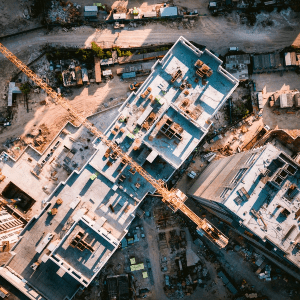

Investors have inked a string of large commercial real estate deals recently in Asia Pacific, a sign of emerging confidence for a sector where allocations continue to increase.

Investors have inked a string of large commercial real estate deals recently in Asia Pacific, a sign of emerging confidence for a sector where allocations continue to increase.

In January, Frasers Commercial Trust sold Cross Street Exchange, a centrally located mixed-use development in downtown Singapore, for S$811 million (US$602 million). Less than two weeks later, the ARA-owned Alpharium Tower office building in Pangyo, South Korea, was scooped up by Seoul-based Mastern Asset Management in a KRW 1.02 trillion (US$853 million) deal.

Such large deal sizes had become rarer in the early months of the pandemic. But interest in deals over US$300 million started to stage a comeback last year, particularly in the booming logistics sector. Case in point: Blackstone’s A$3.8 billion (US$2.9 billion) sale of its Australian logistics portfolio to real estate manager ESR Cayman and GIC, Singapore’s sovereign wealth fund.

“Investors remain underinvested in Asia Pacific property. Larger deals and platform acquisitions will become commonplace this year as investors put capital to work to expand their presence in the region’s real estate sector, which is poised for a strong recovery as economies reopen,” says Stuart Crow, CEO, Capital Markets, Asia Pacific, JLL.

There has been a similar trend in Europe, where big-ticket deals in major office properties picked up after a pause in trading during the thick of the pandemic.

Rising transaction sizes come amid overall strong investment momentum last year, when global deal volumes returned to pre-pandemic levels.

Large deals

Deal sizes are expected to keep rising this year in Asia Pacific, in part due to the sheer weight of capital hunting for commercial real estate, where portfolio under-allocation is at its most severe level in seven years.

Asian institutions may have to deploy 34% more capital into real estate to meet the 11.5% target of actual allocation to real estate in their portfolios, data from JLL shows.

“With record amounts of dry powder and an expanding appetite, we expect increased momentum in 2022 and remain steadfast in our view that investment volumes will cross the US$200 billion mark this year,” says Regina Lim, Head, Capital Markets, Asia Pacific, JLL.

She expects more platform deals — such as ESR’s US$692 million acquisition in February of a prime logistics and industrial portfolio in Greater Shanghai, China — as investors seek exposure to income-producing assets.

Logistics spotlight

When it comes to investment volumes, JLL’s Asia Pacific Capital Tracker 4Q21 shows logistics is leading the pack. The sector saw a fourfold rise in total capital deployed over the past two years.

Investors’ interest in logistics — combined with the recovery across the office, retail, and hotel sectors — drove a 26% surge in Asia Pacific’s commercial real estate market last year, with direct investments reaching US$177 billion.

“The funds raised for logistics investments in 2021 were up 75% year on year and will have to be deployed in the next two to three years,” says Lim during an interview with CNA. “There is still strong investor interest in the sector, partly because of the robust rental growth and the heightened awareness for portfolio diversification both geographically and across sectors.”

Most investors believe transaction volumes will rise further in 2022, with at least 50% showing a preference for larger assets, according to results from a JLL survey.

“Investors want more exposure to Asia Pacific real estate to take advantage of attractive returns from the sector and are willing to undertake more innovative deals to diversify portfolios,” says Lim.