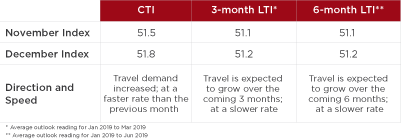

Travel to and within the U.S. grew 3.6 percent year-over-year in December, according to the U.S. Travel Association’s latest Travel Trends Index (TTI)—marking the industry’s 108th straight month of overall expansion.

Travel to and within the U.S. grew 3.6 percent year-over-year in December, according to the U.S. Travel Association’s latest Travel Trends Index (TTI)—marking the industry’s 108th straight month of overall expansion.

The growth trend is tempered by concerning signs in the lucrative international inbound market, however. That segment grew at a rate of 2.8 percent in December—well off November’s hot pace of 3.8 percent growth year-over-year. Worse, the deceleration trend is expected to continue, with the Leading Travel Index (LTI) projecting international inbound travel to slow to 2.0 percent through June 2019.

“A projected global economic cooling and persistent trade tensions will continue to threaten international inbound travel growth,” said U.S. Travel Senior Vice President for Research David Huether. “The expected softening of the dollar and the de-escalation of the U.S.-China trade conflict should be positives for the international segment, but the market will not be able to fully capitalize on those advantages without some help.”

Huether pointed to the long-term renewal of Brand USA and the enhancement and expansion of the Visa Waiver Program (VWP) as two legislative initiatives that could help the U.S. regain its share of the global long-haul travel market in the face of increasing competition for international travelers. Timely reauthorization of Brand USA by Congress is critical to helping turn this trend around, as is the inclusion of additional qualified countries in the VWP.

The TTI’s bright spot is the strength of domestic travel: domestic leisure travel registered 4.0 percent growth in December, while the business segment increased by a more modest 2.6 percent.

Domestic travel overall is projected to expand 2.6 percent over the next six months—breaking down to 3.4 percent growth in domestic business travel and 2.2 percent growth in domestic leisure travel for that time period.

The TTI is prepared for U.S. Travel by the research firm Oxford Economics. The TTI is based on public and private sector source data which are subject to revision by the source agency. The TTI draws from: advance search and bookings data from ADARA and nSight; airline bookings data from the Airlines Reporting Corporation (ARC); IATA, OAG and other tabulations of international inbound travel to the U.S.; and hotel room demand data from STR.

Click here to read the full report.