Let’s not forget that price is only one element in the marketing mix so it should not be insulated from the other variables when making pricing decisions.

Benson P. Shapiro, a well-known authority on marketing strategy has said: ‘’There are three degrees of interaction in the marketing mix: consistency, integration, and leverage. Consistency refers to the fit between two or more of the marketing-mix. Integration refers to an active, harmonious interaction among the elements. Leverage is the use of each element to the best advantage of the overall marketing mix.” In other words, when making pricing decisions, hotel operators need to embrace and understand their organisation’s products and services, as well as all the factors that might impact their rates’ propositions.

In effect, in a fast changing global economy, the key to an effective revenue management strategy is to adopt a systematic approach to pricing. On one hand it should establish rates that are consistent, harmonious, and supportive to the overall marketing mix. On the other hand it should assess consumers’ price sensitivity and monitor the effect of external environmental factors.

Factors that Influence Pricing Decisions in Today’s Global Market Place

Price is the firm’s tool for capturing value, and it affects to a great extent the wealth of the hotel and its patrons; it is dictated by several elements:

1. Marketing Mix

The marketing activities also referred to as the marketing mix or the 4ps have a direct impact on price. Yet in a recent study consumers are found to be more motivated to choose hotels that offer the lowest rates. Certainly, travel shoppers would prefer paying less. De facto, paying nothing at all might be their first choice! But it is simply not logical to accommodate travellers for free! The organisation will simply vanish. Further, it is not in the best interests for the company nor the consumer that the company’s products and services cease to exist.

The marketing mix includes but is not limited to: Product-Service, Presentation, Communication, and Distribution.

- Product- Service: This includes both tangible and intangible elements: for instance, it includes room, service, food but also greetings and smiles. How much could you charge your customers for your products and services knowing that despite managements continuous efforts, half the patrons’ complaints are caused by poor customer service? Further, typically in the hospitality business, there are bound to be conflicts between those responsible for managing revenues, sales and marketing and those with operational responsibilities. Travel shoppers could share hundreds of stories about 5-star hotels that were worth two-stars and others that were utterly different from what they have seen in the brochures. In effect, marketers and revenue managers have to view the product-service from a customer perspective when making pricing decisions. That is, everything that they attempt to do has to be targeted towards increasing revenues but also to make consumers repeat their purchase again and again!

- Presentation: The presentation refers to the physical location of the hotel, the atmosphere and so on. Typically a downtown hotel’s rates are higher than a hotel located in the suburbs

- Communication: It involves all forms of communication between the hotel and its customers. Communications’ channels impact pricing just like any other marketing mix variable does; for instance, the brand’s website could be used as a cost effective alternative channel to communicate the hotel’s best available rates, special promotions and events.

- Distribution: The evolutionary path from manual systems to the Global Distribution Systems (GDS)-based systems then to the online distribution systems enabled by the Internet has created massive opportunities for hotel operators to move their unsold inventory across these channels. One of the most important aspects of this fairly new distribution channel that revenue managers can get, is not just the visibility and how consumers perceive the brand’s products and services, but also greater visibility of how they perceive the competitors’ products and services.

2. The competition

Dealing with the competition when making pricing decisions is the nemesis of many revenue managers. Indeed, the online sphere created new opportunities for hotel operators to attract more customers. Yet, from another perspective, travel review websites and online travel agencies (OTAs) created a holistic outlook of the hotel industry in terms of rating. By this I mean rates as well as value – a position that was not possible previously. Now, it takes a couple of clicks to find out the competition’s best available rates, and to figure out why the neighbouring hotel is generating more sales, even though the compared properties belong to the same category and are selling at the same price.

In today’s hyper-competitive global market, some hotels tend to undertake aggressive battles over room rates. In a difficult economy, some 5-star hotels try to attract guests who would normally stay in 4-star hotels; 4-star hotels poach from 3-star hotels, and so on. In effect, there is no magic solution that revenue managers could use in this case, but the answer lies in data analysis. Using information from the company, as well as from the competition, hotel operators can determine the point at which a particular price adjustment will yield the most revenue.

3. Technology and Social Media

Travel shoppers are moving to mobile technologies at an amazing speed. According to the 2012 Social Media report by Nielsen, time spent on mobile apps and the mobile web account for 63% of the year-over-year growth in overall time using the Internet. On top of that consumers are increasingly looking to new devices to connect on the go. Travellers are posting, sharing, and writing reviews almost instantly. The real big challenge for revenue managers here is to be able to collect and make use of this overflow of data and information to better serve their organisations’ and its patrons. By exploiting the data that comes from social media and review websites, revenue managers will be able to understand why something is occurring? What are the opportunities presented? And what might be the future trends to account for?

Embracing new technologies and platforms will not only give the organisation a competitive advantage but will also provide services and facilities that satisfy ‘today’s consumers’, expand the company’s revenues and allow to effectively control distribution costs to provide a reasonable return on investment.

Going forward, in a recent report by the centre for hospitality research entitled The Impact of Social Media on Lodging Performance, Professor Kris Anderson from Cornell University argues that user generated content UGC will not only impact sales but also rates and RevPar: In fact, If a hotel increases its review score by 1 point on a 5-point scale, then the hotel can increase its price by 11.2% and still maintain the same occupancy or market share, also a 1% increase in a hotel’s online reputation score generates a 0.89% increase in price as measured by the hotel’s average daily rate.

4. The economy

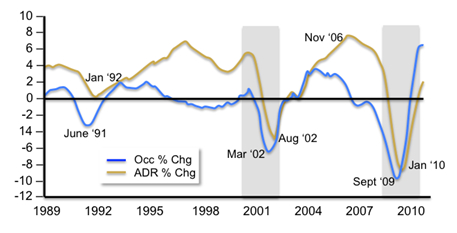

I hate to sound like a broken record but when the competitive environment changes significantly due to a slowdown in the business cycle or a major tragic event, the first thing that some hotel operators think of is cutting prices thus hoping to generate more business. The chart Below from Smith Travel Research shows hotels’ Occupancy and Average Daily Rate (ADR) changes over the past 20 years.

As the charts indicates, the hotel industry went through two distinct dips in terms of occupancy levels and ADR over the past 20 years; the first one was in 2001 (following the attacks of

September 11) and the second was in 2008 (following the global economic downturn).

Beginning in 2001, during the months that followed the attacks, travel activities dropped, and demand fell by close to 10%. Over the next year, hotels reacted by reducing their rates – but with little response in demand. Again in 2008, demand dropped by close to 15%. ADR dropped even further than it has in 2002, and RevPar plunged. Hoteliers adopted a cut-price strategy; the result however was almost the same as in 2002.

The lesson that hotel operators should have learnt from 9/11 is that rate reductions do not necessarily create demand. Further, travel demand takes time to return sometimes, and ‘’spray and pray” strategies in pricing will not certainly accelerate the pace.

Source: Eye for Travel