In follow up to the most recent release of the PATA “Asia Pacific Overall Visitor Forecasts 2022-2024” last week, the Pacific Asia Travel Association (PATA) announced the release of destination-specific reports for each of 39 destinations within the Asia Pacific region.

In follow up to the most recent release of the PATA “Asia Pacific Overall Visitor Forecasts 2022-2024” last week, the Pacific Asia Travel Association (PATA) announced the release of destination-specific reports for each of 39 destinations within the Asia Pacific region.

Sponsored by Visa and with data and insights from Euromonitor International, this suite of reports builds on the current forecasts by delving deeper into the changing dynamics of travel and tourism into and across the Asia Pacific region at the single destination level.

Each of these 39 reports covers a specific destination in the Asia Pacific and individually provides:

-

Annual forecasts of visitor arrival numbers into each destination, by scenario and source region;

-

Recovery rates for international visitor arrival (IVA) growth back to the 2019 benchmark;

-

Annual changes in relative visitor share by source region, year, and scenario;

-

Quarterly changes in scheduled international inbound air seat capacity to 2022; and

-

Economic, income and expenditure outlook & trends, and domestic tourism.

These scenarios, when combined with other relevant metrics, provide hard data on how travel demand preferences could play out in these destinations and how they might recover under various scenario conditions. Scheduled international inbound air seat capacity, for example, shifts relatively quickly according to demand. In other words, understanding the likelihood of when and where capacity increases become a useful barometer of potential demand that can translate into increased arrivals.

Globally, approximately 1.5 billion inbound air seats were lost between 2019 and 2021, with Asia Pacific accounting for 57% of that reduction. While an overall global capacity increase is scheduled for 2022, it will not be uniform across all source and destination markets, and the rate of increase will be slightly slower for Asia Pacific relative to the world average. Such advance indicators of when and where these capacity gains are scheduled to appear will, of course, offer a significant strategic advantage for resource allocation during the gradual return to growth in the international travel and tourism sector [1].

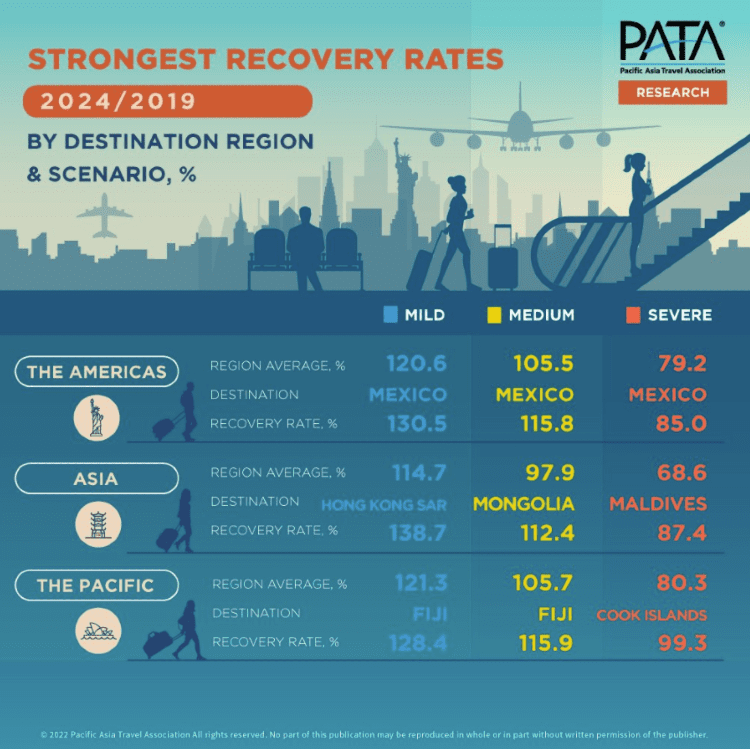

Recovery rates are one metric of growth where the values compare the forecast number of IVAs in 2024 to the actual numbers of 2019 and are expressed as percentages. This gives an indication of the growth trajectory in visitor arrival numbers at the end of this current forecast cycle relative to the 2019 benchmark level.

By the end of 2024, under the mild scenario, 38 of the 39 destinations covered in the reports are forecast to have returned to their respective pre-pandemic levels of foreign arrivals; under the medium scenario, two-thirds of those destinations will reach those benchmarks, however, under the severe scenario, none are predicted to have exceeded their respective 2019 numbers, although several are likely to come close.

The following infographic provides a sample of the data available in each of the 39 destination reports.

The average recovery rates for the source regions into these Asia Pacific destinations also show strong and continuous aggregate increases over the years to 2024, at least under two of the three scenarios. Under the mild scenario for example, the recovery rates for arrivals from Africa, Europe, the Americas and the non-descript ‘others’ category are all forecast to be well above the average in 2022, relative to 2019, but remain well below the pre-pandemic numbers; Asia on the other hand is predicted to still struggle to return to previous levels, lagging 6.6 percentage points behind the average recovery rate in that period.

Calendar year 2023, however, shows solid increases in those recovery rates, and by 2024 all source regions are forecast to exceed their respective 2019 volumes of arrival numbers generated into Asia Pacific.

These recovery rates of course, differ widely by individual destinations and the three scenarios over the years to 2024, and these are all detailed in the full ‘Asia Pacific Visitor Forecasts 2022-2024’ report, released earlier.

As PATA CEO Liz Ortiguera points out, “These latest projections show recovery and opportunity emerging over the next three years to 2024. Capturing growth opportunities will still require solid government support with risk-based health and safety measures, clear and consistent communications of protocols to consumers and a coordinated execution of all the stakeholders involved in the reopenings.”

“This series of scenario-based reports from the PATA Strategic Intelligence Centre is designed to present actionable insights at the individual destination level. While the outlook for a recovery in international travel and tourism over the next few years is decidedly positive, it is projected to be variable across the various destinations. In addition, various parameters that drive and affect the sector could change very quickly, so flexibility, coordination and adaptability will be key to maximising outcomes”, she added.

The Asia Pacific Destination Forecasts 2022-2024 is now available on the PATA website at www.PATA.org/catalog.