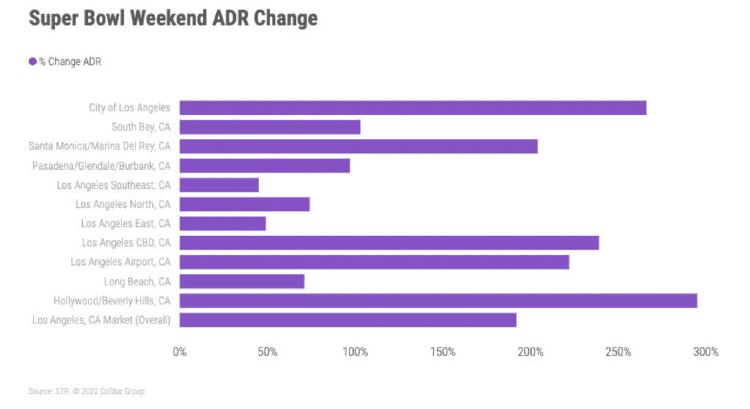

ADR

While absolute ADR ranged significantly through the submarkets, hotels in all areas experienced a lift. Hotels located in the Southeast submarket experienced the smallest gain in average rates, at 49%. On the other end of the spectrum, Hollywood/Beverly Hills hotels pushed their collective three-day ADR to a whopping US$853, a 295% gain over last year. Overall, the Los Angeles market hit a weekend average rate of US$384, which was 192% higher than in 2021 and 115% higher than the pre-pandemic levels of 2020.

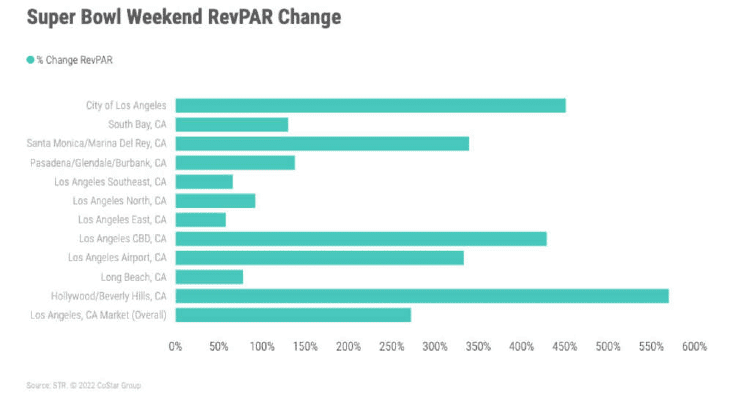

RevPAR Year-over-Year % Change

In the end, the Hollywood/Beverly Hills submarket experienced the greatest weekend RevPAR gain (+570%), far and above the next highest area (the City of Los Angeles at +451%). Overall, two-thirds of submarkets achieved triple-digit RevPAR growth. In Miami in 2020, only half the submarkets hits triple-digit levels.

Comparing performance to the those of the 11 previous Super Bowl host cities provides context to the annual gains attributable to the event. The following charts examine the comparative impact of all 12 host markets.

