Despite the challenges brought on by COVID-19, there are promising signs in consumer spending – including hard-hit sectors like travel, according to Mastercard Recovery Insights.

Mastercard released Recovery Insights: Travel Check-In, the second report in its series focused on the impacts of the pandemic, including emerging trends in travel spending.

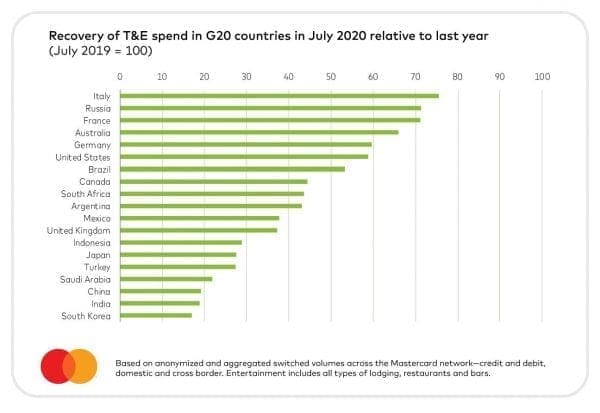

In particular, the analysis of anonymized and aggregated sales activity across the Mastercard network, including in-person and online transactions, shows that Italy, Russia and France are leading in terms of the recovery of travel and entertainment spending across the G20. This includes travel sectors such as airlines and lodging as well as activities such as eating out. Despite being a focus of the pandemic earlier this year, Italy’s significant restaurant culture and extensive domestic tourism industry have helped it to bounce back faster than other markets, including the U.S, Brazil and India.

As the broader global economy begins to show signs of improvement, a number of trends have emerged that mirror overall consumer spending—in particular the shift to a smaller retail radius as consumers travel and spend closer to home.

“There’s no doubt that people love to travel. What we’re seeing, though, is that how they’re traveling has adapted during this time. Gas spending, restaurant spending, bike rental spending – all are improving, showing that the rebound is happening but is focused on local travel and local spending. In other words for those of us in the U.S., the great American road trip has returned in a new way,” says Steve Sadove, Mastercard senior advisor and former CEO of Saks.

Overall key trends spotlighted in Mastercard Recovery Insights: Travel Check-In, according to the analysis of anonymized and aggregated sales activity across the Mastercard network, include:

- Localism Takes Off: In Q2 2020, auto rental’s share of total transportation spending nearly doubled from 9% in 2019 to 17% as consumers prioritized local means of transport. In Switzerland and Germany, for instance, non-air travel made up roughly three-quarters of travel spending the week ending August 7. This tendency to travel closer to home has also driven the trajectory of rentals of micro-mobility solutions (e.g., scooters, bicycles) in countries like the U.S., where they surpassed 2019 levels at the end of July. The rebound of gas spending this summer also speaks to consumers getting out and spending but maintaining a tighter footprint.

- Boutique is Chic: Our analysis shows that travelers are increasingly opting to stay small. Recently, the global recovery rate of small independent hotels has outpaced the recovery of large hotels by over 50%.

- Consumer Travel Leads the Recovery: An analysis of consumer cards compared to business cards shows that spending on consumer air travel and auto rentals is returning ahead of commercial travel.

When looking at U.S. retail sales more broadly, there is also a rebound in spending. According to Mastercard SpendingPulse*, which tracks overall retail sales across all payment types including cash and check, retail sales ex. auto were down just -3 percent for the summer (June 1-August 15) compared to the same time last year. And, total U.S. travel & entertainment retail sales, including airlines, lodging and restaurants, improved in July (-21.5% year over year) compared to June (-25.9%), according to SpendingPulse.

Mastercard has been committed to helping retailers, restaurants, CPG brands and many others navigate the challenges of the pandemic – and now the recovery. This has included making certain insight-driven tools available at no cost to governments and small businesses to give a timely snapshot of economic performance during this time. Having the ability to make informed decisions is critical to the long-term success of companies, communities and individuals around the world.

*About Mastercard SpendingPulse

Mastercard SpendingPulse reports on national retail sales across all payment types in select markets around the world. The findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check. As such, SpendingPulse™ insights do not in any way contain, reflect or relate to actual Mastercard operational or financial performance, or specific payment-card-issuer data.

About Mastercard Recovery Insights

Mastercard launched Recovery Insights to help businesses and governments better manage the health, safety and economic risks presented by COVID-19. The initiative draws on Mastercard’s analytics and experimentation platforms, its longstanding consulting practice and unique data-driven insights to deliver relevant and timely tools, innovation and research.

About Mastercard

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.