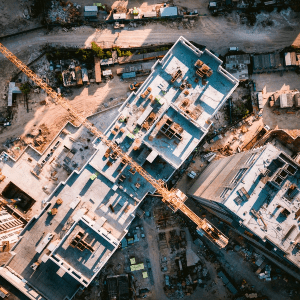

According to the Q4 2022 Construction Pipeline Trend Report for the Asia Pacific region, excluding China, from Lodging Econometrics (LE), the region’s total construction pipeline stands at 1,903 projects/404,222 rooms, up 5% by projects and 2% by rooms year-over-year (YOY). At the Q4 close, projects currently under construction stand at 946 projects/210,559 rooms, up 5% by projects YOY. Projects scheduled to start construction in the next 12 months stand at 317 projects/65,745 rooms. Projects in early planning reached a record count at Q4, closing the quarter at 640 projects/127,918 rooms, up 20% by projects and 14% by rooms YOY. The luxury, upper upscale, and upscale chain scales each hit peak project counts at the end of Q4. Five countries in the Asia Pacific region, excluding China, account for 61% of projects in the region’s total pipeline. The countries with the largest pipelines in Asia Pacific, excluding China, at the close of the third quarter are led by India with 383 projects/47,539 rooms. Next is Vietnam, with 240 projects/88,858 rooms, then Indonesia, with 227 projects/37,319 rooms. These countries are followed by Thailand with 167 projects/40,409 rooms and then Japan with 150 projects/31,368 rooms. At the close of the fourth quarter, cities in the Asia Pacific region, excluding China, with the largest construction pipelines are led by Bangkok, Thailand with 66 projects/17,116 rooms. Next is Seoul, South Korea, with 63 projects/13,075 rooms, and Jakarta, Indonesia, with 49 projects/9,500 rooms. Kuala Lumpur, Malaysia follows with 45 projects/12,953 rooms, and then Phuket, Thailand with 32 projects/8,049 rooms. The top franchise companies, accounting for 46% of guest rooms in the total construction pipeline at Q4 2022, are Marriott International with 281 projects/60,469 rooms, Accor with 215 projects/47,544 rooms, InterContinental Hotels Group (IHG) with 158 projects/33,475 rooms, Wyndham Worldwide follows with 125 projects/31,139 rooms, then Hilton Worldwide with 91 projects/21,336 rooms. The largest brands in the pipeline for each of these companies are Marriott International’s Courtyard brand, with record project and room counts of 41 projects/8,750 rooms, and Marriott Hotel, also reaching record project and room counts at Q4 with 36 projects/9,290 rooms; Accor’s Novotel brand with 52 projects/10,623 rooms and Mercure Hotel with 30 projects/8,236 rooms; IHG’s Holiday Inn with 47 projects/10,130 rooms and Holiday Inn Express with 27 projects/4,571 rooms; Wyndham Hotels & Resorts’ Ramada Inn brand with 51 projects/7,409 rooms and its Wyndham Hotel brand with 35 projects/13,618 rooms; and Hilton’s Hotel & Resort brand with 31 projects/8,643 rooms and Doubletree by Hilton with 27 projects/5,553 rooms. The Asia Pacific region, outside of China, opened 318 new hotels with 58,961 rooms through the close of the fourth quarter of 2022. The LE forecast for new hotel openings expects 370 new hotels/72,441 rooms to open in 2023 and 400 new hotels with 77,524 rooms forecast to open in 2024.

the region’s total construction pipeline stands at 1,903 projects/404,222 rooms, up 5% by projects and 2% by rooms year-over-year (YOY). At the Q4 close, projects currently under construction stand at 946 projects/210,559 rooms, up 5% by projects YOY. Projects scheduled to start construction in the next 12 months stand at 317 projects/65,745 rooms. Projects in early planning reached a record count at Q4, closing the quarter at 640 projects/127,918 rooms, up 20% by projects and 14% by rooms YOY. The luxury, upper upscale, and upscale chain scales each hit peak project counts at the end of Q4. Five countries in the Asia Pacific region, excluding China, account for 61% of projects in the region’s total pipeline. The countries with the largest pipelines in Asia Pacific, excluding China, at the close of the third quarter are led by India with 383 projects/47,539 rooms. Next is Vietnam, with 240 projects/88,858 rooms, then Indonesia, with 227 projects/37,319 rooms. These countries are followed by Thailand with 167 projects/40,409 rooms and then Japan with 150 projects/31,368 rooms. At the close of the fourth quarter, cities in the Asia Pacific region, excluding China, with the largest construction pipelines are led by Bangkok, Thailand with 66 projects/17,116 rooms. Next is Seoul, South Korea, with 63 projects/13,075 rooms, and Jakarta, Indonesia, with 49 projects/9,500 rooms. Kuala Lumpur, Malaysia follows with 45 projects/12,953 rooms, and then Phuket, Thailand with 32 projects/8,049 rooms. The top franchise companies, accounting for 46% of guest rooms in the total construction pipeline at Q4 2022, are Marriott International with 281 projects/60,469 rooms, Accor with 215 projects/47,544 rooms, InterContinental Hotels Group (IHG) with 158 projects/33,475 rooms, Wyndham Worldwide follows with 125 projects/31,139 rooms, then Hilton Worldwide with 91 projects/21,336 rooms. The largest brands in the pipeline for each of these companies are Marriott International’s Courtyard brand, with record project and room counts of 41 projects/8,750 rooms, and Marriott Hotel, also reaching record project and room counts at Q4 with 36 projects/9,290 rooms; Accor’s Novotel brand with 52 projects/10,623 rooms and Mercure Hotel with 30 projects/8,236 rooms; IHG’s Holiday Inn with 47 projects/10,130 rooms and Holiday Inn Express with 27 projects/4,571 rooms; Wyndham Hotels & Resorts’ Ramada Inn brand with 51 projects/7,409 rooms and its Wyndham Hotel brand with 35 projects/13,618 rooms; and Hilton’s Hotel & Resort brand with 31 projects/8,643 rooms and Doubletree by Hilton with 27 projects/5,553 rooms. The Asia Pacific region, outside of China, opened 318 new hotels with 58,961 rooms through the close of the fourth quarter of 2022. The LE forecast for new hotel openings expects 370 new hotels/72,441 rooms to open in 2023 and 400 new hotels with 77,524 rooms forecast to open in 2024.

Top three chain scales in the AP Hotel Construction Pipeline, excluding China, each hit peak project counts at the end of Q4

Tags: AP Hotel, construction pipeline, end of Q4, excluding China, Project Counts, three chain scales

Media,

Related Articles

Related Courses

You might also like:

Join over 60,000 industry leaders.

Receive daily leadership insights and stay ahead of the competition.

Leading solution providers: