Despite continued challenges due to the Delta variant, many countries around the world, thanks to successful vaccination programs, have started to relax travel restrictions and social distancing requirements.

Despite continued challenges due to the Delta variant, many countries around the world, thanks to successful vaccination programs, have started to relax travel restrictions and social distancing requirements.

As a result, more travelers can now explore beyond their locality. But, as restrictions have relaxed and different parts of the world have become more accessible, what changes can be seen in consumer accommodation preferences?

To answer this and other questions as COVID-19 continues to disrupt travel, STR’s Tourism Consumer Insights team has kept a close eye on tourism trends throughout the pandemic.

In this recent wave of research, conducted using our Traveler Panel, STR sought to find out if the accommodation preference changes seen in previous research were still evident, despite significant vaccination progress in many countries.

Same, same but slightly different

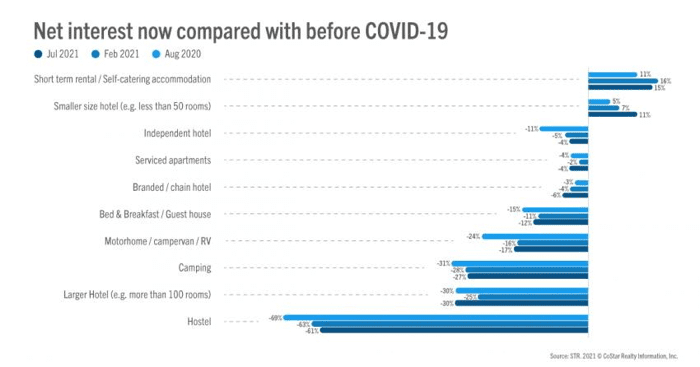

The most recent findings show a familiar picture compared with our previous research. Many accommodation types were still perceived more negatively compared with before the pandemic.

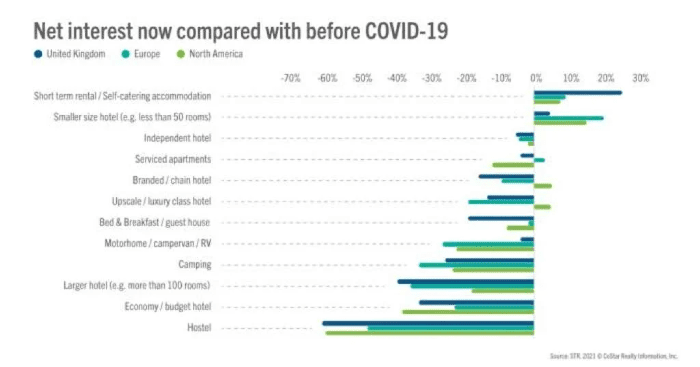

Smaller types of accommodation continue to attract more interest as consumers adapt to living in a COVID-19 world. In July 2021, traveler interest in short-term rentals was 15% above the pre-pandemic level of interest.

Consistent with previous research, hotels with less than 50 rooms also recorded higher interest compared with before the pandemic. Indeed, the trend shows increasing interest in this form of accommodation which is likely due to improved confidence in hotels as many brands have implemented elevated cleaning and other COVID-safe protocols.

Meanwhile, at the other end of the scale, hostels continue to suffer more than other types of accommodation. Some six in 10 travelers said that they were less interested in staying at a hostel now compared with before the pandemic. While this is a difficult reading for the sector, it was an improved result compared with previous findings which again suggests that there is growing confidence in the accommodation sector.

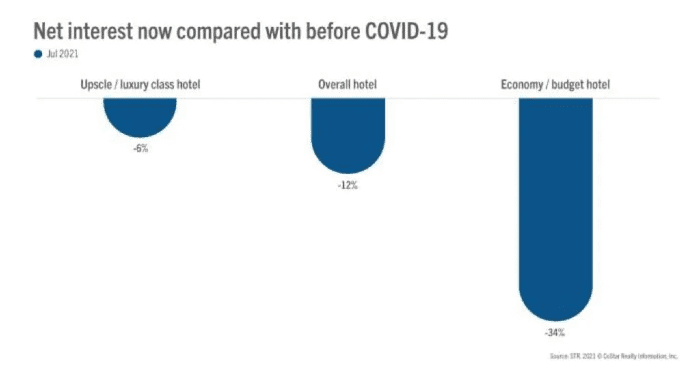

Luxury versus economy divide

Consumers were also asked for their views on different classes of hotel accommodation. Overall, travelers are still less interested in staying at hotels now than compared with before the pandemic. Interestingly, economy and budget hotels were perceived significantly more negatively than upscale and luxury hotels in the current environment. This is likely due to factors including perceptions of cleanliness and property size associations. It will be interesting to monitor how the recovery unfolds for these hotel classes as demand grows.

Cultural preferences examined

In our previous research, we learned that British travelers were less keen to stay in hotels compared with other travelers, favoring self-contained accommodation instead. North Americans were more likely to be interested in branded accommodation than other nationalities. Meanwhile, Europeans preferred smaller accommodation, such as smaller hotels, and bed and breakfasts. These findings and the overall trends previously seen, remain true in our latest survey.

However, there is evidence that views have shifted slightly since our last study in February 2021. North Americans were less interested in almost all forms of accommodation in our latest survey. Meanwhile, the opposite trend could be seen among Brits as they were more interested in almost every category in July 2021 compared with our February 2021 research. These findings are likely a reflection of the different stages of progression and impact of the Delta variant in the regions.

The only exceptions were an increase in interest for smaller sized hotels and decreasing interest in larger hotels among all respondent groups compared with the February 2021 research. These findings highlight that while the impact of new infections shifts sentiment toward accommodation in different countries, new preferences are being established as consumers respond to living with the virus.

New normal or continued pandemic mindset?

Our research findings pose an interesting question: is this a new normal of accommodation preferences or are the challenges posed by the Delta variant resulting in a continued pandemic-mindset in which consumers prioritize efforts to minimize their risk of infection?

In a forthcoming blog, we will examine the changing expectations of travelers at this time which enables a deeper understanding of attitudes to COVID-19 alongside growing vaccination rates and expanding travel options.

Continuing to reassure guests about COVID-safe measures will help to encourage travel at a time when lingering anxieties about the virus remain. Effective marketing will be another important component to enable the recovery of the accommodation industry. The current evidence shows that some sectors may have to be more inventive and creative than others in luring back customers.