This year’s NCAA men’s basketball Final Four championship held in New Orleans over the first weekend in April was an exceptional windfall to area hotels.

This year’s NCAA men’s basketball Final Four championship held in New Orleans over the first weekend in April was an exceptional windfall to area hotels.

STR, CoStar’s hospitality analytics firm, recently took an historic look at the revenue impacts of the NCAA men’s basketball Final Four championship on its host markets.

This follow-up analysis expands on our initial look at total market revenue gains to include more key market indicators as well as examine how event impacts dispersed across the market. Baseline indicators were established by using a seasonal average of the market’s performance from the two surrounding non-tournament weekends. Baseline dates excluded nontypical travel calendar events to New Orleans such as Mardi Gras or Easter week.

The men’s Final Four took place in downtown’s Caesars Superdome and began with two Saturday playoff games (Duke University vs. University of North Carolina and Villanova vs. top-seed University of Kansas) followed by a Sunday break, and then wrapped with Monday’s night’s championship game. Ultimately, the Kansas Jayhawks defeated the UNC Tarheels, 72-69, in an unprecedented second half comeback.

The 71,000 weekend ticket holders also had a major impact on the New Orleans hotel market of 42,000 total rooms, particularly within the New Orleans central business district, which includes the French Quarter and roughly 27,000 submarket hotel rooms.

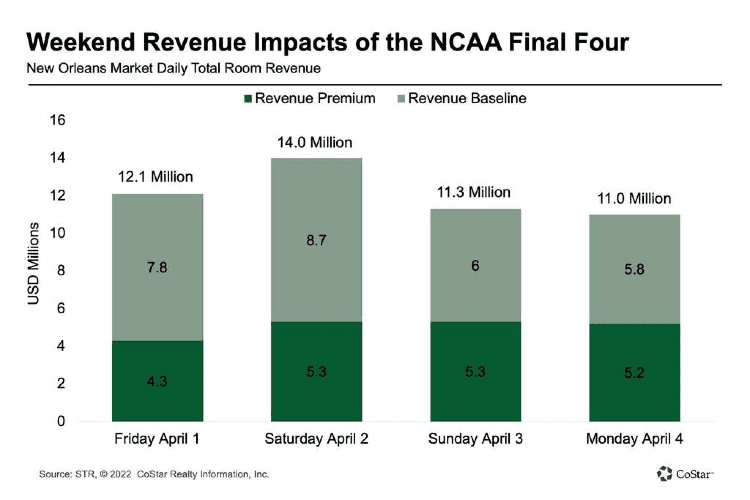

New Orleans hotels generated a record total $48.3 million dollars in room revenues for the extended four-day weekend, a 5% margin over the next best Final Four year which occurred in Fort Worth/Arlington/Dallas (a combination of two STR markets) in 2014.

To add further context, this year’s tournament weekend had total room revenue that was 48% higher than the last time that New Orleans hosted this event in 2012 ($32.7 million dollars inflation adjusted). Collectively, the entire New Orleans hospitality market collected $20.1 million in extra room revenues over its seasonal base levels, revenue premiums that were 71% higher than seasonal expectations.

There are two other interesting patterns in the revenue gains in the New Orleans’ Final Four. First, the daily premiums are surprisingly consistent (and high) day-to-day over the event, ranging from a premium of $4.3 million on the Friday before the Saturday tipoff to $5.2 million dollars on the Monday night of the championship. The NFL’s Super Bowl, for example, more typically has a steep pattern of increasing market returns through game day. The Final Four has multi-day staying power in terms of potential revenue.

A second pattern relates to how strong the market payoffs were on the Sunday (with no game) as well as Monday. Perhaps this is a result of the unique extended game format, with some portion of fans expected to extend their stay with their winning team. Sharper than expected gains on Sunday and Monday can also be explained by some fans overextending their stay as there is no shortage of leisure activities beyond the game. A later than usual tipoff time on Monday probably also precluded some fans from departing early on the last day of the tournament.

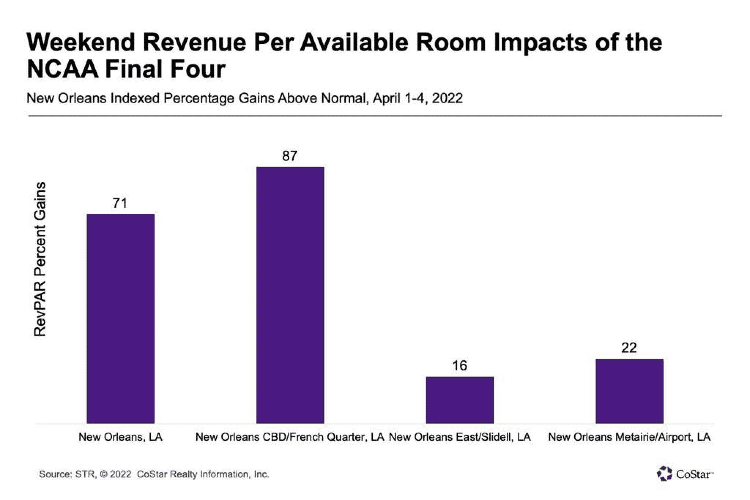

Both because of its centrality, total number of rooms and higher (and more expensive) classes of hotel, central business district/French Quarter hotels captured nine-of-10 extra market revenue dollars for the tournament weekend. While the CBD had the largest weekend revenue lift of 87%, revenues in New Orleans’ outlying submarkets also scored solid percentage revenue gains with East/Slidell achieving 16% lift and Metairie/Airport gaining 22%.

