After facing the lowest occupancy levels since the 1930s and the greatest declines in revenues and profits ever experienced in the second quarter, the U.S. hotel industry is poised to begin a multiyear recovery in the third quarter.

According to Kalibri Labs, the number of room nights occupied in U.S. hotels during the second quarter was 60 percent less than a year earlier. With such a dramatic decline in demand, the national occupancy level for the quarter was just 28.3 percent. It is estimated that 15 percent of U.S. hotels were forced to close for some portion of the three-month period.

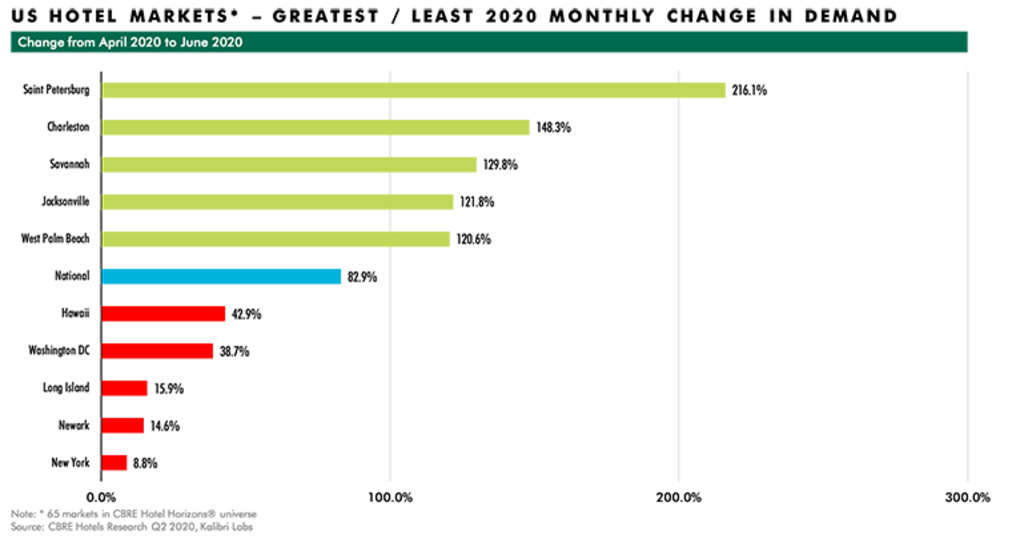

“Fortunately for U.S. hoteliers, indicators of market recovery began to emerge during the quarter. After bottoming out in April, lodging demand increased 83 percent in May and June,” said Jamie Lane, Senior Director of CBRE Hotels Research. “This mini surge in demand was fueled by leisure travelers looking to escape the bonds of home quarantine for safe and healthy rural and resort destinations.”

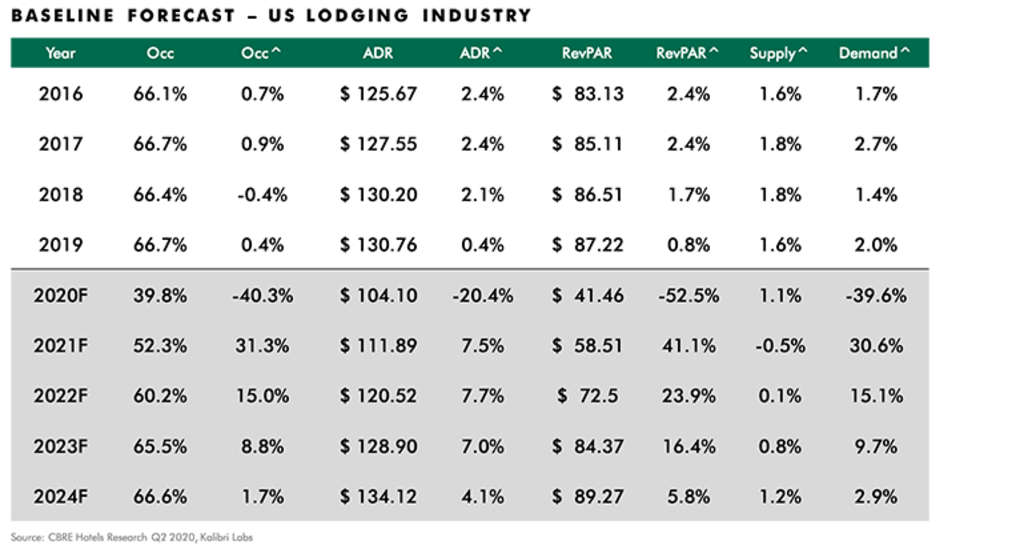

Beyond last quarter’s nadir, CBRE Hotels Research is forecasting continued improvement in U.S. lodging performance through the remainder of the year and beyond. According to the Q2 2020 edition of Hotel Horizons®, U.S. hotel occupancy should average 39.8 percent, along with an average daily rate (ADR) of $104.10 for 2020. The net result is an annual RevPAR level of $41.46, which is 52.5 percent less than the $87.22 RevPAR posted for 2019.