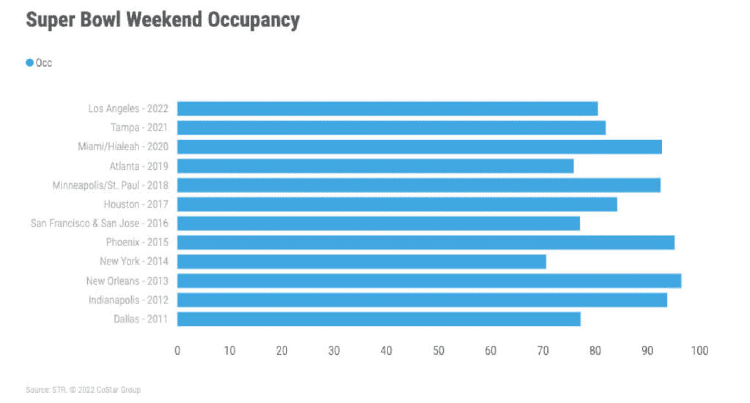

Occupancy – Super Bowl Weekend

The Los Angeles market’s Super Bowl occupancy was lower than STR expectations. As a large Top 25 Market with 112,000 rooms, and one that runs in the 80s in occupancy percentage on February weekends (pre-pandemic), an expectation of occupancy close to the 90% mark seemed logical. But clearly, although most signs of leisure demand indicate a strong willingness to travel despite the pandemic, the timing of the Omicron variant seemed to have an impact on this year’s Super Bowl hotel performance.

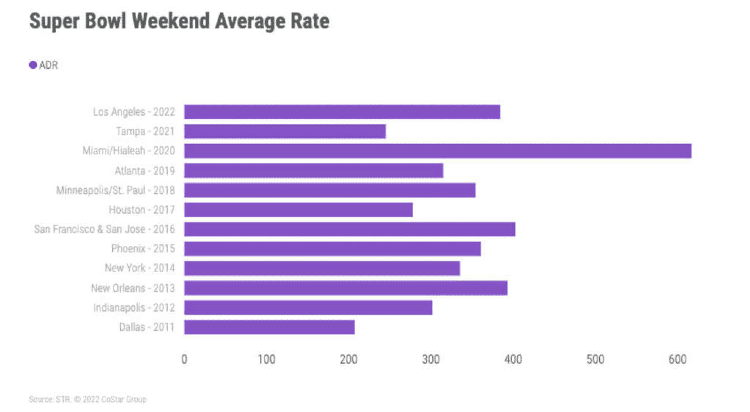

ADR – Super Bowl Weekend

In terms of absolute ADR, Los Angeles hotels performed near the top of the range demonstrated by other host cities (except the wild outlier of Miami). And while this ADR was an admirable 192% lift over 2021 levels, it’s difficult to compare to a period of time in which national travel was substantially muted. The fact that the 2022 Super Bowl weekend ADR was “only” 115% higher than pre-pandemic levels suggests the December/January surge of the Omicron variant may have played a role in tempering performance. As a point of comparison, Atlanta’s 2019 Super Bowl weekend ADR was 307% higher than the previous year.

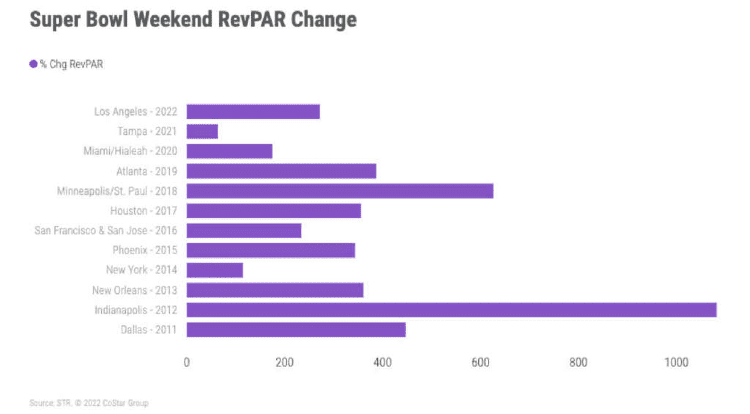

RevPAR % Change – Super Bowl Weekend

Including this year, the straight-average market RevPAR lift during the Super Bowl weekend over the last 12 events is 372%. Los Angeles’s lift of 272% is below that average, likely resulting from 1) the ongoing impact of the pandemic, 2) the sheer size of the market, and 3) typically strong February performance, making it more difficult to achieve substantial percent gains (though 2021 was a soft comp year). Overall, while the weekend performance for Los Angeles hotels was lower than what STR predicted, a nearly quadrupling of RevPAR for a market with over 112,000 hotel rooms is nonetheless an impressive feat.