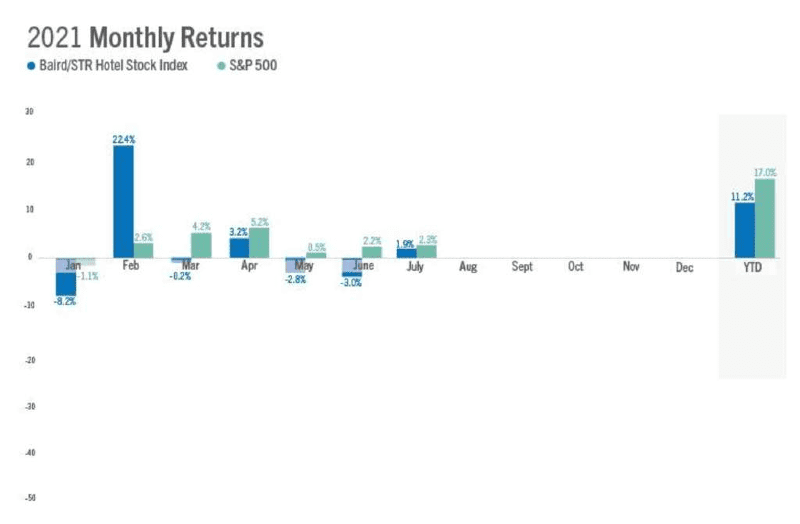

The Baird/STR Hotel Stock Index rose 1.9% in July to a level of 5,086. Year to date through the first seven months of 2021, the stock index was up 11.2%.

The Baird/STR Hotel Stock Index rose 1.9% in July to a level of 5,086. Year to date through the first seven months of 2021, the stock index was up 11.2%.

“Hotel stocks were positive but the performance was mixed in July with the hotel brands significantly outperforming the hotel REITs,” said Michael Bellisario, senior hotel research analyst, and director at Baird. “While second-quarter earnings so far have exceeded expectations, investors appear to be focused on the potential impact of the Delta variant domestically, how business travel might unfold post-Labor Day and broader macroeconomic growth concerns. Sentiment toward the global and domestic recoveries appears to have normalized a bit in July, which we believe explains the large divergence in stock price performance between the hotel brands and hotel REITs last month.”

“Preliminary U.S. performance data for July points to the continued surge in summer leisure travel, although there was some slowing in demand late in the month, which falls in line with historical trends,” said Amanda Hite, STR President. “At the same time, room rates are at an all-time high on a nominal basis. Outsized leisure travel is driving a demand disparity between strong weekends and softer weekdays, which is a cause for concern as the summer travel season nears its end. The sharp rise in the Delta variant will likely put a damper on the expected business travel rebound post-Labor Day. Also, as more states and markets reinstate mask mandates, and the total cost of travel continues to increase, it is possible that corporate travel managers push business travel back to the early part of 2022.”

In July, the Baird/STR Hotel Stock Index fell behind both the S&P 500 (+2.3%) and the MSCI US REIT Index (+4.7%).

The Hotel Brand sub-index increased 5.6% from June to 8,993, while the Hotel REIT sub-index dropped 8.0% to 1,191.

About the Baird/STR Hotel Stock Index and Sub-Indices

The Baird/STR Hotel Stock Index was set to equal 1,000 on 1 January 2000. Last cycle, the Index peaked at 3,178 on 5 July 2007. The Index’s low point occurred on 6 March 2009 when it dropped to 573.

The Hotel Brand sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 3,407 on 5 July 2007. The sub-index’s low point occurred on 6 March 2009 when it dropped to 722.

The Hotel REIT sub-index was set to equal 1,000 on 1 January 2000. Last cycle, the sub-index peaked at 2,555 on 2 February 2007. The sub-index’s low point occurred on 5 March 2009 when it dropped to 298.

The Baird/STR Hotel Stock Index and sub-indices are available exclusively on Hotel News Now. The indices are cobranded and were created by Robert W. Baird & Co. (Baird) and STR. The market-cap-weighted, price-only indices comprise 20 of the largest market-capitalization hotel companies publicly traded on a U.S. exchange and attempt to characterize the performance of hotel stocks. The Index and sub-indices are maintained by Baird and hosted on Hotel News Now, are not actively managed, and no direct investment can be made in them.

As of 31 July 2021, the companies that comprised the Baird/STR Hotel Stock Index included: Apple Hospitality REIT, Ashford Hospitality Trust, Chatham Lodging Trust, Choice Hotels International, DiamondRock Hospitality Company, Hersha Hospitality Trust, Hilton Inc., Host Hotels & Resorts, Hyatt Hotels, InterContinental Hotels Group, Marriott International, Park Hotels & Resorts, Inc., Pebblebrook Hotel Trust, RLJ Lodging Trust, Ryman Hospitality Properties, Service Properties Trust, Summit Hotel Properties, Sunstone Hotel Investors, Wyndham Hotels & Resorts, and Xenia Hotels & Resorts.

This communication is not a call to action to engage in a securities transaction and has not been individually tailored to a specific client or targeted group of clients. Research reports on the companies identified in this communication are provided by Robert W. Baird & Co. Incorporated and are available to clients through their Baird Financial Advisor. This communication does not provide recipients with information or advice that is sufficient on which to base an investment decision. This communication does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this communication as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this release.

About Baird

Putting clients first since 1919, Baird is an employee-owned, international wealth management, asset management, investment banking/capital markets, and private equity firm with offices in the United States, Europe, and Asia. Baird has approximately 4,500 associates serving the needs of individual, corporate, institutional, and municipal clients and more than $350 billion in client assets as of December 31, 2020. Committed to being a great workplace, Baird ranked No. 32 on the 2021 Fortune 100 Best Companies to Work For® list. Baird is the marketing name of Baird Financial Group. Baird’s principal operating subsidiaries are Robert W. Baird & Co. Incorporated in the United States and Robert W. Baird Group Ltd. in Europe. Baird also has an operating subsidiary in Asia supporting Baird’s investment banking and private equity operations. For more information, please visit Baird’s website at www.rwbaird.com.