“U.S. lodging demand is forecast to increase by a compound annual growth rate of 14.1 percent over the next four years, recovering to 2019 levels by Q3 2023,” said Mr. Lane.

Recovery patterns vary by chain-scale. Occupied room nights for hotels in the upper-midscale segment are projected to return to 2019 levels in 2022, while luxury and upper-upscale demand will lag until 2024.

“Economic, social and operational factors influence demand recovery,” said Bram Gallagher, Senior Economist with CBRE Hotels Research. “In the past quarter we observed geographically staggered rates of infection throughout the U.S. Therefore, CBRE forecasts an economic cycle shallower than initially anticipated, followed by a longer recovery. In turn, this has extended our forecast of recovery in lodging demand to 2023 from 2022.”

New Data Provider, New Insights

Starting this quarter, CBRE entered into an agreement with Kalibri Labs to provide historical lodging performance data to underpin its Hotel Horizons® econometric forecasting model. As of June, Kalibri Labs collects daily transactional booking data from approximately 34,500 hotels offering more than 3 million guest rooms across the U.S. With this partnership, CBRE gains insights into how guests book their hotel rooms, the lead time for making their reservation, the length of time they stayed in the hotel, and the costs associated with all bookings. The Kalibri Labs data set also enables CBRE to more clearly demonstrate the disparities by market, so critical in a post-COVID world.

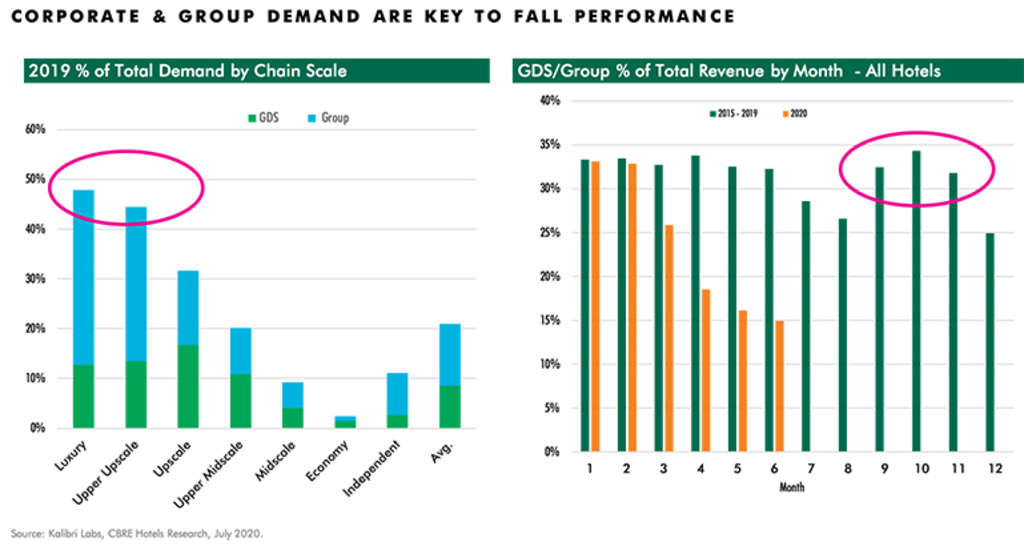

“The Kalibri Labs data has been extremely useful in 2020 as we attempt to understand the real impact of the COVID-19 virus on travel patterns. For example, the global distribution system (GDS) and group booking channel information lets us make assumptions regarding the pace of recovery for markets and segments that are dependent on corporate and group demand,” Mr. Lane said.

Cindy Estis Green, CEO of Kalibri Labs, said, “Even before COVID, the operating environment had become more complex and more expensive as the booking process has moved online and the data is now available to illustrate the segments and channels that comprise demand along with their costs. Key market drivers can be clearly defined and as a result, CBRE’s important projections for the future can be considerably more refined and accurate.”

The Q2 2020 edition of Hotel Horizons® for the U.S. lodging industry and 65 major markets can be purchased by visiting: https://pip.cbrehotels.com. To view CBRE Hotels’ latest analysis of the impact of COVID-19 on the lodging industry, please visit:

https://www.cbrehotels.com/en/global/covid-19.

About CBRE Hotels

CBRE Group, Inc. (NYSE: CBRE), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (based on 2019 revenue). The company has more than 100,000 employees (excluding affiliates) and serves real estate investors and occupiers through more than 530 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.