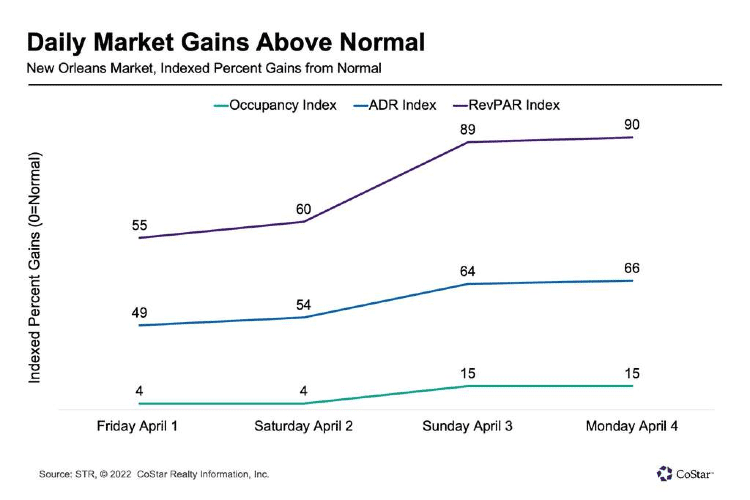

Higher than normal average daily rates were the market’s primary driver of increased revenue premiums. Weekend ADRs averaged $338, a $122 premium (+57%) above the nearest weekends’ average. ADRs peaked on Saturday night ($368, +29%), but there was an atypical lack of rate discounting for the Sunday ($327, +28%) or championship Monday ($316, +25%).

Among New Orleans’ submarkets, the greatest weekend ADR lift occurred in the central business district with ADR of $407 (+66%). Downtown hotels were not alone in achieving higher ADRs for the weekend as both Metairie/Airport and the New Orleans East/Slidell submarket had solid ADR gains (increases of 21% and 15% respectively).

In contrast, demand/occupancy premiums for the tournament weekend were relatively subdued compared to an already robust seasonal baseline. The New Orleans market weekend occupancy averaged 86%, a 9% increase above base performance levels for the four-day period. That translates to a market-level gain of 7.2 percentage points over the seasonal average occupancy of 78.8%.

Hotels in the central business district/French Quarter, the center of activity, averaged 90.6% occupancy over the long weekend and topped 95.6% occupancy on Saturday. Occupancy for the Sunday and Monday were more than 15 points above normal. Outside of downtown, occupancy levels were basically unchanged from their already solid seasonal expectations, with hotels in both of New Orleans’ outer lying submarkets — East/Slidell and New Orleans Metairie/Airport — recording single-percentage-point gains (75% and 79.6% actuals, respectfully) for the weekend.

Combining stellar ADRs with solid occupancy, the market revenue per available room indices for the full weekend were 71% above baselines. Four-day average market RevPAR was $290, or $121 above the baseline. In comparison, the second-best tournament period RevPAR over the past 10 years was $271 (inflation-adjusted) in 2012, also in New Orleans.

Market RevPAR peaked on Saturday at $335. The CBD/French Quarter submarket averaged $368 per day in RevPAR, a $172 (+87%) premium with New Orleans East/Slidell gaining $18 (+16%), and the closer Metairie/Airport submarket attaining RevPAR premiums of $28 (+22%). The downtown submarket’s indexed RevPAR returns on both the Sunday and Monday were more than double than seasonal expectations.

All-in-all, it will be difficult for future tournament Four host markets to match the hotel impacts from New Orleans’ recent Final Four. There are a range of factors that could have contributed to a particular tournament year. Perhaps one distinguishing factor of 2022’s Final Four was its list of finalists. Most blue-chip college basketball teams have highly “motivated” fans who are willing to pay room premiums on short notice. However, this year’s fanbase was uniquely “amped” as it guaranteed that one of two arch-rival North Carolina teams (Duke University or University of North Carolina) would be in the final championship.

One other possible factor relates to bottlenecks in national air travel over the tournament weekend. More than 10,000 weekend flights had to be delayed or canceled as result of technology issues as well as storms. Invariably some percentage of game travelers may have chosen to stay an extra night in city hotel due to inconvenient (or unavailable) alternative flights.

While the market’s recent market demand has still not caught up with 2019 levels, it remains a popular and busy COVID-recovery spring leisure destination. Like other markets experiencing a surge in leisure travel, New Orleans hotels have recorded average daily rates that outpace its demand/occupancy returns. This trend is particularly pronounced among higher-end hotels, and the CBD/French Quarter submarket is dominated by rooms in these higher-class brackets.

This first weekend in April in New Orleans is typically near its peak season. With already high relative demand/occupancy levels, extra bookings led to market compression. When combined with a short booking window spurred by the tournament’s elimination format, local hotel operators captured solid ADR premiums for the entire weekend.

In other words, it was opportune time to repeat the Mardi Gras’ slogan “Laissez les bons temps rouler!”

M. Brian Riley is a senior research analyst for product analytics and insights at STR.