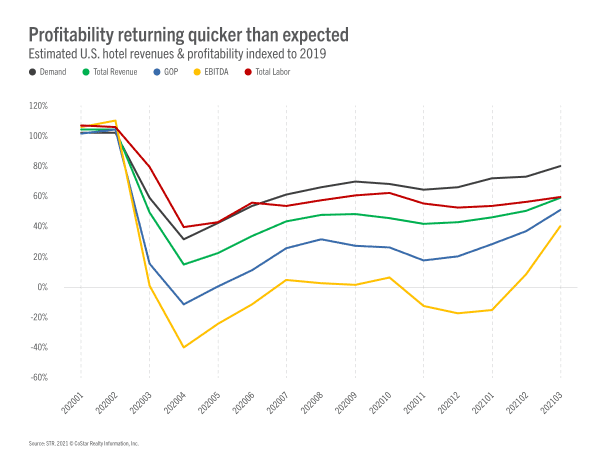

Gross operating profit for U.S. hotels reached 50% of the comparable 2019 level, according to STR‘s March 2021 monthly P&L data release.

Gross operating profit for U.S. hotels reached 50% of the comparable 2019 level, according to STR‘s March 2021 monthly P&L data release.

GOPPAR, TRevPAR and EBITDA per available room came in higher than any month since February 2020.

- GOPPAR: US$26.79

- TRevPAR: US$86.61

- EBITDA PAR: US$12.77

- LPAR (Labor Costs): US$27.66

Amid hiring difficulties, total labor costs were just 60% of the figure reported for March 2019.

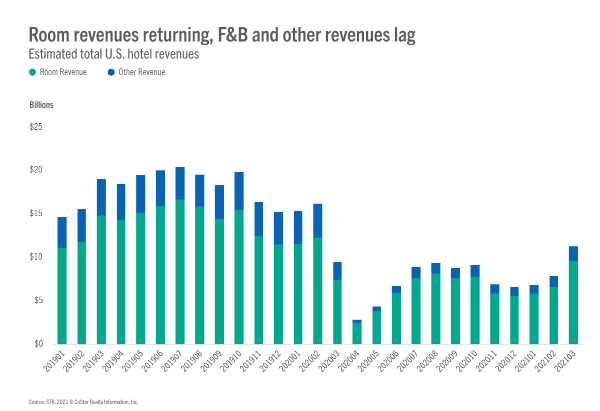

“We have seen continued improvement in room revenue, but with little coming in from F&B and other departments, industry TrevPAR is not gaining as much steam,” said Raquel Ortiz, STR’s assistant director of financial performance. “At the same time, however, the lack of F&B expenses is allowing profit margins to grow closer to normal. Though other revenues are up compared with recent months, we don’t expect to see a significant boost in those numbers until group demand resurfaces.

“Fortunately, not all hotels are struggling. Hotels with enough demand to achieve occupancy levels above 50% have been able to turn a profit. This is especially true for the limited-service segment, where 68% of hotels have remained profitable. These margins are of course at reduced operations in a lot of cases, so some full-service hotels are operating more like limited-service with far less F&B offerings, and some limited-service hotels are operating like extended-stay properties with less daily room cleanings. Overall, profitability is recovering at a slightly quicker pace than anticipated, although the industry has a long way to go.”

Key profitability metrics:

TRevPAR – Total revenue per available room

GOPPAR – Gross operating profit per available room

EBITDA – Earnings before interest, income tax, depreciation, and amortization

LPAR – Total labor costs per available room